On December 5, 2024, Owl Creek Asset Management, L.P. (Trades, Portfolio) made a significant move by acquiring an additional 132,141 shares of Anterix Inc (ATEX, Financial) at a transaction price of $34.26 per share. This acquisition brings the firm's total holdings in Anterix to 5,543,917 shares. The transaction reflects a strategic decision by Owl Creek to bolster its position in Anterix, which now constitutes 7.58% of the firm's portfolio. This move is noteworthy for value investors monitoring the telecommunications sector, as it indicates confidence in Anterix's potential despite its current valuation challenges.

Owl Creek Asset Management: A Brief Profile

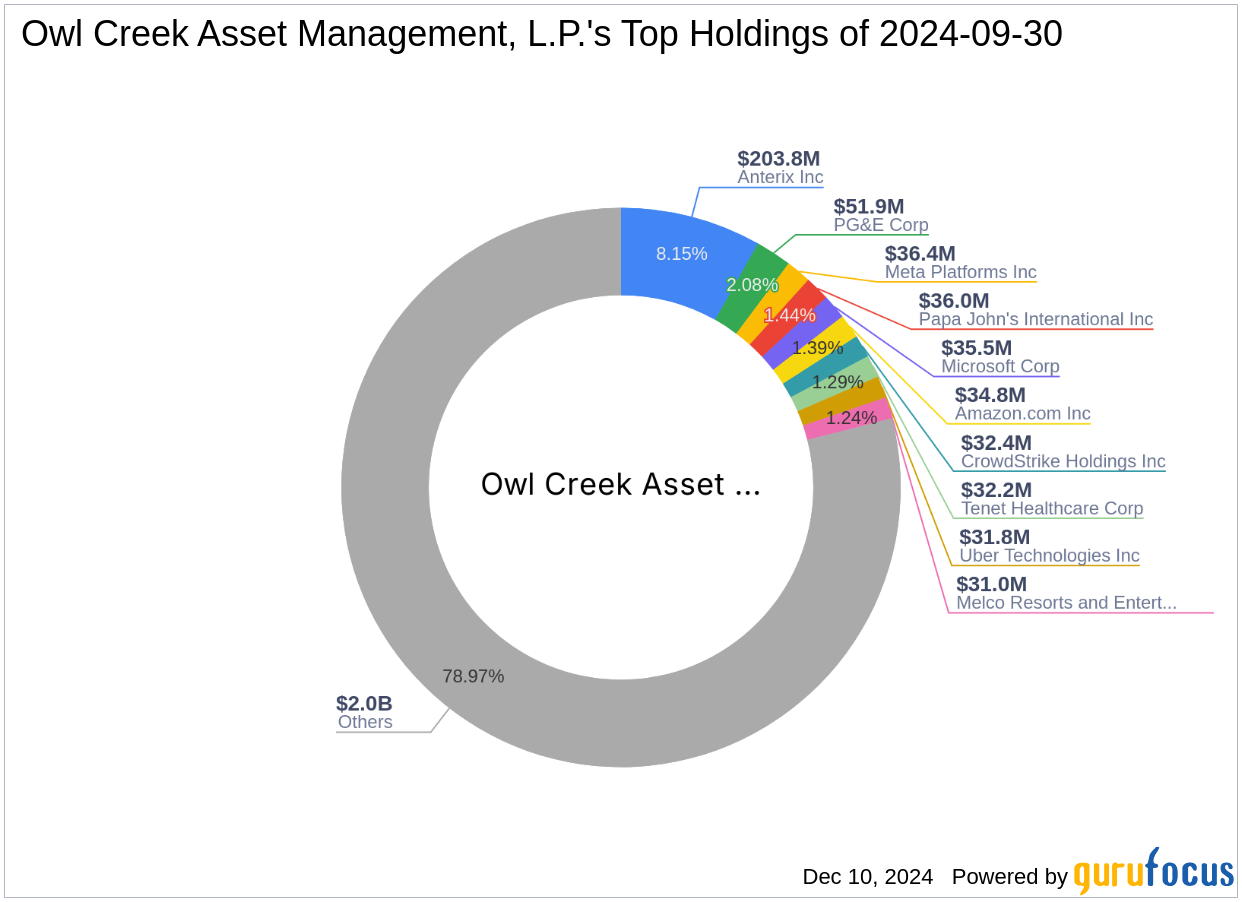

Owl Creek Asset Management, L.P. (Trades, Portfolio), headquartered at 640 Fifth Avenue, New York, NY, manages a substantial equity portfolio valued at $2.5 billion. While the firm's specific investment philosophy is not detailed, its top holdings include major companies such as Meta Platforms Inc (META, Financial), Microsoft Corp (MSFT, Financial), Anterix Inc (ATEX, Financial), Papa John's International Inc (PZZA, Financial), and PG&E Corp (PCG, Financial). The firm's investment focus is primarily on the Communication Services and Consumer Cyclical sectors, indicating a strategic approach to sectors with significant growth potential.

Anterix Inc: Company Overview

Anterix Inc, based in the USA, went public on February 3, 2015. The company specializes in providing broadband solutions essential for modernizing infrastructure across various industries, including energy and transportation. Anterix's market capitalization stands at $633.952 million, with a current stock price of $34.05. Despite its innovative offerings, the company's valuation presents a potential challenge, as indicated by a Price-to-GF Value ratio of 0.33, suggesting it may be a value trap. The GF Value of Anterix is estimated at $104.70, highlighting a significant gap between the current price and its intrinsic value.

