Overview of the Recent Transaction

On September 30, 2024, DYNAMO INTERNACIONAL GESTAO DE RECURSOS LTDA. (Trades, Portfolio), a prominent investment firm, executed a significant transaction involving the shares of Vtex (VTEX, Financial). The firm reduced its holdings by 475,772 shares, which resulted in a 7.77% decrease in their position, bringing their total share count to 5,648,948. This move impacted their portfolio by -0.6%, with the shares traded at a price of $7.44 each.

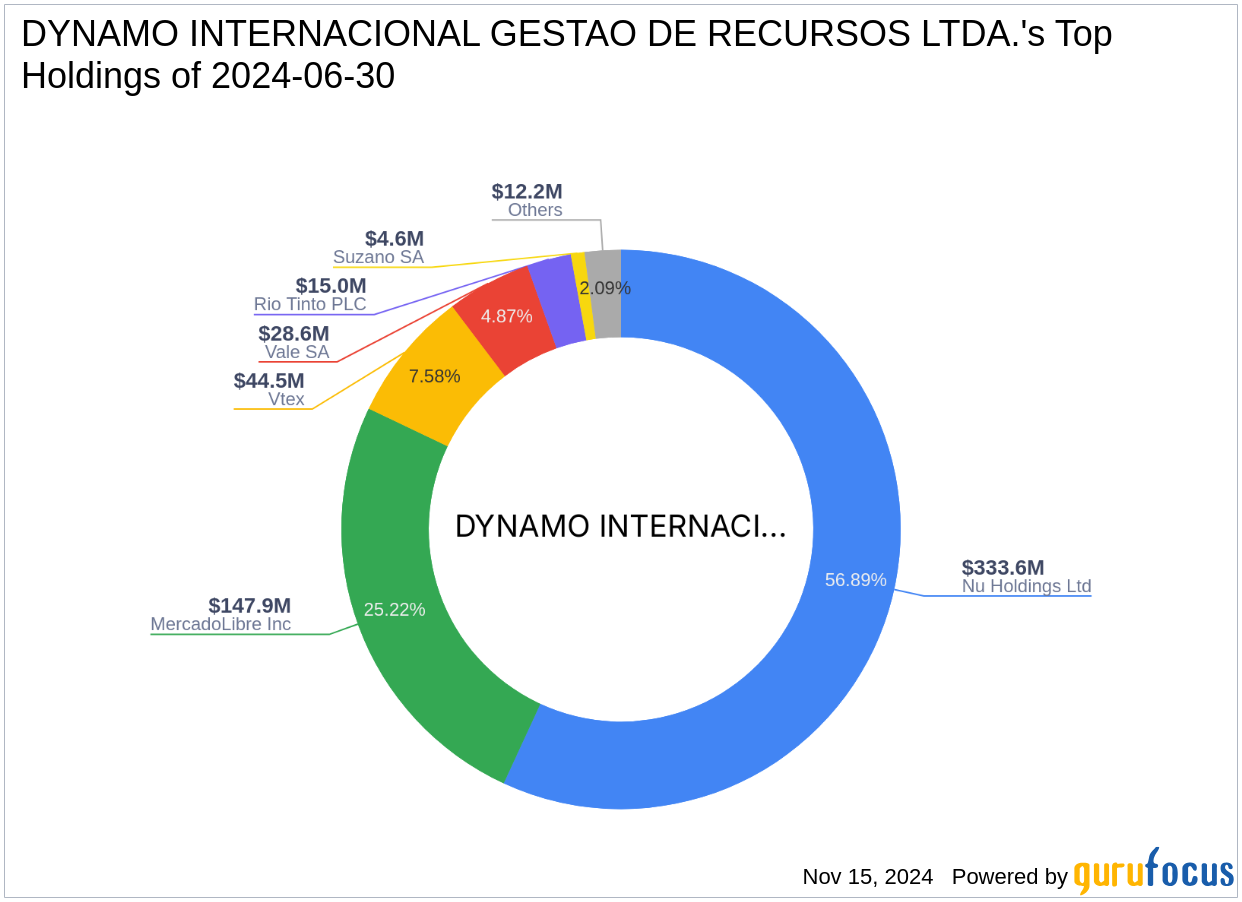

Profile of DYNAMO INTERNACIONAL GESTAO DE RECURSOS LTDA. (Trades, Portfolio)

DYNAMO INTERNACIONAL GESTAO DE RECURSOS LTDA. (Trades, Portfolio) is based in Rio de Janeiro and operates as an investment firm with a keen focus on delivering substantial returns through diverse global investments. The firm manages an equity portfolio worth approximately $587 million, primarily concentrated in the Financial Services and Consumer Cyclical sectors. Their top holdings include prominent companies such as MercadoLibre Inc (MELI, Financial), Rio Tinto PLC (RIO, Financial), and Vale SA (VALE, Financial).

Introduction to Vtex

Vtex is a UK-based company that offers a software-as-a-service digital commerce platform. It caters to enterprise brands and retailers, enabling them to manage online stores, integrate orders across channels, and create marketplaces. The company's revenue streams are primarily divided into services and subscription revenues, with a significant market presence in Brazil and other parts of Latin America.

Financial and Market Analysis of Vtex

Vtex currently holds a market capitalization of $1.21 billion. Despite being modestly undervalued with a GF Value of $7.22, the company's stock price has seen a decline of 12.37% since the transaction date, now standing at $6.52. The stock's performance has been underwhelming with a year-to-date decrease of 2.54% and a significant drop of 74.02% since its IPO in 2021. Financially, Vtex struggles with a low profitability rank of 2/10 and a growth rank of 0/10, indicating potential challenges in these areas.

Impact of the Trade on DYNAMO INTERNACIONAL's Portfolio

The reduction in Vtex shares by DYNAMO INTERNACIONAL has adjusted their portfolio's composition, decreasing their stake in Vtex to 7.20%. This strategic move might reflect the firm's response to the recent performance dips and market volatility associated with Vtex, aiming to optimize their investment allocations amidst changing market conditions.

Market and Sector Context

Vtex operates within the competitive software industry, which is continually influenced by technological advancements and shifting enterprise needs. The firm's ability to innovate and adapt to market demands plays a crucial role in maintaining its competitive edge. However, the current financial metrics and market performance suggest that Vtex faces significant challenges that could impact its industry standing.

Investment Considerations

Investors considering Vtex should note its GF Score of 63/100, indicating a below-average future performance potential. The company's financial strength and profitability metrics suggest caution, while its modest undervaluation provides a narrow margin of safety. Prospective investors should weigh these factors alongside the broader industry trends and the firm's strategic responses to market challenges.

Conclusion

The recent transaction by DYNAMO INTERNACIONAL GESTAO DE RECURSOS LTDA. (Trades, Portfolio) reflects a strategic adjustment in response to Vtex's performance and market valuation. While the firm has reduced its exposure to Vtex, the broader implications for both the investment firm and potential investors hinge on Vtex's ability to navigate its current challenges within the dynamic software market.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.