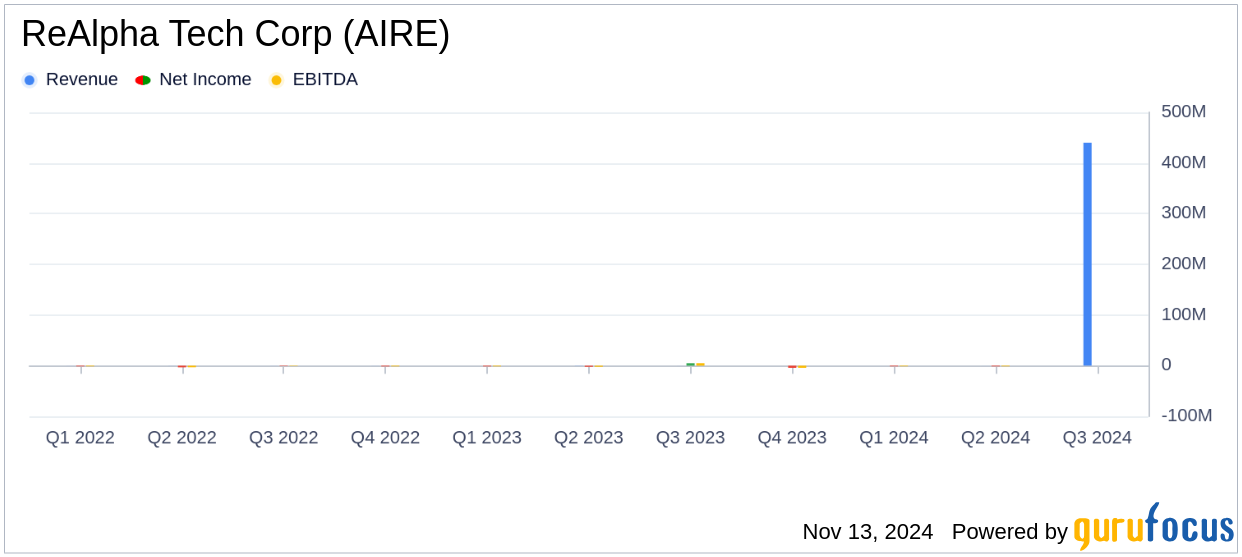

ReAlpha Tech Corp (AIRE, Financial) released its 8-K filing on November 12, 2024, announcing a remarkable 440% increase in revenue for the quarter ended September 30, 2024. This real estate technology company, known for its AI-driven platform that empowers retail investors in short-term rental properties, has exceeded its revenue growth guidance by 274%.

Company Overview

ReAlpha Tech Corp is a pioneering real estate technology firm that leverages artificial intelligence to facilitate retail investor participation in short-term rental markets. The company offers a platform that analyzes rental properties for potential profitability and provides investment opportunities through its app. ReAlpha operates primarily in two segments: Platform Services, which is the main revenue driver, and the Rental business segment.

Performance and Challenges

The company's performance in the third quarter of 2024 highlights the success of its acquisition-led growth strategy. The significant revenue increase underscores the effectiveness of integrating new acquisitions and expanding its technological capabilities. However, challenges remain, particularly in maintaining this growth trajectory and integrating acquired companies into its existing operations.

Financial Achievements

ReAlpha's financial achievements are noteworthy, especially in the context of the real estate industry, which is undergoing significant transformation. The company's focus on AI and acquisitions positions it well to capitalize on emerging trends and shifts in the market, such as the move towards commission-free real estate transactions.

Key Financial Metrics

ReAlpha's balance sheet as of September 30, 2024, shows total assets of $34.19 million, up from $27.42 million at the end of 2023. Current assets increased to $7.99 million, with cash reserves rising to $7.08 million. The company's liabilities also grew, with total liabilities reaching $11.64 million, compared to $2.72 million at the end of 2023. Stockholders' equity stood at $22.55 million, reflecting a slight decrease from $24.71 million.

| Metric | September 30, 2024 | December 31, 2023 |

|---|---|---|

| Total Assets | $34,190,822 | $27,424,869 |

| Total Liabilities | $11,637,641 | $2,716,084 |

| Stockholders' Equity | $22,553,181 | $24,708,785 |

Strategic Initiatives and Future Outlook

ReAlpha's strategic initiatives include the completion of its fifth acquisition, Be My Neighbor, a mortgage brokerage, and the launch of the reAlpha Super App, which offers a commission-free homebuying experience. Additionally, the company has established reAlpha AI Labs to invest in AI startups, further enhancing its technological edge.

Mike Logozzo, President and COO of reAlpha, stated, "Our acquisition-led growth strategy continues to drive positive results, as demonstrated by an over 440% quarter-over-quarter revenue increase. We’re excited to build on this momentum by further investing in AI technology and acquisitions to further accelerate our growth trajectory."

ReAlpha's focus on AI and acquisitions is expected to continue driving growth, with plans to expand its platform's availability and capabilities. The company's innovative approach and strategic investments position it well to navigate the evolving real estate landscape.

Explore the complete 8-K earnings release (here) from ReAlpha Tech Corp for further details.