Overview of the Recent Transaction

On September 30, 2024, Hill City Capital, LP (Trades, Portfolio) made a significant addition to its investment portfolio by acquiring 950,000 shares of Array Technologies Inc (ARRY, Financial). This transaction, executed at a price of $6.60 per share, increased the firm's total holdings in ARRY to 14,265,335 shares. This move not only reflects a strategic investment decision but also impacts the firm's portfolio with a 0.45% increase in position size, raising its stake to 9.39% of the traded stock.

Insight into Hill City Capital, LP (Trades, Portfolio)

Hill City Capital, LP (Trades, Portfolio), based at 8 Elm Ct., Cohasset, MA, operates as a focused investment entity. The firm's investment philosophy emphasizes strategic equity placements in sectors like Industrials and Technology, with a portfolio valued at approximately $1.39 billion. Among its top holdings are notable companies such as First Solar Inc (FSLR, Financial) and Dycom Industries Inc (DY, Financial), highlighting its inclination towards technologically innovative sectors.

Array Technologies Inc: A Solar Energy Innovator

Array Technologies Inc, headquartered in the USA, specializes in manufacturing ground-mounting systems for solar energy projects. Its flagship product, a single-axis tracker, optimizes solar panel orientation to enhance energy production. Despite its innovative approach, the company's financial health raises concerns, with a current market capitalization of $1 billion and a stock price of $6.59, closely mirroring its recent transaction price. The GF Value of $10.65 suggests a cautious investment approach, labeled as a "Possible Value Trap, Think Twice" by GuruFocus.

Impact on Hill City Capital’s Portfolio

The recent acquisition of ARRY shares has notably increased Hill City Capital's exposure to the technology sector, particularly in renewable energy. The firm's position in ARRY now stands at 6.74% of its total portfolio, making it one of the top holdings and reflecting a strategic emphasis on the growing solar technology sector.

Market Context and Stock Performance

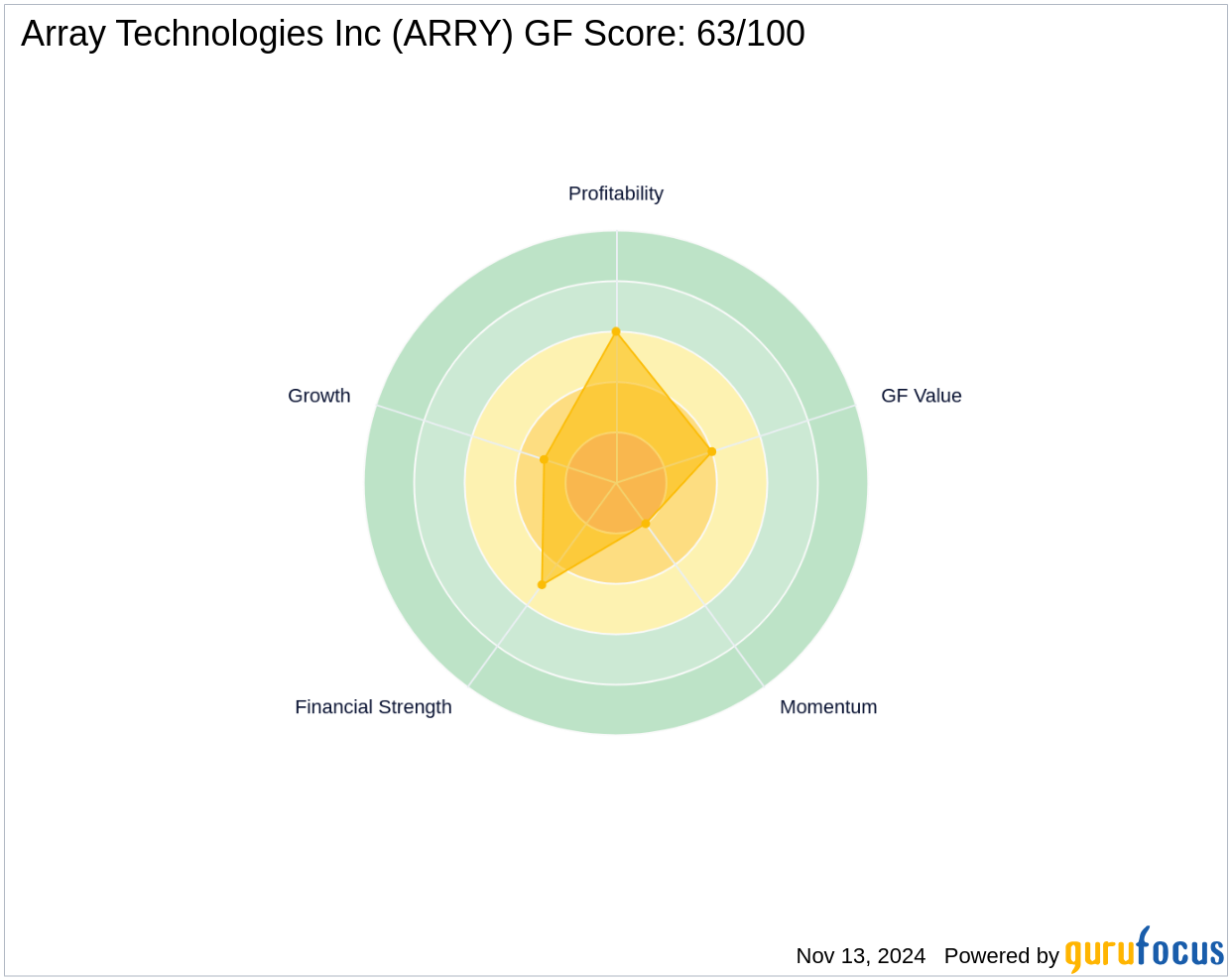

ARRY's stock performance has been underwhelming, with a year-to-date decline of 61.14% and a significant drop of 77.66% since its IPO in 2020. The stock's GF Score of 63 indicates poor future performance potential, compounded by low rankings in Growth Rank and Momentum Rank. These metrics suggest that while the firm sees potential in ARRY, market sentiment remains cautious.

Broader Market Implications and Other Significant Stakeholders

Hill City Capital’s increased stake in ARRY could signal a bullish outlook on the solar energy sector despite current market challenges. Other significant investors include Gotham Asset Management, LLC, and firms like Jefferies Group (Trades, Portfolio) and Barrow, Hanley, Mewhinney & Strauss, indicating a mixed but noteworthy interest in ARRY's market activities and potential recovery.

This strategic move by Hill City Capital, LP (Trades, Portfolio) may be an early indicator of shifting trends in the renewable energy sector, suggesting a possible long-term recovery or technological advancements that could redefine market dynamics in the coming years.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.