On November 13, 2024, Mobile Infrastructure Corp (BEEP, Financial) released its 8-K filing detailing the financial results for the third quarter ended September 30, 2024. Mobile Infrastructure Corp, a company specializing in acquiring, owning, and leasing parking facilities across the United States, reported significant progress in key financial metrics, despite facing challenges in transient business conditions.

Company Overview and Revenue Performance

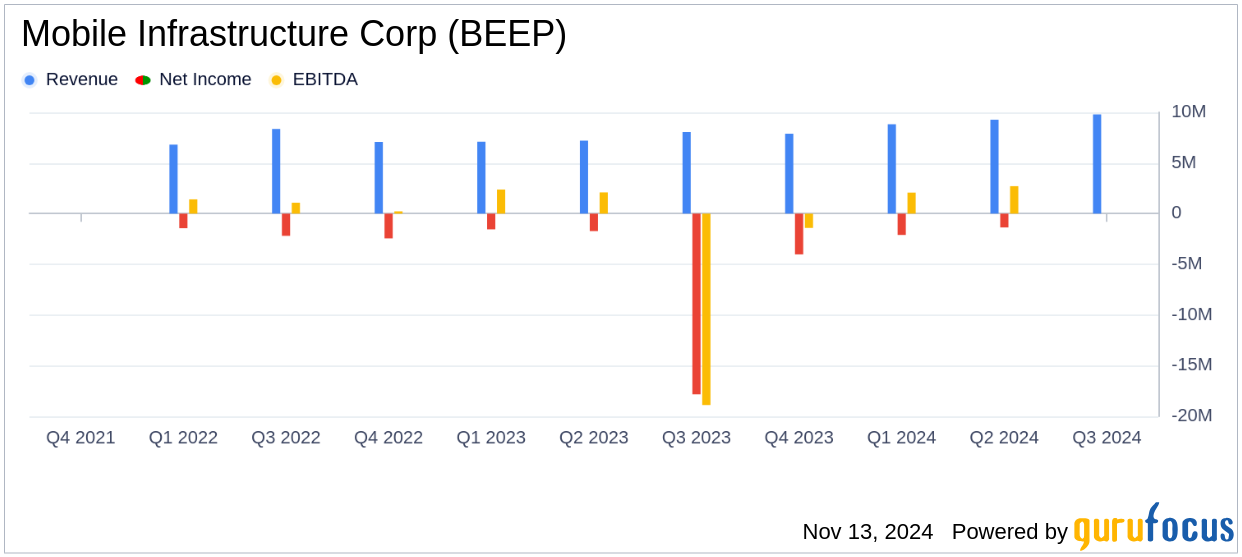

Mobile Infrastructure Corp (BEEP, Financial) owns a diversified portfolio of 43 parking facilities in 21 markets across the United States, totaling approximately 15,700 parking spaces. The company primarily generates revenue from percentage rental income. In the third quarter of 2024, Mobile Infrastructure Corp reported a total revenue of $9.8 million, marking a 21.0% increase from $8.1 million in the same period last year. This growth was driven by stable asset portfolio performance and strong recurring contract parking volumes.

Financial Achievements and Strategic Actions

Net Operating Income (NOI) increased by 3.8% year-over-year to $6.1 million, reflecting the company's effective management of property-level operations. Adjusted EBITDA also saw a modest increase of 2.2%, reaching $4.5 million. These achievements underscore the company's resilience and strategic focus on enhancing shareholder value.

Mobile Infrastructure Corp took several strategic actions during the quarter, including securing a $40.4 million line of credit to facilitate future preferred stock redemptions and commencing a common stock repurchase plan. These initiatives aim to narrow the gap between the company's Net Asset Value (NAV) of $7.25 per share and its current market price.

Income Statement and Balance Sheet Highlights

Despite the positive revenue growth, the company reported a net loss of $1.9 million, a significant improvement from the $24.6 million loss in the prior-year period. General and administrative expenses decreased to $2.7 million from $4.2 million, reflecting reduced non-cash compensation costs. Interest expenses also declined slightly to $3.3 million from $3.6 million.

As of September 30, 2024, Mobile Infrastructure Corp had $14.3 million in cash, cash equivalents, and restricted cash, with total debt outstanding at $203.3 million, up from $192.9 million at the end of 2023. The company's balance sheet reflects a strategic focus on maintaining liquidity and managing debt levels effectively.

Key Metrics and Future Outlook

Same location Revenue Per Available Stall (RevPAS) increased by 1.6% to $227.60, indicating improved performance in parking operations. This metric is crucial for evaluating the company's ability to generate revenue from its parking assets.

Manuel Chavez III, CEO, commented, "Our asset portfolio performance was stable in the third quarter, with Net Operating Income increasing 3.8% from the same period last year. Recurring contract parking volumes showed continued strength, offsetting sluggish transient business conditions that affected utilization at hospitality and event locations."

Looking ahead, Mobile Infrastructure Corp reaffirms its full-year 2024 guidance, projecting revenue between $38 million and $40 million and Net Operating Income between $22.5 million and $23.25 million. The company anticipates benefiting from secular trends, including the return to office dynamics and conversions of downtown office spaces to residential rentals, which are expected to drive future growth.

| Financial Metric | Q3 2024 | Q3 2023 | Change |

|---|---|---|---|

| Total Revenue | $9.8 million | $8.1 million | +21.0% |

| Net Operating Income | $6.1 million | $5.9 million | +3.8% |

| Adjusted EBITDA | $4.5 million | $4.4 million | +2.2% |

| Net Loss | $(1.9) million | $(24.6) million | Improved |

Conclusion

Mobile Infrastructure Corp's third-quarter results highlight the company's strategic focus on enhancing operational efficiency and shareholder value. While challenges in transient business conditions persist, the company's proactive measures and favorable market trends position it well for future growth. Investors and stakeholders will be keenly watching how these strategies unfold in the coming quarters.

Explore the complete 8-K earnings release (here) from Mobile Infrastructure Corp for further details.