Overview of the Recent Transaction

On September 30, 2024, Kayne Anderson Rudnick Investment Management LLC executed a significant transaction involving the shares of Endava PLC (DAVA, Financial), a prominent IT services company based in the UK. The firm reduced its holdings by 346,741 shares, resulting in a new total of 3,691,215 shares. This move adjusted the firm's position in Endava to 0.23% of its portfolio, reflecting a slight decrease in their investment strategy with an impact of -0.02%.

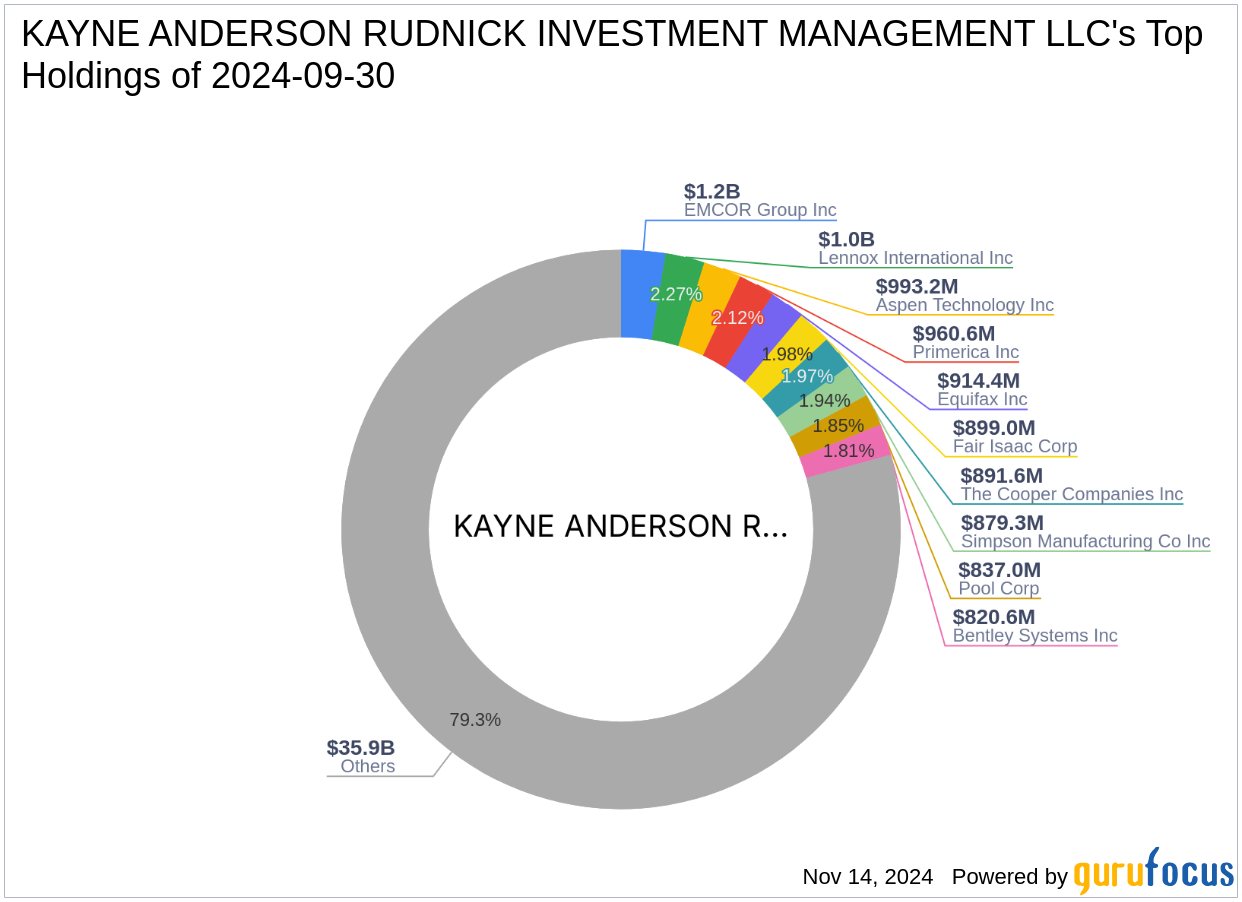

Profile of Kayne Anderson Rudnick Investment Management LLC

Founded in 1984, Kayne Anderson Rudnick Investment Management LLC is a distinguished investment management firm based in Los Angeles. With a team of 76 employees, including 16 investment professionals, the firm operates under the umbrella of Virtus Partners. Specializing in public equity and fixed income markets globally, Kayne Anderson Rudnick is known for its rigorous in-house research and fundamental analysis. The firm predominantly invests in high-quality growth and value stocks across various sectors, with a significant focus on the information technology sector. As of now, the firm manages assets worth approximately $45.31 billion.

