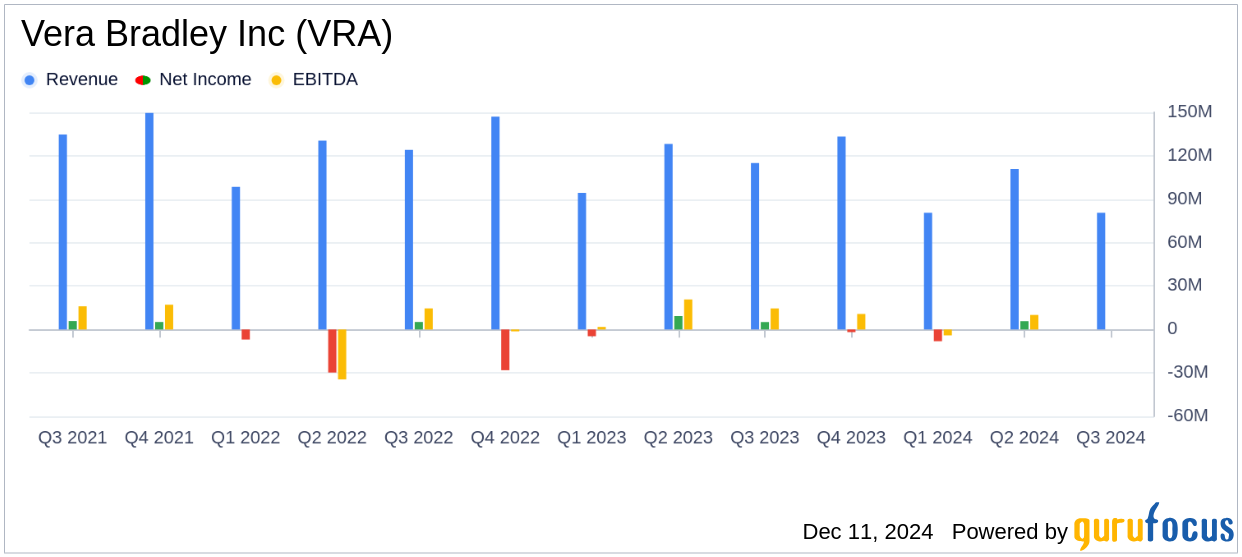

On December 11, 2024, Vera Bradley Inc (VRA, Financial) released its 8-K filing detailing the financial results for the third quarter of fiscal year 2025. The company, known for designing women's handbags, travel items, and accessories, reported consolidated net revenues of $80.6 million, falling short of the analyst estimate of $98.70 million. The company also reported a net loss of $12.8 million, or $0.46 per diluted share, which was below the estimated earnings per share of $0.12.

Company Overview and Strategic Challenges

Vera Bradley Inc operates primarily in the United States, with most sales occurring through its retail stores and e-commerce platforms. The company also engages in a substantial wholesale business. The third quarter was marked by the early stages of 'Project Restoration,' a strategic initiative aimed at transforming the business model and repositioning the brand. CEO Jackie Ardrey noted the challenges faced during this period, emphasizing the need for adjustments in product assortment and value proposition to align with consumer expectations.

Financial Performance and Key Metrics

Vera Bradley Inc's financial performance in the third quarter highlighted significant challenges. The company's consolidated net revenues decreased from $115.0 million in the prior year to $80.6 million. The net loss of $12.8 million, or $0.46 per diluted share, contrasts sharply with the previous year's net income of $5.1 million, or $0.16 per diluted share. On a non-GAAP basis, the net loss was $7.5 million, or $0.27 per diluted share, compared to a non-GAAP net income of $6.1 million, or $0.19 per diluted share, in the prior year.

Segment Performance and Operational Insights

The Vera Bradley Direct segment reported revenues of $52.5 million, a 27.4% decrease from the previous year. The Indirect segment saw a 27.9% decline in revenues to $18.0 million, while the Pura Vida segment experienced a 42.9% drop to $10.1 million. These declines were attributed to reduced specialty and key account orders, as well as decreased e-commerce and wholesale sales.

Balance Sheet and Cash Flow Analysis

As of November 2, 2024, Vera Bradley Inc reported cash and cash equivalents of $13.7 million, down from $52.3 million at the end of the previous year's third quarter. The company maintained no debt, with a total liquidity of approximately $89 million. Inventory levels slightly increased to $131.3 million from $129.1 million. The company repurchased approximately $5.3 million of its common stock during the third quarter.

CEO Commentary and Strategic Outlook

"The third quarter was extremely challenging as we remained in the early stages of ‘Project Restoration’, our strategic initiative to transform our business model and transition Vera Bradley’s brand positioning. With the current consumer mindset focused on value, we have more work ahead of us on our repositioning journey." - Jackie Ardrey, CEO

Conclusion and Future Prospects

Vera Bradley Inc's third-quarter results reflect the difficulties of navigating a strategic transformation amid a challenging retail environment. The company's focus on repositioning and brand restoration is crucial for long-term growth. However, the significant revenue and earnings declines underscore the challenges ahead. Investors and stakeholders will be closely monitoring the company's progress in executing its strategic initiatives and adapting to consumer demands.

Explore the complete 8-K earnings release (here) from Vera Bradley Inc for further details.