Overview of the Recent Transaction

On September 30, 2024, T. Rowe Price Investment Management, Inc. (Trades, Portfolio) made a significant addition to its investment portfolio by acquiring 93,551 shares of Artesian Resources Corp (ARTNA, Financial), a prominent player in the regulated utilities sector. This transaction was executed at a price of $37.18 per share, increasing the firm's total holdings in ARTNA to 884,334 shares. This move reflects a strategic adjustment in the firm's investment portfolio, emphasizing its confidence in ARTNA's market position and future prospects.

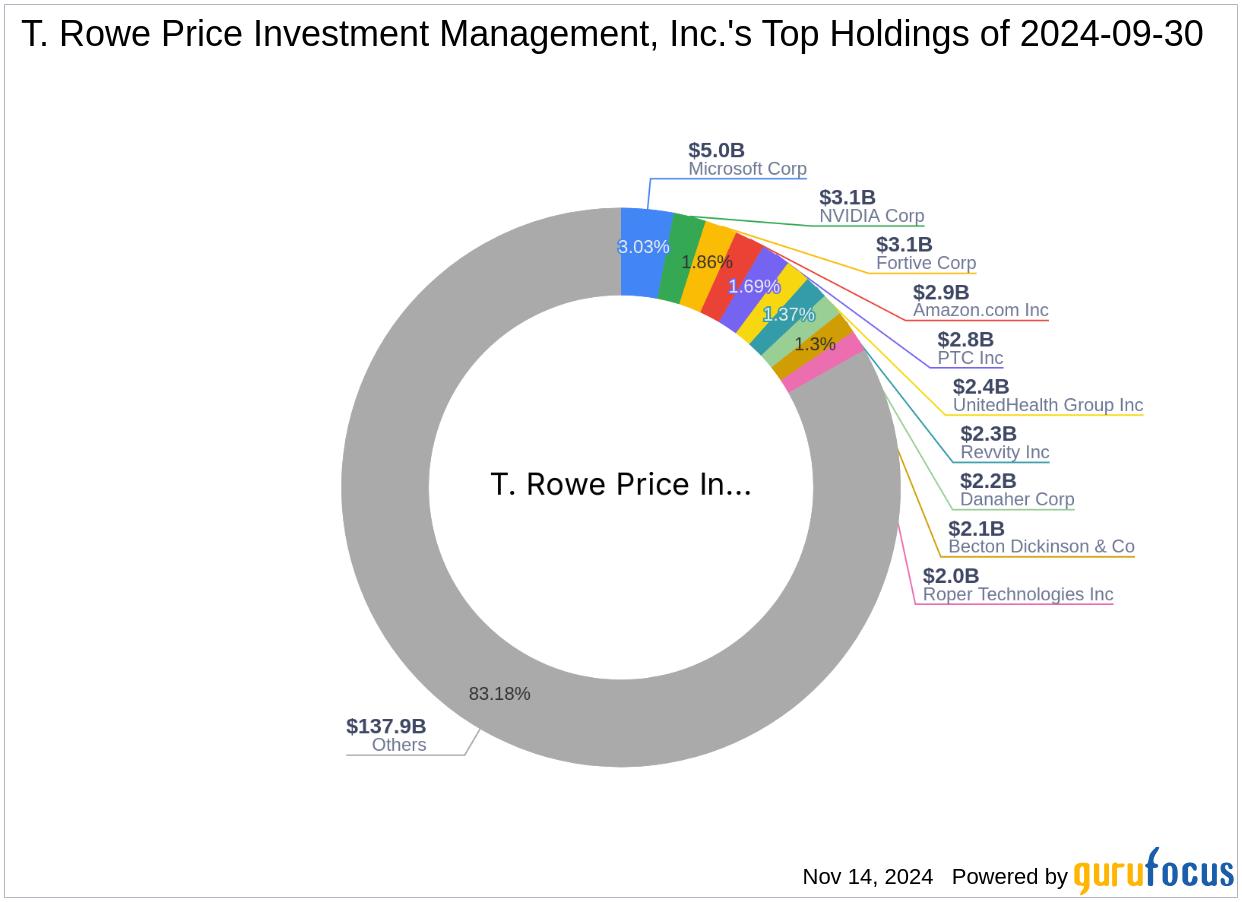

Profile of T. Rowe Price Investment Management, Inc. (Trades, Portfolio)

T. Rowe Price Investment Management, Inc. (Trades, Portfolio), headquartered at 100 East Pratt Street, Baltimore, MD, is a renowned investment management firm with a robust portfolio of investments. The firm manages an equity portfolio worth approximately $165.83 billion, focusing on high-value investments in various sectors. Its top holdings include major corporations such as Amazon.com Inc (AMZN, Financial), Microsoft Corp (MSFT, Financial), and NVIDIA Corp (NVDA, Financial). The firm's investment philosophy prioritizes long-term growth and stability, leveraging in-depth market analysis and trends to guide its investment choices.

Introduction to Artesian Resources Corp (ARTNA, Financial)

Artesian Resources Corp, trading under the symbol ARTNA, operates primarily within the utilities sector, focusing on water distribution and wastewater services across Delaware, Maryland, and Pennsylvania. Since its IPO on May 24, 1996, ARTNA has grown to achieve a market capitalization of $350.568 million. The company's business model is centered around its regulated utility segment, which is the largest contributor to its operations. ARTNA's commitment to providing essential utility services positions it as a key player in the industry.

