On November 30, 2024, AWM Investment Company, Inc. (Trades, Portfolio) executed a significant transaction involving OptimizeRx Corp (OPRX, Financial), reducing its holdings by 193,347 shares. This adjustment brought the firm's total shares in OptimizeRx to 878,485, representing a 0.58% position in its portfolio. The transaction was executed at a price of $5.45 per share, reflecting a strategic decision by the firm to recalibrate its investment in the healthcare provider. This move is part of AWM's ongoing portfolio management strategy, which focuses on optimizing returns while managing risk.

AWM Investment Company, Inc. (Trades, Portfolio): A Profile

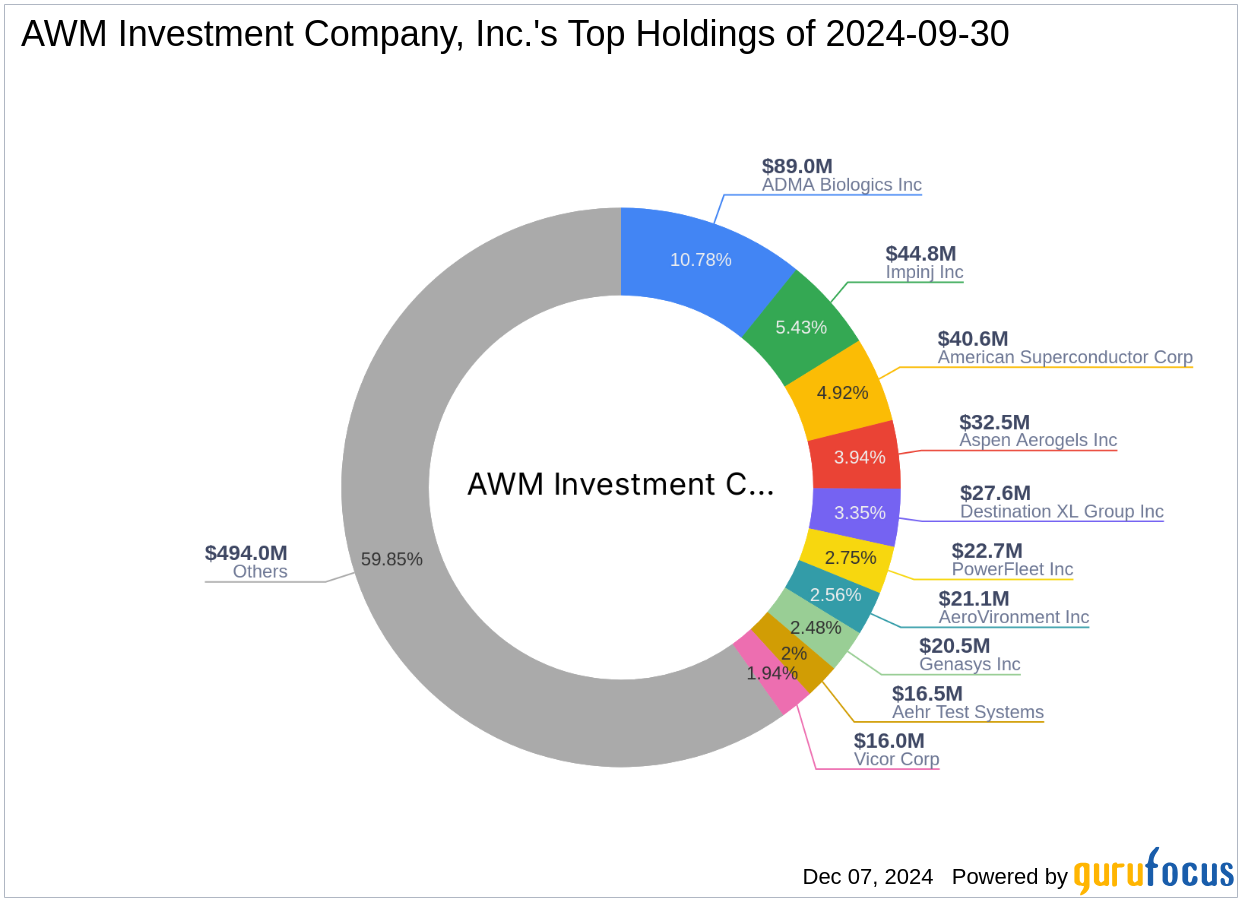

AWM Investment Company, Inc. (Trades, Portfolio) is a well-regarded investment firm headquartered at 527 Madison Avenue, New York. Known for its strategic focus on the technology and healthcare sectors, AWM manages a diverse portfolio with a total equity of $825 million. The firm's investment philosophy emphasizes long-term growth and value creation, often targeting innovative companies within its preferred sectors. Among its top holdings are ADMA Biologics Inc (ADMA, Financial), American Superconductor Corp (AMSC, Financial), and Destination XL Group Inc (DXLG, Financial), showcasing its commitment to high-potential growth stocks.

OptimizeRx Corp: Company Overview

OptimizeRx Corp is a prominent player in the U.S. healthcare market, specializing in digital health messaging services. The company provides a cloud-based platform that facilitates communication between pharmaceutical companies, healthcare providers, and patients. Its offerings include Financial Messaging, Brand and Clinical Messaging, and Patient Engagement solutions, all designed to enhance medication adherence and patient outcomes. With a market capitalization of $98.735 million and a current stock price of $5.36, OptimizeRx is positioned as a key innovator in healthcare communication.

