Overview of the Recent Transaction

On November 8, 2024, FMR LLC (Trades, Portfolio) executed a significant transaction involving the shares of Seagate Technology Holdings PLC (STX, Financial), a prominent player in the hard disk drive market. The firm reduced its holdings by 1,349,952 shares, which adjusted its total share count to 8,700,722. This move, priced at $104.78 per share, reflects a strategic adjustment in FMR LLC (Trades, Portfolio)’s portfolio, with the trade impacting the firm's holdings in Seagate by a mere 0.01%.

Profile of FMR LLC (Trades, Portfolio)

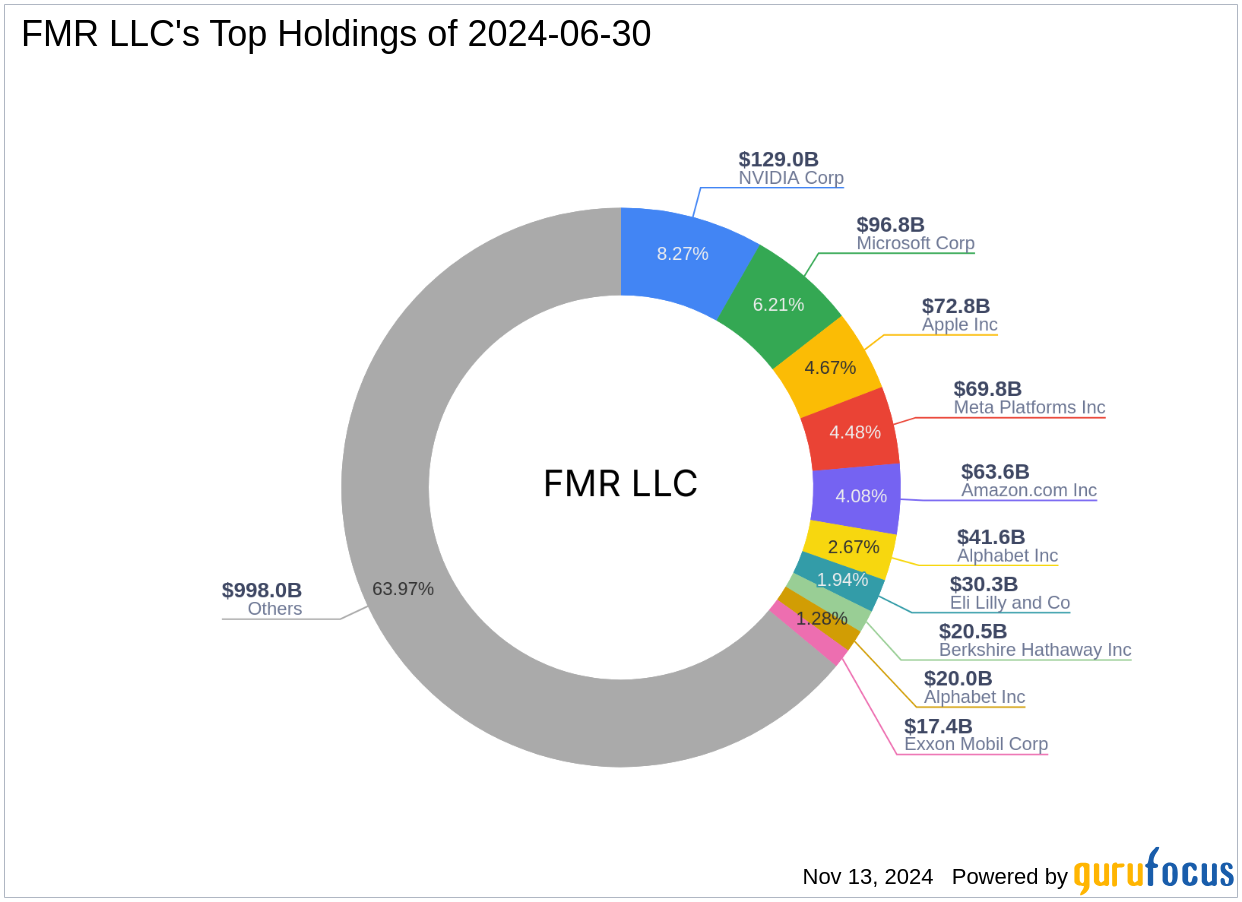

Founded in 1946 by Edward C. Johnson II, FMR LLC (Trades, Portfolio), commonly known as Fidelity, has grown into a powerhouse in investment management. The firm's philosophy has always centered on high growth potential stocks and innovative financial products. Fidelity's history is marked by a series of pioneering initiatives and a focus on individual talent, which has propelled it to over $1 trillion in assets under management. The firm's top holdings include giants like Apple Inc (AAPL, Financial) and Microsoft Corp (MSFT, Financial), emphasizing its strong inclination towards the technology sector.

Introduction to Seagate Technology Holdings PLC

Seagate Technology Holdings PLC, headquartered in Singapore, has been a leading supplier in the hard disk drive market since its IPO in 2002. The company is known for its robust manufacturing and distribution of storage solutions, maintaining a competitive stance against its primary rival, Western Digital. Seagate's market position is critical as it navigates through the evolving demands of data storage in both enterprise and consumer segments.

Analysis of the Trade Impact

The reduction in Seagate shares by FMR LLC (Trades, Portfolio) is a tactical move, adjusting its exposure in the technology sector. Holding 4.13% of its portfolio in Seagate, the firm's recent action aligns with its broader investment strategy, which may be responding to market dynamics or portfolio rebalancing needs. This adjustment is subtle yet could signify a strategic shift or risk management approach by FMR LLC (Trades, Portfolio).

Financial Health and Market Performance of Seagate

Seagate Technology currently holds a market capitalization of $21.11 billion, with a stock price of $99.8, reflecting a 4.75% decrease since the transaction. The company is rated as "Significantly Overvalued" with a GF Value of $64.96, indicating a potential misalignment with its intrinsic value. Despite these challenges, Seagate maintains a strong Profitability Rank and has shown resilience in its operational capabilities.

Sector and Market Analysis

The technology and hardware sector continues to be a hotbed of innovation and competition. Seagate, as a significant entity within this industry, faces the dual challenges of technological shifts and intense market competition. Its performance and strategic maneuvers are closely watched by investors and competitors alike.

Comparative Insight

Comparing FMR LLC (Trades, Portfolio)'s other major holdings, Seagate's role in the portfolio is distinctive, given its specific industry focus. The largest shareholder of Seagate, Gotham Asset Management, LLC, holds a substantial stake, emphasizing the stock's appeal to major investment firms.

Conclusion

FMR LLC (Trades, Portfolio)'s recent reduction in Seagate shares highlights a strategic portfolio adjustment. While the firm maintains a significant stake in the company, this move could reflect broader market strategies or responses to Seagate's current valuation and market performance. Investors and market watchers will undoubtedly keep a close eye on FMR LLC (Trades, Portfolio)'s future transactions and Seagate's adaptation to market trends.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.