On November 12, 2024, Solus Alternative Asset Management LP (Trades, Portfolio) executed a significant transaction involving the shares of Bristow Group Inc (VTOL, Financial), marking a strategic adjustment in its investment portfolio. The firm reduced its holdings by 72,088 shares, resulting in a new total of 3,276,917 shares. This move reflects a -2.15% change in the firm's position, with a trade impact of -0.88% on its portfolio, and a trade price of $38.09 per share.

Profile of Solus Alternative Asset Management LP (Trades, Portfolio)

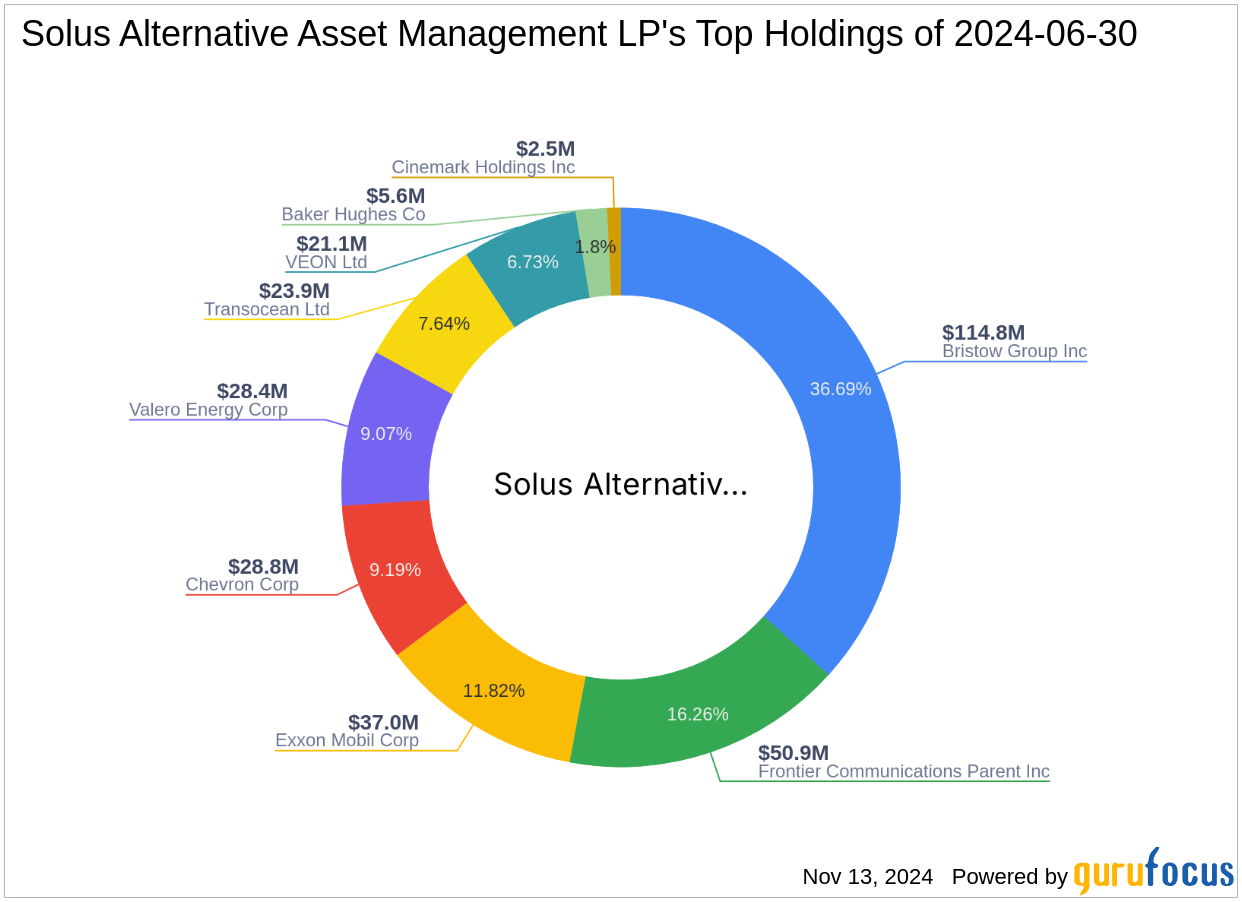

Located at 25 Maple Street, Summit, NJ, Solus Alternative Asset Management LP (Trades, Portfolio) is known for its focused investment philosophy. With a portfolio primarily concentrated in the energy and communication services sectors, the firm manages assets totaling $313 million. Its top holdings include Chevron Corp (CVX, Financial), Valero Energy Corp (VLO, Financial), and Exxon Mobil Corp (XOM, Financial), with Bristow Group Inc (VTOL, Financial) being a significant part of its investment strategy.

Overview of Bristow Group Inc (VTOL, Financial)

Bristow Group Inc, based in the USA, is a leading provider of vertical flight solutions, offering services across various segments including fixed-wing services, government services, and offshore energy services. Since its IPO on June 12, 2020, the company has shown substantial market growth. With a current market capitalization of $1.08 billion and a stock price of $37.8, Bristow is positioned as a key player in the oil & gas industry. The stock is currently rated as modestly overvalued with a GF Value of $31.71 and a price to GF Value ratio of 1.19.

