Overview of the Recent Transaction

On November 8, 2024, FMR LLC (Trades, Portfolio), a prominent investment firm, expanded its holdings in Cirrus Logic Inc (CRUS, Financial) by acquiring an additional 217,404 shares. This transaction was executed at a price of $103.71 per share, increasing FMR LLC (Trades, Portfolio)'s total ownership in the company to 3,678,141 shares. This move reflects a strategic adjustment in FMR LLC (Trades, Portfolio)'s portfolio, where Cirrus Logic now represents approximately 0.02% of its total investments, with a significant 6.89% stake in the company itself.

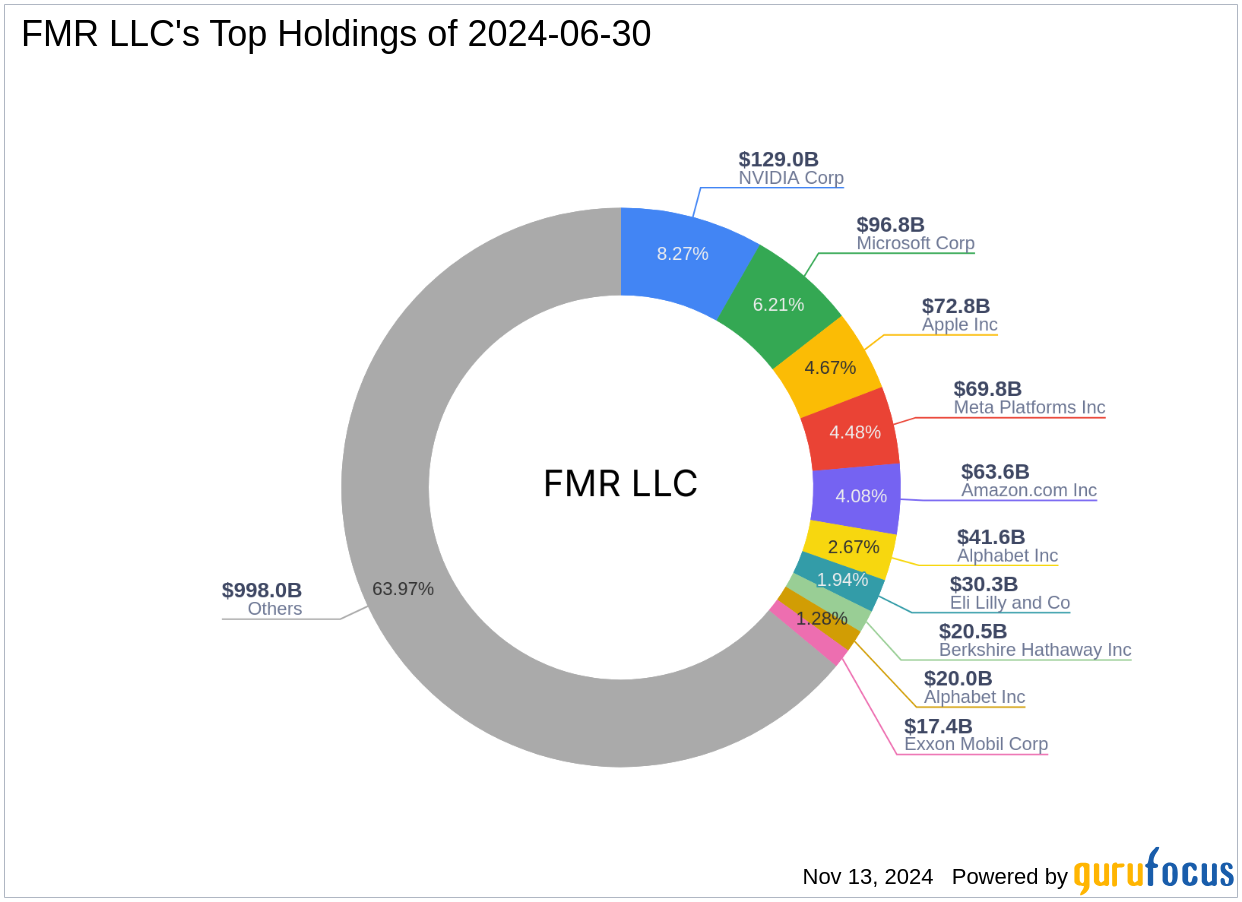

Insight into FMR LLC (Trades, Portfolio)

Founded in 1946 by Edward C. Johnson II, FMR LLC (Trades, Portfolio) has evolved into a powerhouse in the investment world, known for its bold, growth-focused investment philosophy. The firm has a rich history of innovation in financial products and services, including the creation of the first money market fund with check-writing capabilities. Today, under the leadership of CEO Abigail Johnson, FMR LLC (Trades, Portfolio) manages assets exceeding $1 trillion, with a strong emphasis on technology and healthcare sectors. Its top holdings include major names like Apple Inc (AAPL, Financial) and Microsoft Corp (MSFT, Financial).

About Cirrus Logic Inc

Cirrus Logic Inc, based in the USA, specializes in integrated circuits for audio and voice signal processing applications. Since its IPO on June 8, 1989, the company has grown significantly, with a current market capitalization of $5.56 billion. Cirrus Logic's product portfolio includes amplifiers, codecs, and digital signal processors, crucial for various high-tech applications. The company's financial health is robust, with a PE ratio of 17.74 and a stock price of $104.72, slightly above its GF Value of $93.92, indicating a modest overvaluation.

