Foundations Investment Advisors, LLC (Trades, Portfolio) recently expanded its portfolio by acquiring 484 shares of FIRST TR EXCH ALPH (FGM, Financial) on November 30, 2024. The transaction was executed at a price of $38.6466 per share, marking a strategic move by the firm to enhance its investment holdings. This acquisition reflects the firm's ongoing strategy to diversify its portfolio and capitalize on potential growth opportunities within the market. The purchase of these shares represents a new holding for the firm, indicating a fresh interest in the prospects of FGM.

About Foundations Investment Advisors, LLC (Trades, Portfolio)

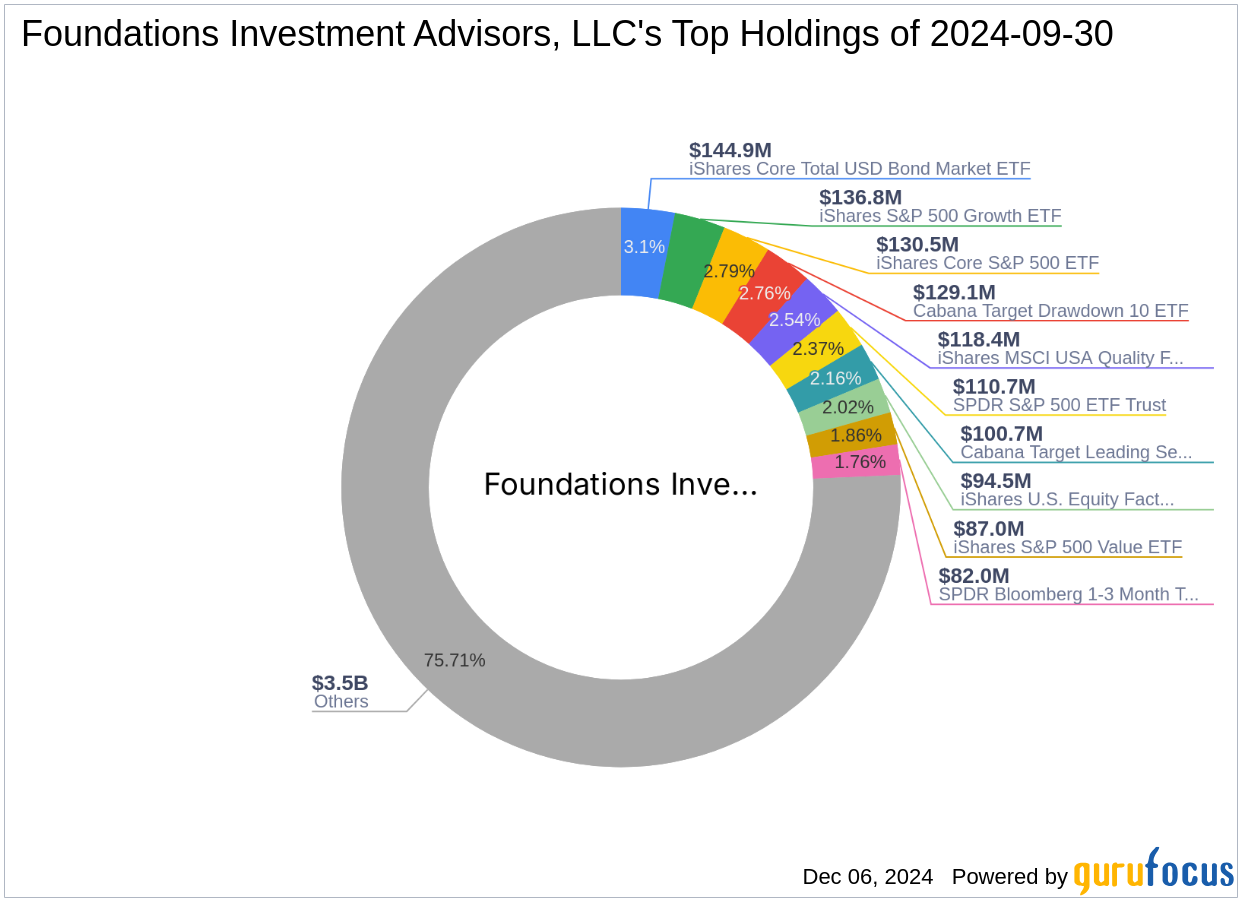

Based in Scottsdale, Arizona, Foundations Investment Advisors, LLC (Trades, Portfolio) is a prominent investment firm known for its focus on the technology and healthcare sectors. The firm operates from its headquarters at 10575 N. 114th Street, Ste. 107, Scottsdale, AZ 85259. With a robust investment philosophy centered around these dynamic sectors, the firm manages an equity portfolio valued at $4.67 billion. Some of its top holdings include iShares Core Total USD Bond Market ETF (IUSB, Financial), iShares Core S&P 500 ETF (IVV, Financial), and iShares S&P 500 Growth ETF (IVW, Financial). This strategic focus allows the firm to leverage growth opportunities in sectors that are pivotal to technological advancement and healthcare innovation.

Overview of FIRST TR EXCH ALPH (FGM, Financial)

FIRST TR EXCH ALPH (FGM) is a company with a market capitalization of $7.840 million. As of the latest data, the stock is trading at $38.9263 with a price-to-earnings ratio of 5.56. Despite its relatively small market cap, FGM presents a unique investment opportunity, albeit with certain risks. The stock's current valuation suggests it is overvalued, with a GF Value of $33.01, indicating a price to GF Value ratio of 1.18. This suggests that the stock is trading above its intrinsic value, which could imply limited upside potential unless the company's fundamentals improve significantly.