Impact of the Trade on Solus's Portfolio

The recent transaction by Solus Alternative Asset Management LP (Trades, Portfolio) has adjusted its exposure to VTOL, now accounting for 40.24% of its portfolio with an 11.45% holding in the company. This reduction aligns with the firm's strategic portfolio management, reflecting a recalibration of its investment in Bristow Group amidst shifting market dynamics.

Market and Industry Analysis

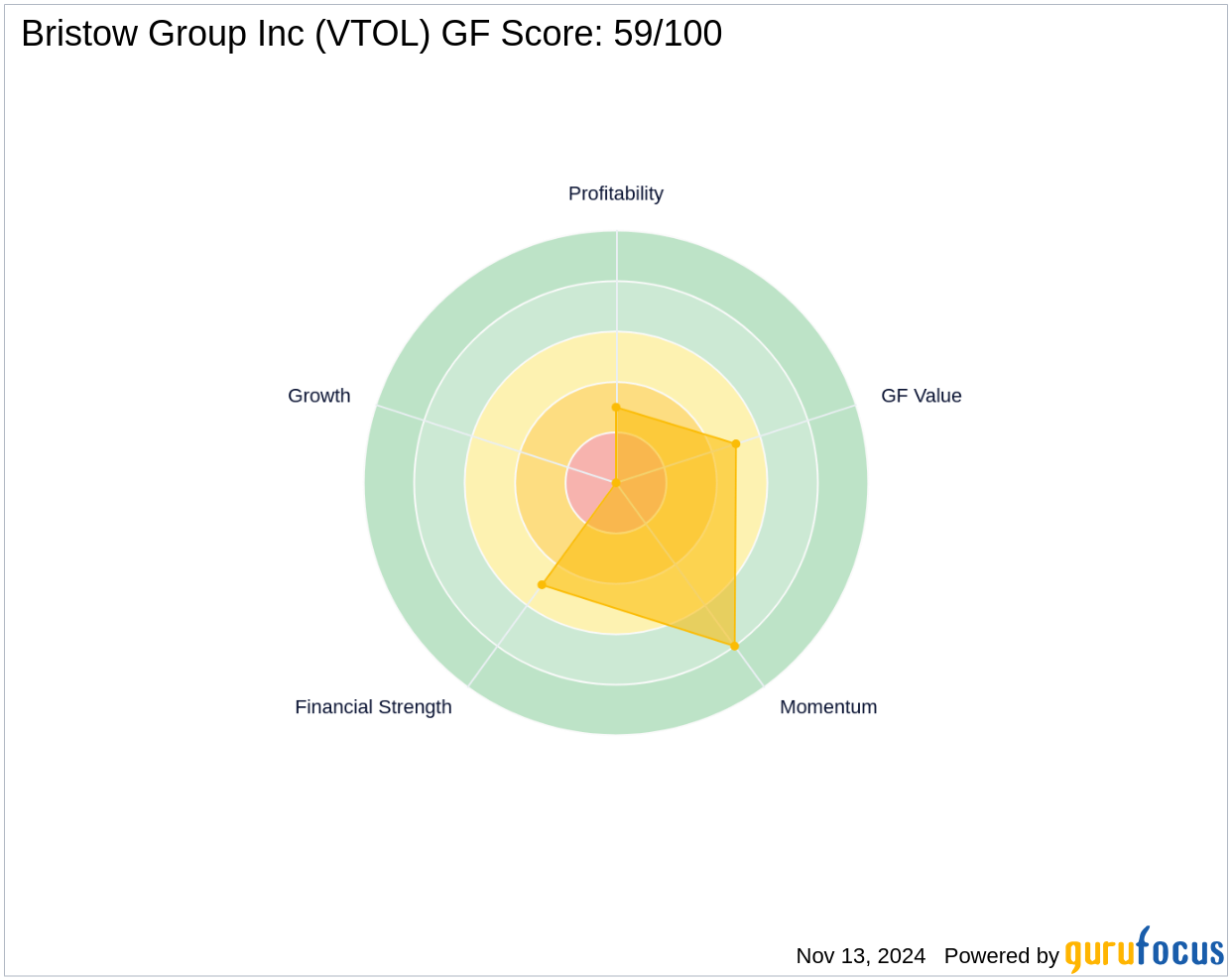

Bristow's performance in the market has been notable with a year-to-date price increase of 34.14%. The company's role in the oil & gas sector places it in a critical position amidst the industry's current conditions. Despite being modestly overvalued, Bristow maintains a GF Score of 59/100, indicating a potential for average future performance. GF-Score

Comparative Guru Investments

Notable investors in VTOL include Donald Smith & Co. and Arnold Van Den Berg (Trades, Portfolio), with Solus Alternative Asset Management LP (Trades, Portfolio) holding a significant but reduced stake compared to these investors. This strategic positioning by Solus reflects its unique investment approach within the competitive landscape.

Conclusion

The recent adjustment by Solus Alternative Asset Management LP (Trades, Portfolio) in its VTOL holdings marks a strategic move within its portfolio management. As the firm navigates the complexities of the market, this transaction could have significant implications for its investment strategy and the performance of Bristow Group Inc in the evolving oil & gas sector.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.