On December 6, 2024, TOWERVIEW LLC (Trades, Portfolio), a prominent investment firm, expanded its holdings in StealthGas Inc (GASS, Financial) by acquiring an additional 245,000 shares. This transaction brings the firm's total ownership in the company to 2,702,500 shares. The acquisition was executed at a trade price of $5.14 per share, reflecting a strategic move by TOWERVIEW LLC (Trades, Portfolio) to bolster its position in the international shipping transportation sector. This transaction now represents 8.9% of the firm's portfolio, with StealthGas Inc accounting for a 7.40% position in the traded stock.

About TOWERVIEW LLC (Trades, Portfolio)

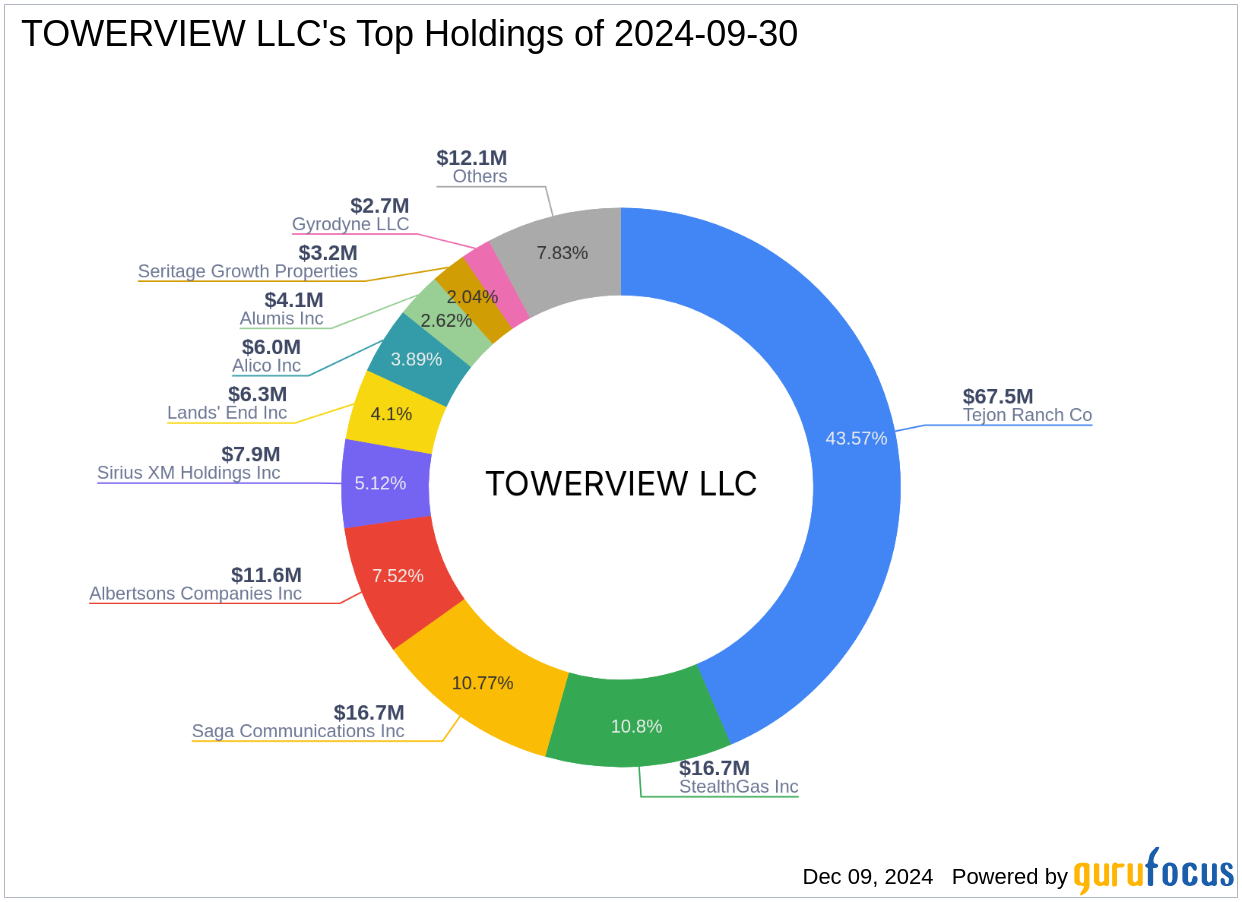

TOWERVIEW LLC (Trades, Portfolio) is a well-regarded investment firm headquartered in New York, known for its strategic investments across various sectors. The firm focuses primarily on the Industrials and Communication Services sectors, demonstrating a keen interest in companies with robust growth potential and solid fundamentals. With a portfolio equity of $155 million, TOWERVIEW LLC (Trades, Portfolio)'s top holdings include Saga Communications Inc (SGA, Financial), StealthGas Inc (GASS, Financial), Sirius XM Holdings Inc (SIRI, Financial), Tejon Ranch Co (TRC, Financial), and Albertsons Companies Inc (ACI, Financial).

StealthGas Inc: A Leader in Shipping Transportation

StealthGas Inc, based in Greece, is a leading international shipping transportation company. The company specializes in owning and operating liquefied petroleum gas (LPG) pressurized carriers, providing essential seaborne transportation services to LPG producers and users. StealthGas Inc's fleet carries various petroleum gas products, including propane, butane, and propylene, which are byproducts of crude oil and natural gas production. The company plays a crucial role in the global energy supply chain, serving oil producers, refineries, and commodities traders.