Strategic Implications of the Trade

The recent acquisition by FMR LLC (Trades, Portfolio) is a strategic enhancement to its portfolio, reflecting confidence in Cirrus Logic's growth prospects. This transaction does not significantly alter the overall weight of CRUS in FMR LLC (Trades, Portfolio)'s portfolio but reinforces the firm's commitment to investing in high-potential technology stocks. The addition of shares also solidifies FMR LLC (Trades, Portfolio)'s position as a major investor in Cirrus Logic, alongside other notable investors like Hotchkis & Wiley Capital Management LLC and Joel Greenblatt (Trades, Portfolio).

Market Performance and Comparative Analysis

Cirrus Logic's stock has shown a year-to-date growth of 28.21%, with an impressive increase of 1,591.76% since its IPO. The company's strong market performance is supported by solid financial metrics, including a Operating Margin growth of 15.50% and consistent revenue growth. Compared to other investors, FMR LLC (Trades, Portfolio)'s stake is significant, underscoring its bullish outlook on the semiconductor industry and Cirrus Logic's positioning within it.

Investment Outlook and Future Prospects

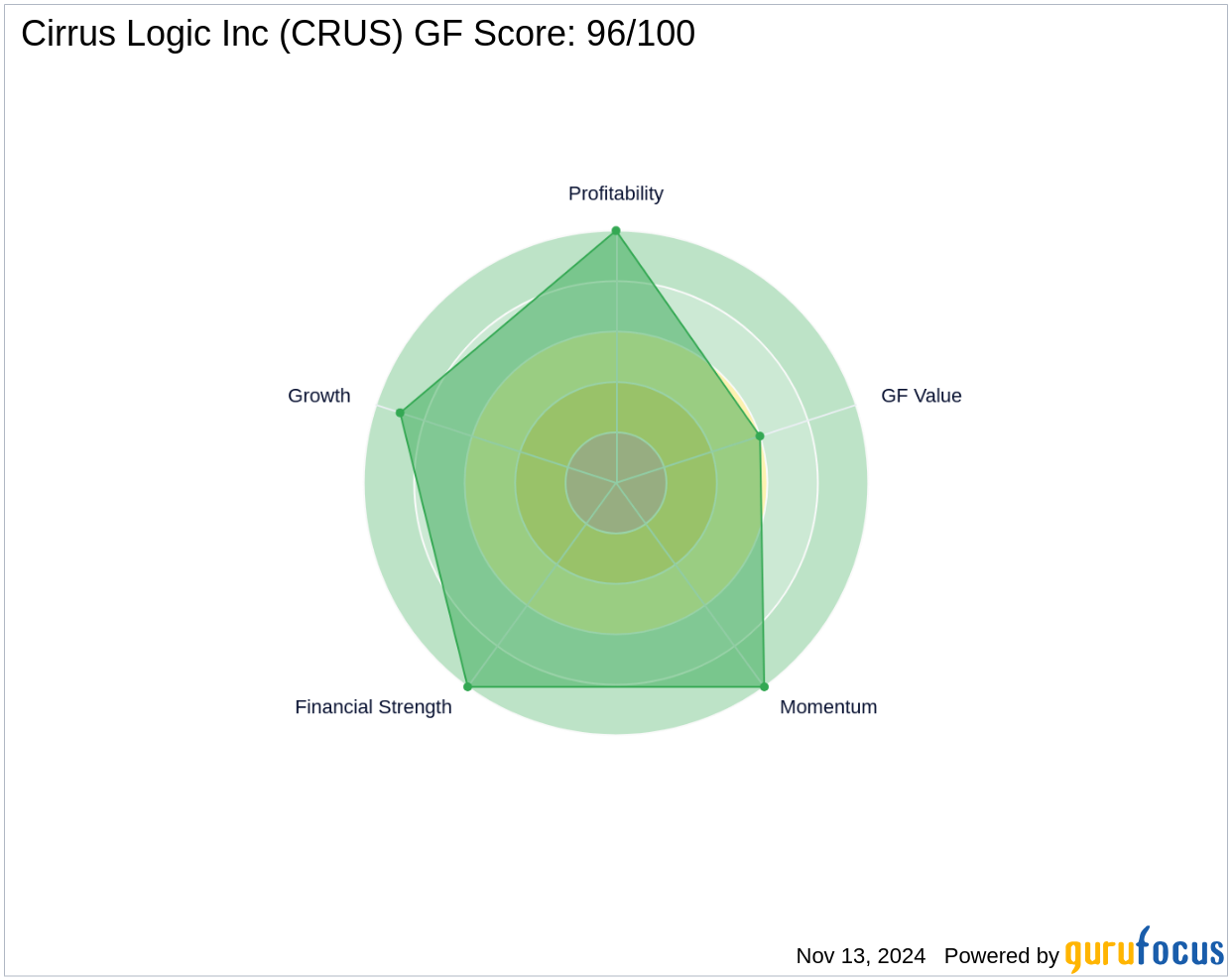

Cirrus Logic's ongoing innovation and market adaptation suggest a promising future. The company's strong GF Score of 96 indicates potential for high outperformance, supported by excellent ranks in Financial Strength, Profitability, and Growth. These factors make Cirrus Logic a compelling choice for investors looking for robust returns in the technology sector.

Conclusion

FMR LLC (Trades, Portfolio)'s recent investment in Cirrus Logic underscores a strategic positioning for potential growth in the semiconductor industry. This move not only enhances FMR LLC (Trades, Portfolio)'s portfolio but also reflects a strong conviction in Cirrus Logic's future market performance. Investors and market watchers will undoubtedly keep a close eye on this partnership's evolution and its impacts on the broader market dynamics.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.