Financial Metrics and Valuation

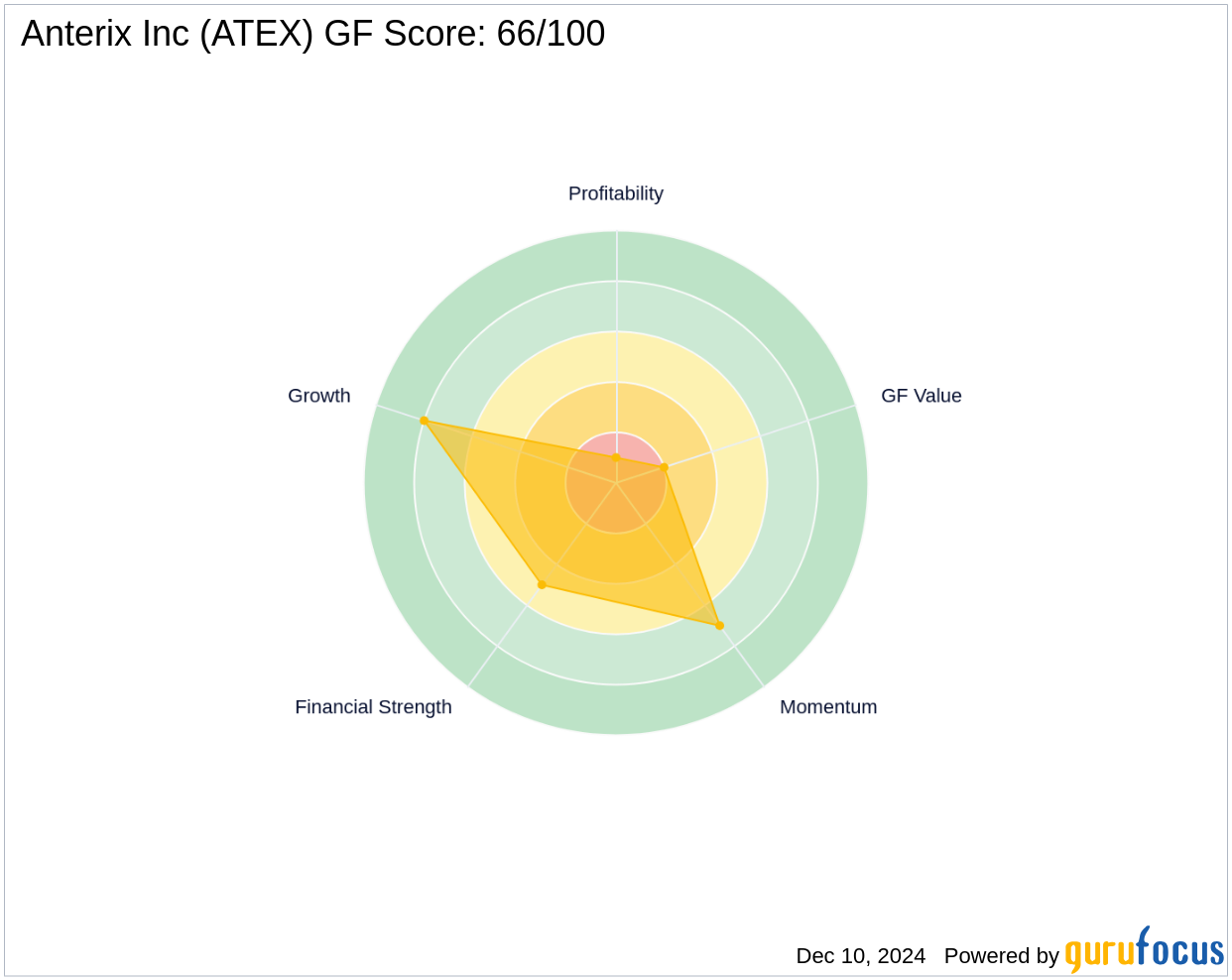

Anterix's financial metrics reveal a mixed picture. The company's year-to-date price change is a modest 1.28%, and its GF Score of 66/100 suggests poor future performance potential. The company's Profitability Rank is 1/10, indicating significant challenges in achieving profitability. However, Anterix has demonstrated robust revenue growth of 61.40% over the past three years, although its EBITDA growth has slightly declined by 0.40% during the same period. These metrics underscore the company's growth potential, albeit with profitability concerns.

Impact of the Transaction

The recent acquisition by Owl Creek Asset Management has increased its stake in Anterix to 7.58% of its portfolio, reflecting a 0.18% increase. This strategic addition underscores the firm's confidence in Anterix's long-term potential, despite the current valuation challenges. The total shares held by Owl Creek now amount to 5,543,917, positioning the firm as a significant stakeholder in Anterix.

Performance and Growth Indicators

Anterix's performance indicators reveal a complex landscape. The company's revenue growth over the past three years is impressive at 61.40%, yet its Operating Margin growth has declined by 15.10%. The Growth Rank is 8/10, indicating strong growth potential, but the Profitability Rank remains low at 1/10. These indicators suggest that while Anterix is expanding, it faces challenges in converting growth into profitability.

Market and Industry Context

Operating within the Telecommunication Services industry, Anterix is part of a competitive landscape. The largest guru holding Anterix shares is GAMCO Investors, with Jefferies Group (Trades, Portfolio) also being a notable holder. This context highlights the interest of significant investors in Anterix, despite its current valuation concerns, suggesting potential long-term value.

Conclusion

Owl Creek Asset Management's strategic addition of Anterix Inc shares reflects a calculated bet on the company's future potential. While Anterix presents a challenging valuation scenario, its growth indicators and strategic industry position offer potential opportunities for value investors. As the telecommunications sector continues to evolve, Anterix's role in modernizing infrastructure could prove pivotal, making it a stock worth monitoring closely.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

Also check out: