Costco Wholesale Corp (COST, Financial) released its 8-K filing on December 12, 2024, reporting robust financial results for the first quarter of fiscal 2025. The company, known for its membership-based retail model, reported a net income of $1,798 million, or $4.04 per diluted share, exceeding the analyst estimate of $3.78 per share. This represents a significant increase from the previous year's net income of $1,589 million, or $3.58 per diluted share.

Company Overview

Costco operates a no-frills retail model, offering a select product assortment in bulk quantities at competitive prices. The company maintains a lean cost structure by storing inventory on pallets and limiting distribution expenses, which allows it to price merchandise below competitors and drive high sales volume. Costco operates over 600 warehouses in the United States and holds more than 60% market share in the domestic warehouse club industry. Internationally, it has 270 warehouses in countries including Canada, Mexico, Japan, and the UK.

Performance and Challenges

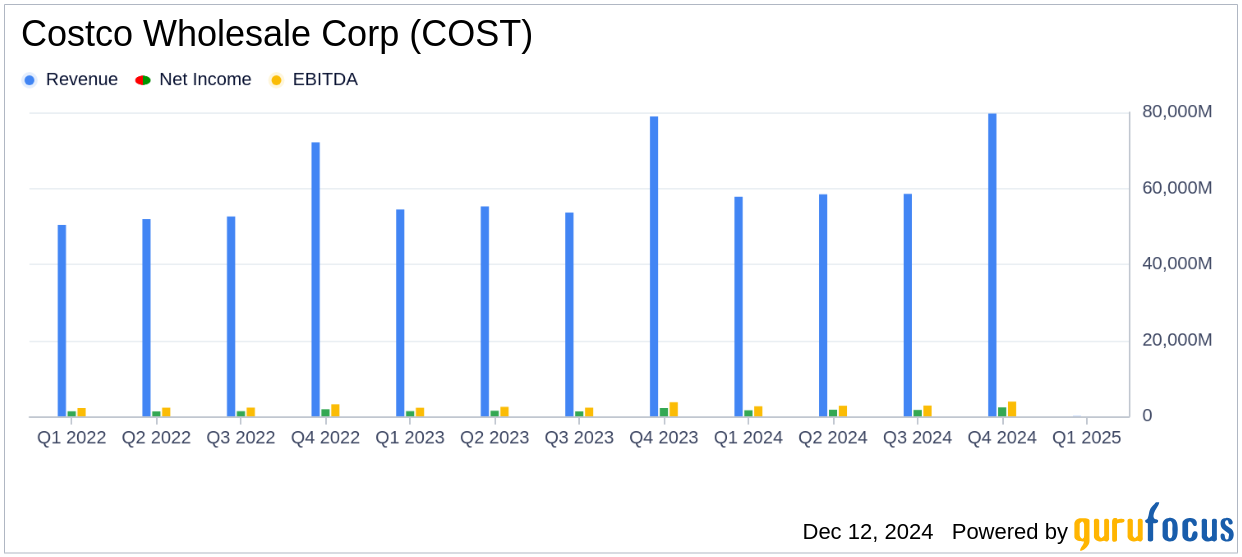

Costco's net sales for the first quarter increased by 7.5% to $60.99 billion, up from $56.72 billion in the previous year. This growth is crucial as it underscores Costco's ability to maintain its competitive edge in the retail sector, particularly in a challenging economic environment. However, the company faces challenges such as fluctuating gasoline prices and foreign exchange rates, which can impact comparable sales figures. Despite these hurdles, Costco's adjusted comparable sales showed strong growth across all regions, with a notable 13.2% increase in e-commerce sales.

Financial Achievements

Costco's financial achievements are significant in the retail industry, particularly in the defensive sector. The company's ability to generate strong profits on thin margins is a testament to its efficient cost management and high sales volume. The increase in membership fees to $1,166 million from $1,082 million also highlights Costco's growing customer base and loyalty, which are vital for sustained revenue growth.

Key Financial Metrics

Costco's operating income rose to $2,196 million from $1,984 million, reflecting its effective cost control and operational efficiency. The company's total revenue reached $62,151 million, surpassing the estimated revenue of $62,082.76 million. These metrics are crucial as they demonstrate Costco's ability to leverage its business model to achieve financial stability and growth.

| Metric | Q1 FY2025 | Q1 FY2024 |

|---|---|---|

| Net Sales | $60.99 billion | $56.72 billion |

| Net Income | $1,798 million | $1,589 million |

| Diluted EPS | $4.04 | $3.58 |

| Operating Income | $2,196 million | $1,984 million |

Analysis and Insights

Costco's performance in the first quarter of fiscal 2025 highlights its resilience and adaptability in a competitive retail landscape. The company's ability to exceed earnings estimates and achieve substantial revenue growth is indicative of its strong market position and operational efficiency. As Costco continues to expand its international presence and enhance its e-commerce capabilities, it remains well-positioned to capitalize on future growth opportunities.

Overall, Costco's latest earnings report underscores its robust financial health and strategic prowess, making it an attractive prospect for value investors seeking stability and growth in the retail sector.

Explore the complete 8-K earnings release (here) from Costco Wholesale Corp for further details.