Star Group LP (SGU, Financial) released its 8-K filing on December 4, 2024, detailing its fiscal 2024 fourth quarter and full-year financial results. The company, a prominent provider of home heating products and services in the U.S., reported a 10% decrease in total revenue for the fourth quarter, amounting to $240.3 million compared to $266.9 million in the same period last year. This decline was attributed to lower volumes sold and reduced selling prices for petroleum products, partially offset by increased service and installation revenue.

Company Overview and Market Position

Star Group LP is a leading distributor of home heating oil and propane, offering heating and air conditioning equipment, home security, and plumbing services. The company also sells diesel fuel, gasoline, and home heating oil, primarily operating in the Northeast and Mid-Atlantic regions of the United States.

Performance and Challenges

During the fiscal 2024 fourth quarter, Star Group LP faced a net loss increase of $15.4 million, totaling $35.1 million. This was primarily due to a $28.4 million unfavorable change in the fair value of derivative instruments. Despite these challenges, the company managed to reduce its Adjusted EBITDA loss by $1.7 million, thanks to higher per-gallon margins and increased service profitability.

“As we move into the heating season and begin a new fiscal year, it’s a great time to reflect on the past twelve months’ performance,” said Jeff Woosnam, Star Group’s President and Chief Executive Officer.

Financial Achievements and Industry Context

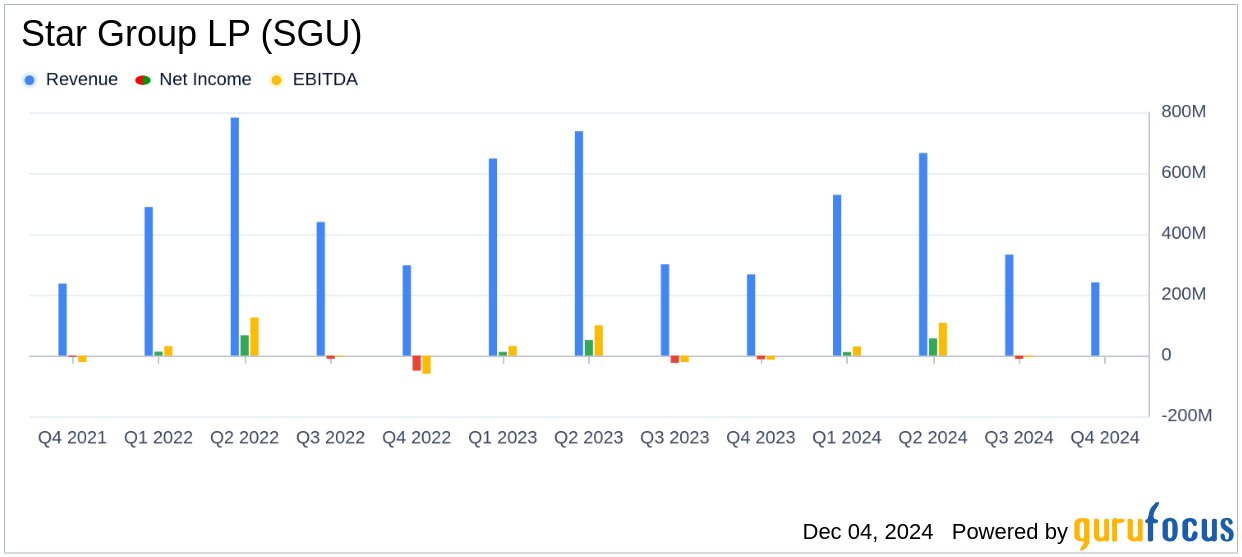

For the full fiscal year 2024, Star Group LP reported a 9.6% decrease in total revenue to $1.8 billion, down from $2.0 billion in fiscal 2023. Despite the revenue decline, the company achieved a $14.7 million increase in Adjusted EBITDA, reaching $111.6 million. This improvement was driven by enhanced margins and profitability in service and installation sectors, as well as contributions from acquisitions.

Key Financial Statements and Metrics

Star Group LP's balance sheet revealed total assets of $939.6 million as of September 30, 2024, up from $875.5 million the previous year. The company reported a net income increase of $3.3 million for the fiscal year, totaling $35.2 million. The following table summarizes key financial data:

| Metric | 2024 | 2023 |

|---|---|---|

| Total Revenue | $1.8 billion | $2.0 billion |

| Net Income | $35.2 million | $31.9 million |

| Adjusted EBITDA | $111.6 million | $96.9 million |

Analysis and Outlook

Star Group LP's performance reflects the challenges of fluctuating petroleum prices and customer attrition. However, the company's strategic focus on cost containment and acquisitions has bolstered its financial position. The increase in Adjusted EBITDA highlights the effectiveness of these strategies, positioning Star Group LP to navigate future market conditions effectively.

Investors and stakeholders will be keen to observe how Star Group LP continues to manage its operational costs and customer base while capitalizing on acquisition opportunities to drive growth in the competitive oil and gas industry.

Explore the complete 8-K earnings release (here) from Star Group LP for further details.