Impact of the Transaction on AWM's Portfolio

The reduction in OptimizeRx shares marks a strategic shift in AWM's portfolio management. Despite the decrease, OptimizeRx remains a significant holding, accounting for 4.80% of the firm's total investments. This adjustment may reflect AWM's response to market conditions or a reassessment of OptimizeRx's growth potential. The transaction's impact on the portfolio is relatively minor, with a -0.13% change, indicating a cautious approach to rebalancing.

Financial Metrics and Valuation of OptimizeRx Corp

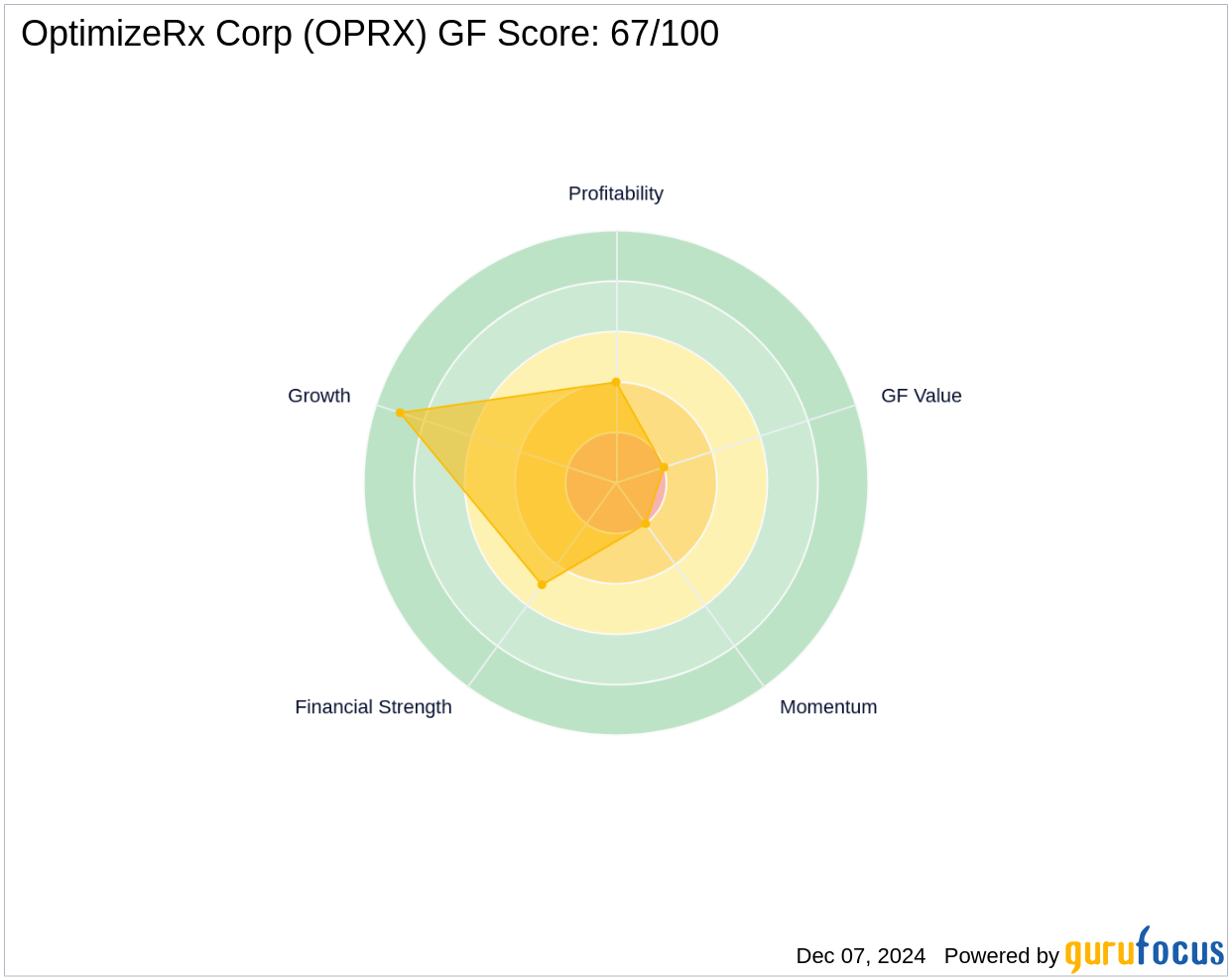

OptimizeRx's financial metrics present a mixed picture. The company has a GF Score of 67/100, suggesting poor future performance potential. Its market cap stands at $98.735 million, with a GF Value Rank of 2/10, indicating a possible value trap. The stock's Profitability Rank is 4/10, and its Growth Rank is 9/10, reflecting strong revenue growth but challenges in profitability.

Historical Performance and Market Sentiment

Since its IPO in 2009, OptimizeRx has experienced a dramatic -99.98% change in stock price, highlighting significant volatility. Year-to-date, the stock has declined by 61.82%, with recent price changes showing a -1.65% drop since the transaction. Market sentiment indicators, such as the RSI and momentum indexes, suggest a neutral to bearish outlook, with the Momentum Rank at 2/10.

Conclusion

AWM Investment Company, Inc. (Trades, Portfolio)'s decision to reduce its stake in OptimizeRx Corp reflects a strategic portfolio adjustment in response to market dynamics and company performance. While OptimizeRx continues to innovate in digital health messaging, its financial metrics and market sentiment suggest caution. The firm's future performance will depend on its ability to enhance profitability and capitalize on growth opportunities in the healthcare sector. Investors should consider these factors when evaluating the potential of OptimizeRx as part of a diversified investment strategy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.