On November 25, 2024, New Jersey Resources Corp (NJR, Financial) released its 8-K filing detailing the fiscal 2024 fourth-quarter and year-end results. New Jersey Resources, an energy services holding company, operates both regulated and nonregulated businesses, including New Jersey Natural Gas, which serves nearly 600,000 customers, and various solar and midstream natural gas projects.

Performance Highlights and Challenges

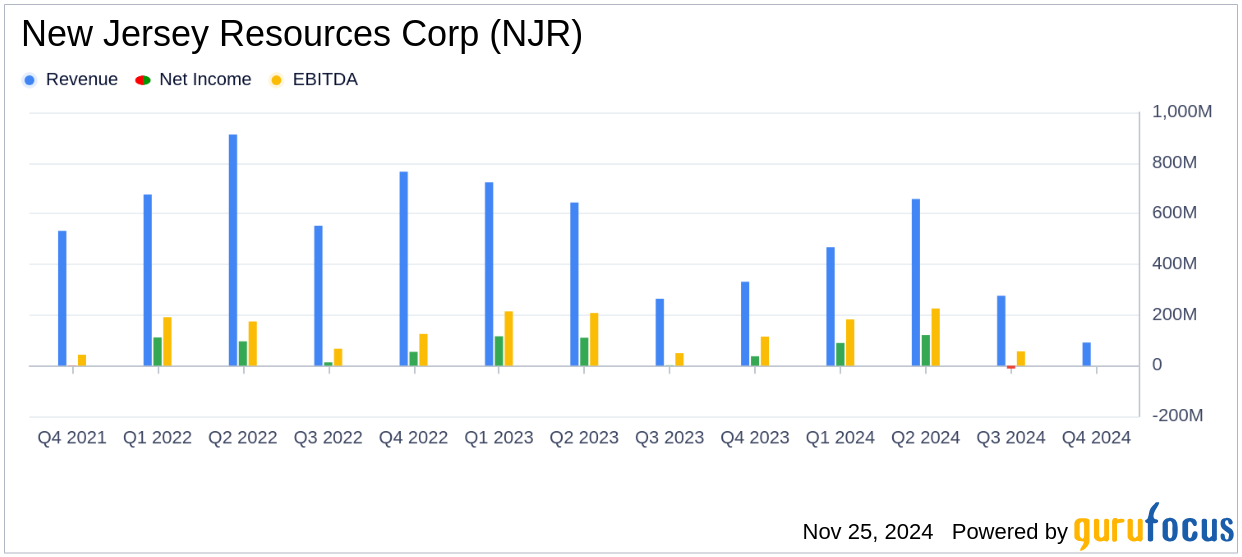

New Jersey Resources Corp (NJR, Financial) reported a consolidated net income of $289.8 million, or $2.94 per share, for fiscal 2024, surpassing the analyst estimate of $2.93 per share. This marks an increase from the previous year's net income of $264.7 million, or $2.73 per share. The company's net financial earnings (NFE) also rose to $290.8 million, or $2.95 per share, compared to $261.8 million, or $2.70 per share, in fiscal 2023. The fourth-quarter net income was $91.1 million, or $0.92 per share, exceeding the estimated earnings per share of $0.88. It was significantly higher than the $37.0 million, or $0.38 per share, reported in the same period last year.

Financial Achievements and Industry Impact

NJR achieved the higher end of its fiscal 2024 net financial earnings per share (NFEPS) guidance range of $2.85 to $3.00. This achievement is crucial for a regulated utility company like NJR, as it reflects the company's ability to manage its operations efficiently and capitalize on its strategic initiatives, such as the Asset Management Agreements (AMAs) signed in December 2020, which contributed to higher operating revenue at Energy Services.

Detailed Financial Metrics

The company's financial performance is further detailed in its income statement, balance sheet, and cash flow statement. Key metrics include:

| Metric | Fiscal 2024 | Fiscal 2023 |

|---|---|---|

| Consolidated Net Income | $289.8 million | $264.7 million |

| Net Financial Earnings (NFE) | $290.8 million | $261.8 million |

| Fourth-Quarter Net Income | $91.1 million | $37.0 million |

| Fourth-Quarter NFE | $88.7 million | $29.6 million |

Analysis of Business Segments

New Jersey Natural Gas (NJNG) reported fiscal 2024 NFE of $133.4 million, up from $131.4 million in fiscal 2023, driven by customer growth and higher utility gross margins. However, the fourth-quarter net financial loss was $(19.0) million, an improvement from $(24.8) million in the previous year.

Clean Energy Ventures (CEV) saw a decline in NFE to $33.7 million from $44.5 million in fiscal 2023, primarily due to a reversal of a valuation allowance on deferred tax assets in the prior year. Energy Services, on the other hand, reported a significant increase in NFE to $111.5 million from $68.5 million, thanks to the AMAs.

Management Commentary

Steve Westhoven, President and CEO of New Jersey Resources, stated, “Fiscal 2024 was an excellent year for NJR, with solid financial performance across all business segments. We achieved NFEPS at the higher end of our guidance, which was raised in February. This marks the fourth consecutive year of exceeding our 7 to 9 percent stated NFEPS growth rate. We advanced our strategic objectives by settling our base rate case and the largest energy efficiency program in NJNG’s history, while making key investments to position us for continued long-term success.”

Conclusion

New Jersey Resources Corp (NJR, Financial) has demonstrated robust financial performance in fiscal 2024, surpassing analyst estimates and achieving significant growth across its business segments. The company's strategic initiatives and regulatory approvals have positioned it well for continued success in the regulated utilities sector. Investors and stakeholders will be keenly watching NJR's progress as it enters fiscal 2025 with a positive outlook and new guidance.

Explore the complete 8-K earnings release (here) from New Jersey Resources Corp for further details.