On December 12, 2024, Quanex Building Products Corp (NX, Financial) released its 8-K filing detailing the financial results for the fourth quarter and full fiscal year ending October 31, 2024. The company, a manufacturer of components for the building products industry, reported significant revenue growth driven by the recent Tyman acquisition, although earnings per share fell short of analyst expectations.

Company Overview

Quanex Building Products Corp is a key player in the building products industry, manufacturing engineered products such as window and door components, solar panel sealants, and precision-formed metal and wood products. The company operates through three segments: North American Fenestration, European Fenestration, and North American Cabinet Components, with the majority of its revenue derived from the United States.

Performance and Challenges

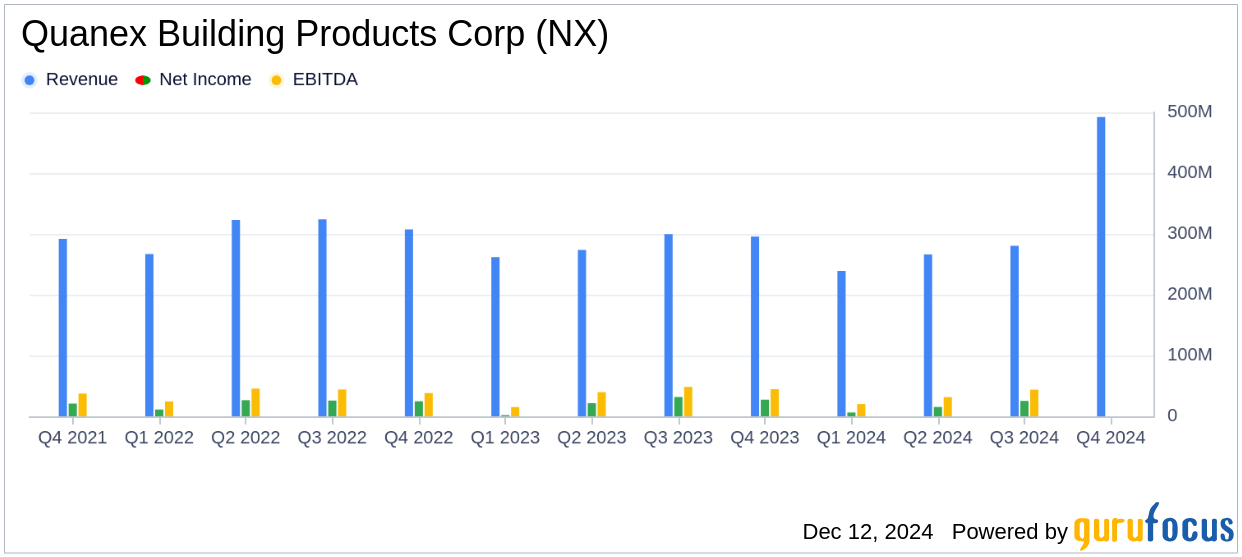

Quanex reported net sales of $492.2 million for the fourth quarter, a 66.6% increase from $295.5 million in the same period of 2023. For the full year, net sales reached $1.28 billion, up 13% from $1.13 billion in 2023. This growth was largely attributed to the Tyman acquisition completed on August 1, 2024. However, excluding Tyman's contribution, net sales would have declined by 2.3% for the quarter and 5.0% for the year, primarily due to lower volumes.

Despite the revenue growth, Quanex reported a net loss of $13.9 million for the fourth quarter, translating to a diluted EPS of ($0.30), missing the analyst estimate of $0.55. For the full year, net income was $33.1 million, with a diluted EPS of $0.90, below the annual estimate of $1.98. The decline in earnings was influenced by increased costs and a challenging macroeconomic environment.

Financial Achievements and Industry Impact

The Tyman acquisition significantly boosted Quanex's financial performance, contributing $203.4 million in net sales during the fourth quarter. The acquisition also facilitated margin expansion on a consolidated basis for the full year, despite a challenging market environment. This strategic move is crucial for Quanex as it enhances its market position and operational capabilities in the construction industry.

Key Financial Metrics

Quanex's adjusted net income for the fourth quarter was $28.6 million, with an adjusted diluted EPS of $0.61, surpassing the estimated EPS of $0.55. Adjusted EBITDA for the quarter was $81.1 million, reflecting a margin of 16.5%. For the full year, adjusted net income was $80.4 million, with an adjusted diluted EPS of $2.19, and adjusted EBITDA was $182.4 million, with a margin of 14.3%.

These metrics are vital for assessing Quanex's operational efficiency and profitability, especially in the context of its recent acquisition and integration efforts.

Balance Sheet and Cash Flow

As of October 31, 2024, Quanex reported total assets of $2.32 billion, with total liabilities of $1.31 billion. The company successfully repaid $53.75 million in debt during the fourth quarter, reducing its leverage ratio to 3.7x. Quanex's liquidity stood at $343.3 million, comprising $97.7 million in cash and availability under its credit facility.

Free cash flow for the year was $51.7 million, down from $109.7 million in 2023, reflecting increased capital expenditures and acquisition-related costs.

Commentary and Future Outlook

George Wilson, Chairman, President and Chief Executive Officer, commented, “On a consolidated basis, results for the fourth quarter and full year were boosted by the contribution from the Tyman acquisition. Results from the legacy Quanex business were in-line with our expectations for both the fourth quarter and full year. We are pleased with profitability despite the soft macro environment we experienced throughout 2024.”

Looking ahead, Quanex anticipates continued demand softness into early 2025, with expectations for improvement in the latter half of the year. The company remains focused on integrating the Tyman acquisition and capturing synergies to drive long-term growth and shareholder value.

Explore the complete 8-K earnings release (here) from Quanex Building Products Corp for further details.