On December 9, 2024, Amtech Systems Inc (ASYS, Financial) released its 8-K filing detailing the financial results for the fourth quarter and fiscal year ended September 30, 2024. The company, a manufacturer of capital equipment for semiconductor fabrication, reported a net revenue of $24.1 million for the fourth quarter, exceeding the analyst estimate of $23.75 million. However, the company posted a GAAP net loss of $0.5 million, translating to a loss of 4 cents per share, which is below the estimated earnings per share of -0.01.

Company Overview

Amtech Systems Inc is a prominent player in the semiconductor industry, specializing in the manufacture of thermal processing and wafer polishing equipment. The company operates through two segments: Semiconductor, which caters to semiconductor manufacturers and industries like electronics and automotive, and Material and Substrate, which focuses on consumables and machinery for polishing various materials.

Performance and Challenges

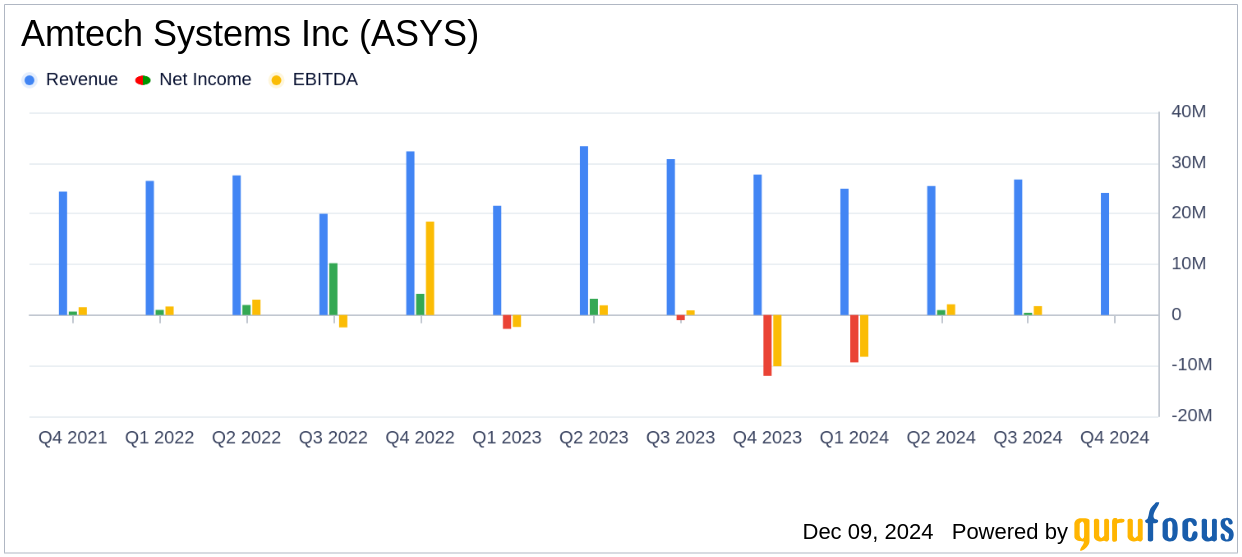

Amtech Systems Inc's performance in the fourth quarter reflects a strategic focus on cost alignment with market conditions, resulting in a positive adjusted EBITDA of $0.8 million. Despite a challenging market environment, the company managed to fully repay $10.7 million in debt, strengthening its financial position. However, the company faced a sequential revenue decline of 10% and a year-over-year decrease of 13%, primarily due to reduced sales in diffusion furnaces and wafer cleaning equipment.

Financial Achievements

For fiscal 2024, Amtech Systems Inc reported a net revenue of $101.2 million, slightly surpassing the annual estimate of $100.85 million. The company achieved a non-GAAP net income of $43.0 thousand and an adjusted EBITDA of $4.0 million. These achievements are significant in the semiconductor industry, where maintaining profitability amidst cyclical demand is crucial.

Key Financial Metrics

Amtech Systems Inc's GAAP gross margin improved to 40.7% in the fourth quarter, up from 10.1% in the same period last year, driven by better margin profiles and cost savings. The company's cash position stood at $11.1 million, with cash provided by operations amounting to $9.8 million. The backlog at the end of the fiscal year was $25.3 million, indicating a steady demand pipeline.

| Metric | Q4 FY 2024 | Q3 FY 2024 | Q4 FY 2023 |

|---|---|---|---|

| Net Revenue | $24.1 million | $26.7 million | $27.7 million |

| GAAP Net Loss | $0.5 million | $0.4 million (income) | $12.0 million |

| Non-GAAP Net Income | $7.0 thousand | $1.1 million | $2.5 million (loss) |

Analysis and Commentary

Amtech Systems Inc's ability to exceed revenue expectations despite a challenging market underscores its strategic focus on cost management and product diversification. The company's efforts to expand its product offerings and customer base in higher-margin segments are expected to drive future growth. As noted by CEO Bob Daigle,

We are pleased to report that in the fourth quarter, our strategic focus on aligning our cost structure with prevailing market conditions enabled us to achieve our fourth consecutive quarter of positive adjusted EBITDA and operating cash flow."

Overall, Amtech Systems Inc's fiscal 2024 results highlight its resilience and strategic adaptability in the semiconductor industry, positioning it for potential growth in the coming quarters. For more detailed insights and analysis, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Amtech Systems Inc for further details.