Financial Metrics and Valuation

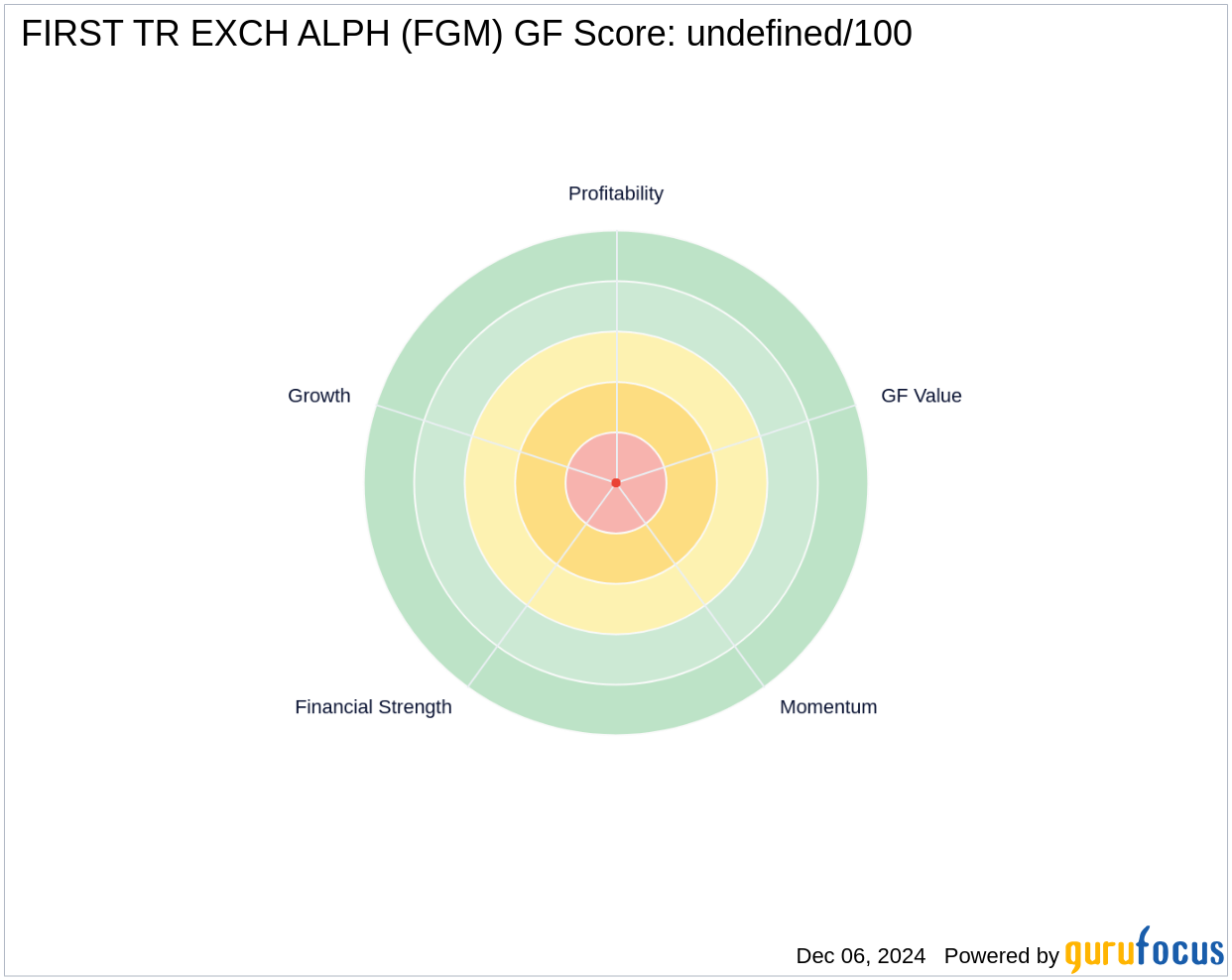

FGM's financial metrics reveal a mixed picture. The stock's GF Score of 71/100 suggests it is likely to have average performance in the long term. The stock's GF Value Rank is 6/10, indicating a moderate valuation level. Investors should exercise caution, as the GF Valuation data is out of date, and the stock is currently considered overvalued. This valuation assessment is crucial for value investors who prioritize buying stocks at a discount to their intrinsic value.

Performance and Growth Indicators

Since the transaction, FGM has experienced a modest gain of 0.72%. Over the past three years, the company has demonstrated a strong earnings growth rate of 25.18%, alongside a revenue growth rate of 12.93%. These growth metrics highlight the company's potential to deliver solid returns, although the stock's Growth Rank is 6/10, indicating moderate growth prospects. Investors should consider these factors when evaluating the stock's potential for future appreciation.

Risk and Profitability Assessment

FGM's profitability and growth ranks are both at 6/10, reflecting a balanced risk-reward profile. The stock's balance sheet rank is 5.7/10, with a cash to debt ratio of 2.50, suggesting a reasonable level of financial strength. The company's interest coverage ratio of 19.22 indicates a strong ability to meet its debt obligations. However, the Altman Z score of 2.45 suggests a moderate risk of financial distress, which investors should consider when assessing the stock's risk profile.

Strategic Implications for Investors

The decision by Foundations Investment Advisors, LLC (Trades, Portfolio) to invest in FGM may be driven by the company's growth potential and strategic positioning within its industry. For value investors, this transaction highlights the importance of balancing growth prospects with valuation considerations. While FGM's current valuation appears stretched, its growth metrics and financial health offer a compelling case for potential long-term gains. Investors should weigh these factors carefully, considering the stock's valuation and growth prospects, before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.