Overview of the Recent Transaction

On September 30, 2024, Select Equity Group, L.P. (Trades, Portfolio) made a significant addition to its investment in Core & Main Inc (CNM, Financial), a key player in the industrial distribution sector. The firm acquired an additional 948,245 shares at a price of $44.40 per share, bringing its total holdings in the company to 16,375,022 shares. This transaction has increased the firm's stake in Core & Main to 8.50% of its portfolio, marking a substantial impact of 0.17%.

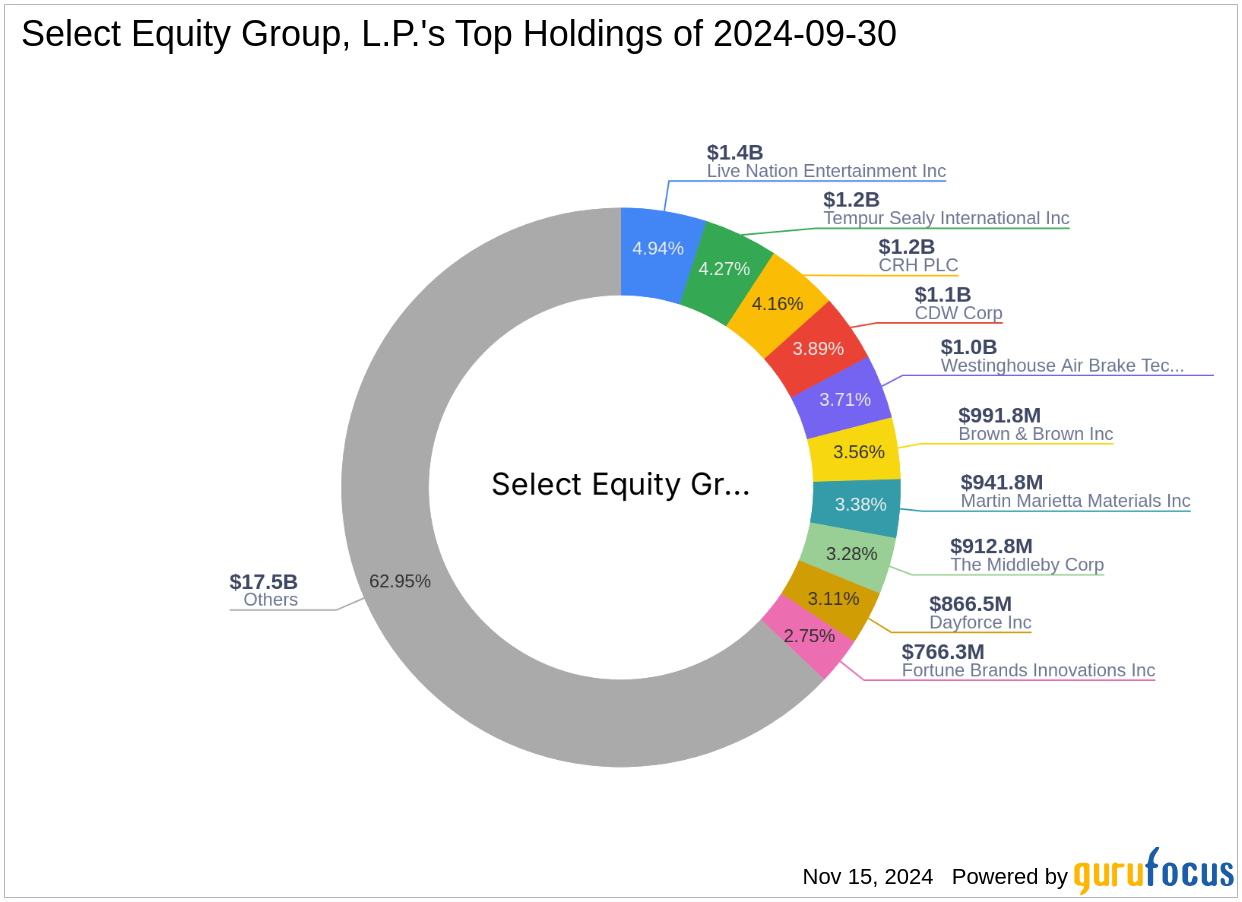

Insight into Select Equity Group, L.P. (Trades, Portfolio)

Founded in 1990 by George S. Loening, Select Equity Group, L.P. (Trades, Portfolio) is a prominent hedge fund sponsor based in New York City. The firm is renowned for its research-intensive, value-biased investment approach, focusing on high-quality businesses. Initially centered on U.S. small to mid-cap companies, the firm has expanded its reach to include larger cap companies and international markets. With $17 billion in assets under management and a diverse client base, Select Equity Group is a major player in the financial sector, heavily investing in industrials and technology among other sectors.

Core & Main Inc: A Closer Look

Core & Main Inc specializes in distributing products and services for water, wastewater, storm drainage, and fire protection. The company, which went public on July 23, 2021, operates across municipal, non-residential, and residential markets. With a market capitalization of $8.07 billion and a PE ratio of 20.05, Core & Main is currently considered modestly overvalued with a GF Value of $37.30. Despite this, the company has shown robust growth and profitability, reflected in its high GF Score of 89/100, indicating strong future performance potential.

Strategic Timing and Market Context

The acquisition by Select Equity Group comes at a time when Core & Main's stock has experienced a year-to-date increase of 5.81%, although it has seen a decline of 5.61% since the transaction date. The stock has significantly outperformed since its IPO, with an increase of 93.13%. This strategic investment aligns with the firm's focus on industrials, leveraging Core & Main's strong market presence and growth trajectory.

Impact on Select Equity Group’s Portfolio

The recent acquisition has bolstered Select Equity Group's position in Core & Main, making it a more influential component of its portfolio. Prior to the transaction, the firm held a smaller stake, which has now increased to a substantial 2.86% of its total investments. This adjustment underscores the firm's confidence in Core & Main's ongoing and future market performance.

Industry Dynamics and Future Outlook

Core & Main operates within the industrial distribution industry, a sector that has been witnessing significant growth and transformation. The company's focus on essential infrastructure products positions it well for sustained growth, supported by increasing urbanization and municipal investments. With high ranks in profitability (8/10) and growth (9/10), Core & Main is poised for continued success, potentially delivering substantial returns to its investors like Select Equity Group.

Broader Investment Landscape

Other notable investors in Core & Main include Keeley-Teton Advisors, LLC (Trades, Portfolio) and Joel Greenblatt (Trades, Portfolio), highlighting the stock's appeal to savvy investors. The firm's strategic stake increase aligns with broader industry trends and investor confidence in the industrial distribution sector, suggesting a positive outlook for Core & Main's stock.

Conclusion

Select Equity Group's increased investment in Core & Main reflects a strategic positioning to capitalize on the expected growth in the industrial distribution sector. With a solid track record and a strategic approach to investment, Select Equity Group is set to potentially reap significant benefits from this investment, aligning with its overall portfolio strategy and growth objectives.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.