Financial Metrics and Valuation of StealthGas Inc

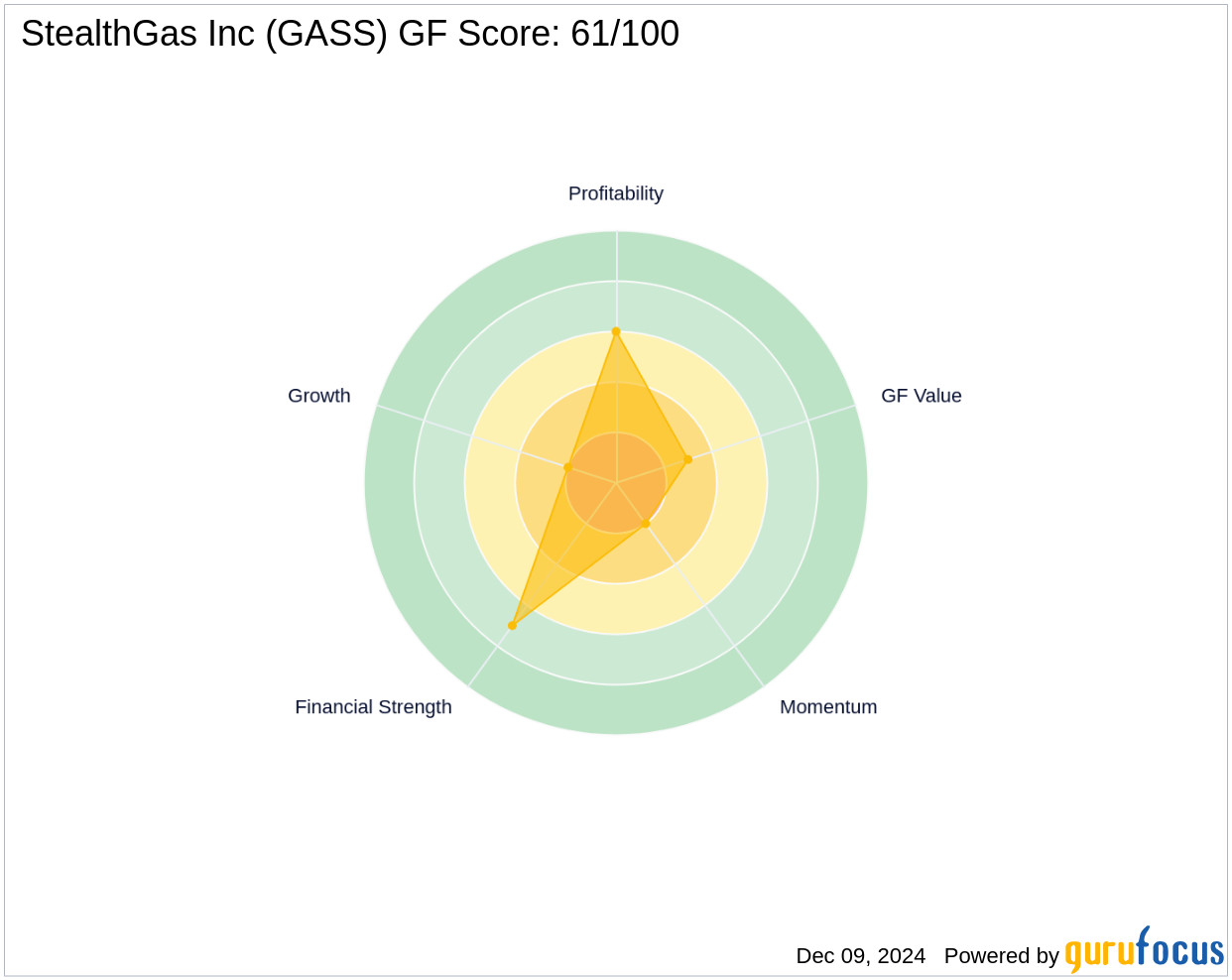

StealthGas Inc currently holds a market capitalization of $191.423 million, with a stock price of $5.21. The company's price-to-earnings (PE) ratio stands at 2.94, indicating a potentially undervalued stock relative to its earnings. However, the GF Valuation suggests that the stock is significantly overvalued, with a GF Value of $3.79 and a price-to-GF Value ratio of 1.37. These metrics highlight the complexities in assessing the stock's true value, considering both its current market performance and intrinsic value.

Impact on TOWERVIEW LLC (Trades, Portfolio)'s Portfolio

The recent acquisition of StealthGas Inc shares has notably increased TOWERVIEW LLC (Trades, Portfolio)'s stake in the company, making it a significant component of the firm's investment portfolio. With the stock now representing 8.9% of the portfolio, TOWERVIEW LLC (Trades, Portfolio) demonstrates confidence in StealthGas Inc's potential for growth and profitability. This strategic move aligns with the firm's investment philosophy of targeting sectors with promising long-term prospects.

Performance and Growth Indicators of StealthGas Inc

StealthGas Inc has shown mixed growth indicators, with a 3-year revenue growth of 0.60% and a substantial earnings growth of 45.60%. The company's profitability and balance sheet are ranked at 6/10 and 7/10, respectively, reflecting moderate financial strength. Key performance metrics such as return on equity (ROE) and return on assets (ROA) are 11.23% and 8.98%, respectively, indicating efficient management of resources and capital.

Market and Stock Performance Analysis

Despite its operational strengths, StealthGas Inc has faced challenges in the stock market, with a year-to-date price change of -25.46% and an IPO price change of -63.57%. The stock's momentum and RSI indicators suggest potential future performance challenges, with a 14-day RSI of 27.52, indicating oversold conditions. These factors highlight the volatility and risks associated with investing in the company, despite its operational capabilities.

Conclusion

TOWERVIEW LLC (Trades, Portfolio)'s increased stake in StealthGas Inc underscores a strategic investment decision aimed at capitalizing on the company's potential in the shipping transportation sector. While the stock presents certain risks, including market volatility and valuation concerns, the firm's confidence in StealthGas Inc's growth prospects suggests potential opportunities for long-term gains. Investors should consider these factors in the context of current market conditions when evaluating the merits of this investment.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.