Analysis of the Trade's Impact

The recent acquisition by T. Rowe Price Investment Management has increased its stake in ARTNA to 9.40% of the company's outstanding shares, representing a 0.02% position in the firm's total portfolio. This strategic investment not only underscores the firm's confidence in ARTNA's business model and market position but also aligns with its long-term investment philosophy aimed at capitalizing on stable and growing utility sectors.

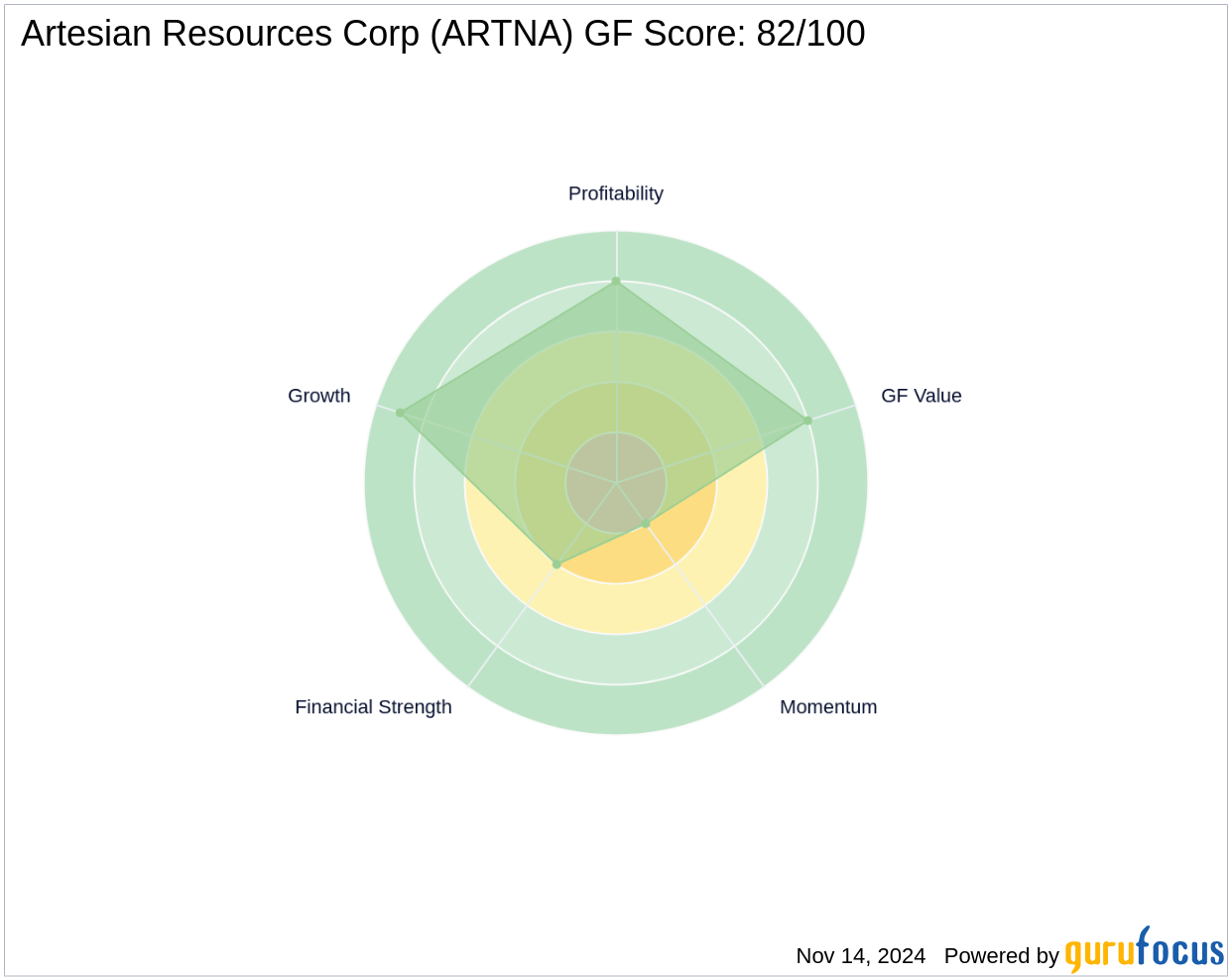

Financial Health and Market Valuation of ARTNA

ARTNA is currently considered modestly undervalued with a GF Score of 82/100, indicating good potential for outperformance. The stock's current price-to-GF Value ratio stands at 0.72, suggesting that it is trading below its intrinsic value calculated at $47.44. Despite a year-to-date price decline of 16.74%, ARTNA maintains a strong Profitability Rank and Growth Rank, reflecting its robust operational performance and growth potential.

Strategic Implications of the Trade

The decision by T. Rowe Price Investment Management to increase its holdings in ARTNA likely stems from a positive evaluation of the company's market stability and growth trajectory within the utilities sector. This move could be indicative of the firm's strategy to invest in companies with stable earnings and potential for consistent growth, aligning with its overall investment philosophy.

Conclusion

In conclusion, T. Rowe Price Investment Management's recent acquisition of additional shares in Artesian Resources Corp signifies a strategic enhancement of its investment portfolio. This transaction not only reflects the firm's confidence in ARTNA's financial health and market position but also aligns with its broader investment strategy aimed at long-term value creation. As ARTNA continues to perform and grow within the regulated utilities market, this investment may well prove to be a prudent addition to T. Rowe Price's diverse and robust portfolio.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.