On December 10, 2024, Avid Bioservices Inc (CDMO, Financial) released its 8-K filing detailing the financial results for the second quarter ended October 31, 2024. Avid Bioservices Inc is a clinical-stage biopharmaceutical company specializing in the development and Current Good Manufacturing Practices (CGMP) of biopharmaceutical products derived from mammalian cell culture. The company operates in one reportable segment, providing contract manufacturing and development services, including clinical and commercial drug substance manufacturing, bulk packaging, release and stability testing, and regulatory submissions support.

Quarterly Financial Performance

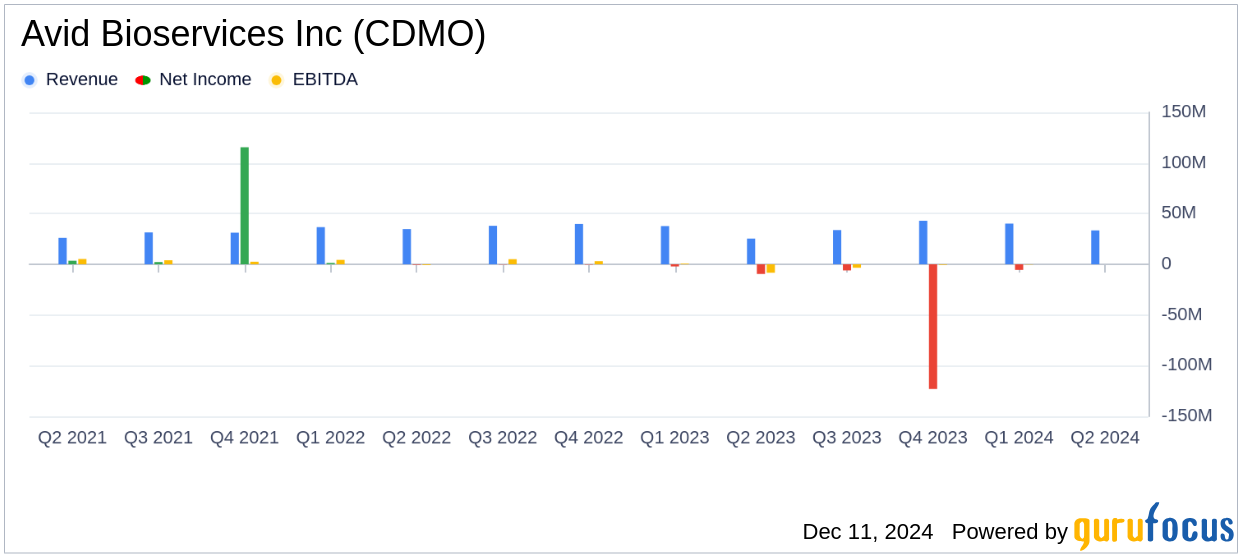

Avid Bioservices reported revenues of $33.5 million for the second quarter, which represents a 32% increase from $25.4 million in the same period last year. However, this figure fell short of the analyst estimate of $33.80 million. The revenue growth was primarily driven by increases in manufacturing and process development revenues. Despite the revenue growth, the company reported a net loss of $17.4 million, or $0.27 per share, which is significantly wider than the $9.5 million, or $0.15 per share, loss reported in the prior year period. This net loss also exceeded the analyst estimate of a $0.12 loss per share.

Financial Highlights and Challenges

For the first six months of fiscal 2025, Avid Bioservices achieved revenues of $73.7 million, marking a 17% increase from $63.1 million in the same period last year. The company's backlog as of October 31, 2024, was $220 million, an 11% increase from $199 million at the end of the same quarter last year. This backlog is expected to convert into revenue over the next five fiscal quarters.

Despite the revenue growth, the company faced challenges with increased costs. Gross loss for the second quarter was $2.0 million, an improvement from a gross loss of $4.7 million in the prior year period. However, SG&A expenses rose by 61% to $10.6 million, primarily due to higher compensation, benefits, and legal fees. These increased expenses contributed to the widened net loss.

Strategic Developments and Industry Impact

Avid Bioservices announced a definitive merger agreement with GHO Capital Partners and Ampersand Capital Partners, valued at approximately $1.1 billion. This acquisition, expected to close in the first quarter of 2025, offers a 13.8% premium to Avid's closing share price on November 6, 2024. The transaction is anticipated to provide significant cash value to shareholders and leverage the partners' industry experience for future growth.

“We delivered solid results in a competitive environment, with increased revenues and backlog offset by increased costs,” stated Nick Green, president and CEO of Avid Bioservices.

Financial Metrics and Analysis

Key financial metrics from the earnings report include a gross profit of $3.7 million for the first six months of fiscal 2025, compared to a gross loss of $0.6 million in the prior year period. The company's cash and cash equivalents stood at $33.4 million as of October 31, 2024, down from $38.1 million on April 30, 2024. The expiration of the company's revolving line of credit during the second quarter may impact liquidity management.

| Metric | Q2 2024 | Q2 2023 |

|---|---|---|

| Revenue | $33.5 million | $25.4 million |

| Net Loss | $17.4 million | $9.5 million |

| SG&A Expenses | $10.6 million | $6.6 million |

| Cash and Cash Equivalents | $33.4 million | $38.1 million (April 30, 2024) |

Conclusion

Avid Bioservices Inc (CDMO, Financial) demonstrated revenue growth in a competitive market, yet faced challenges with increased costs leading to a widened net loss. The strategic acquisition by GHO Capital Partners and Ampersand Capital Partners is expected to provide financial stability and growth opportunities. Investors and stakeholders will be closely monitoring the company's ability to convert its backlog into revenue and manage expenses effectively in the coming quarters.

Explore the complete 8-K earnings release (here) from Avid Bioservices Inc for further details.