Insight into Endava PLC

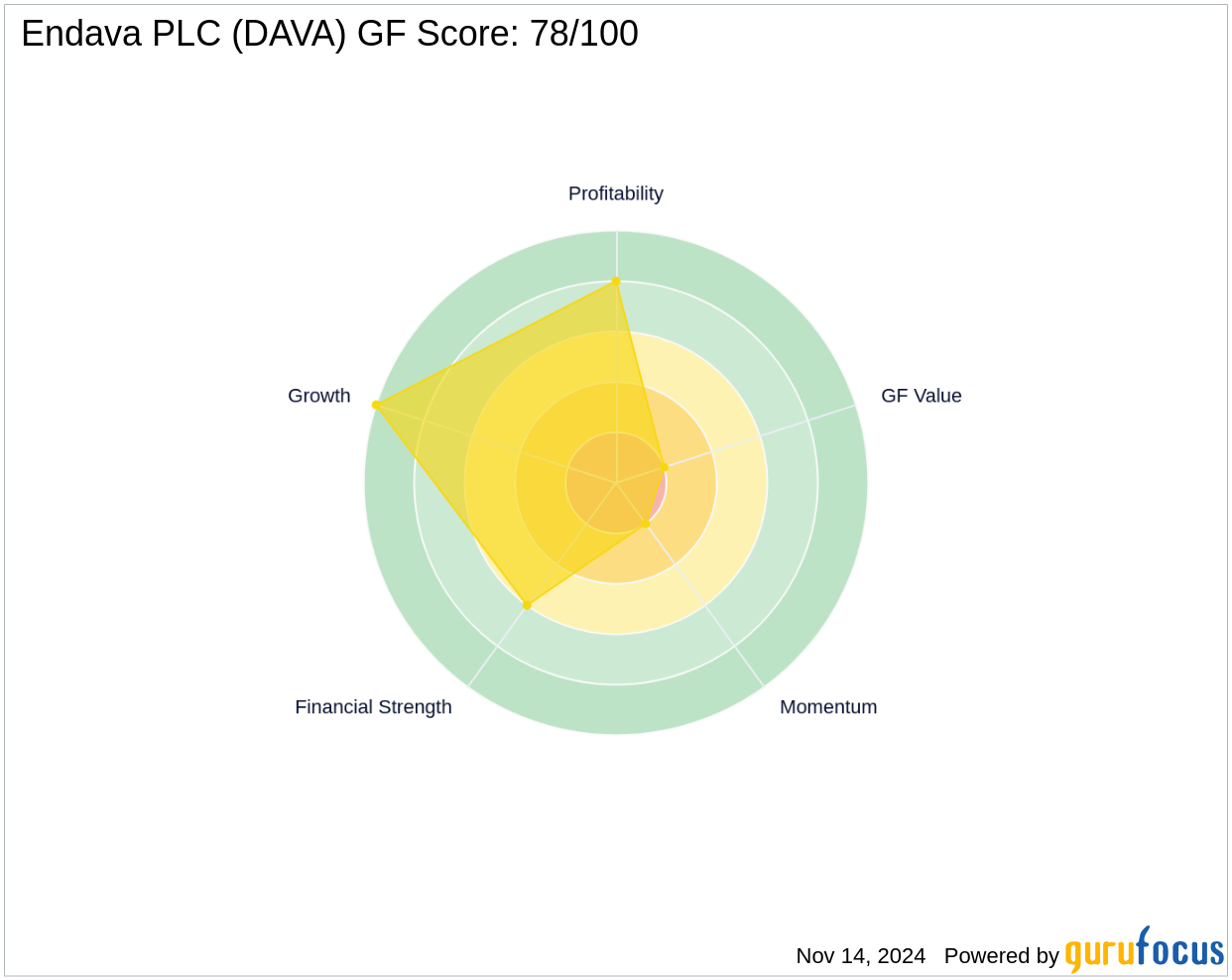

Endava PLC specializes in next-generation IT services, aiding clients predominantly in the UK and Europe with digital transformation projects. Since its inception in 2006, Endava has focused on sectors like payments, financial services, technology, media, and telecom. Despite a challenging market, Endava boasts a market capitalization of $1.74 billion and a PE ratio of 84.54, indicating profitability but also suggesting a high valuation relative to earnings.

Impact of the Trade on Kayne Anderson Rudnick's Portfolio

The recent reduction in Endava shares by Kayne Anderson Rudnick reflects a strategic adjustment in their portfolio, possibly due to the stock's performance or sector realignment. With Endava constituting 0.23% of their portfolio and a significant 8.26% of the firm's holdings in the stock, this move could signal a cautious approach towards the IT sector or a response to the stock's valuation metrics.

Market Performance and Valuation of Endava PLC

Endava's current stock price stands at $29.42, which is above its GF Value of $78.38, categorized as a possible value trap. This suggests that investors should be cautious, as the stock might be overvalued. The stock has seen a 15.19% increase since the transaction date, yet it has a year-to-date decline of -61.36%, highlighting volatility and potential risk.

Comparative Analysis with Other Major Investors

Baron Funds is another significant investor in Endava, although specific details of their holdings were not disclosed. Comparing strategies, both firms seem to recognize the potential in Endava but might be adjusting their stakes based on performance metrics and market conditions.

Conclusion

Kayne Anderson Rudnick's recent reduction in Endava shares marks a strategic pivot that could influence their portfolio's performance, especially within the technology sector. This transaction not only reflects the firm's responsive investment approach but also highlights the broader market's fluctuating dynamics. Investors and market watchers will likely keep a close eye on further movements by Kayne Anderson Rudnick and other major stakeholders in Endava.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.