Zedge Inc (ZDGE, Financial) released its 8-K filing on December 16, 2024, detailing the financial results for the first quarter of fiscal 2025, which ended on October 31, 2024. Zedge Inc, a leader in digital marketplaces and interactive games, provides a platform for content distribution, enabling users to personalize their mobile devices with a variety of digital content. The company operates through two main segments: the Zedge Marketplace and GuruShots.

Performance Overview

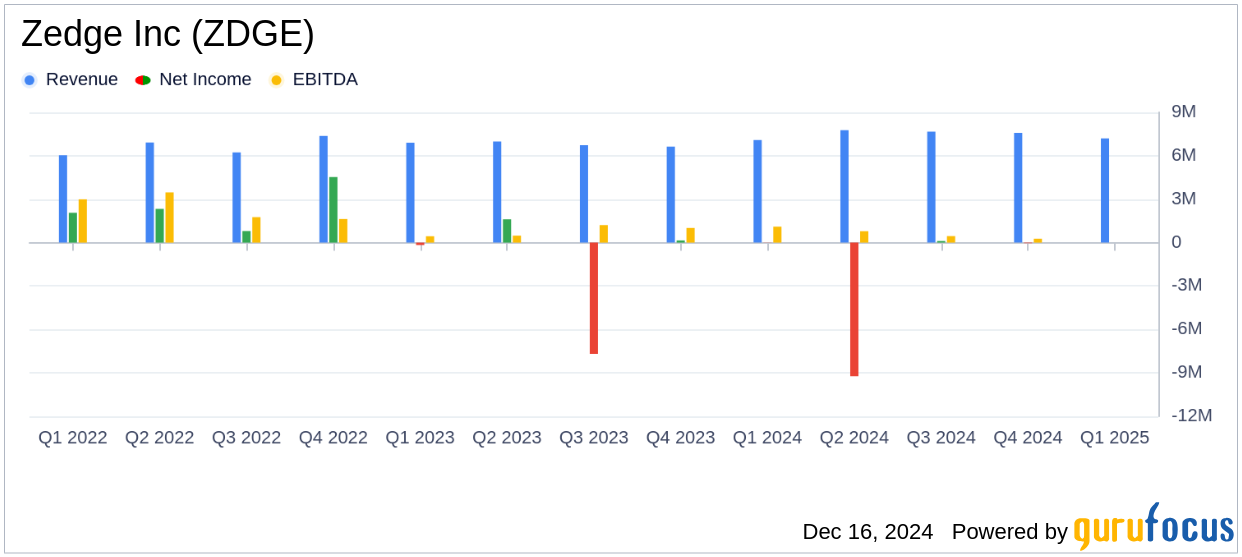

In the first quarter of fiscal 2025, Zedge Inc reported a revenue increase of 1.6% to $7.2 million, which fell short of the analyst estimate of $7.28 million. The company faced a GAAP operating loss of $0.5 million, contrasting with an operating income of $0.3 million in the same quarter last year. The GAAP net loss was $0.3 million, translating to a loss per share (EPS) of $0.02, compared to a break-even point in the previous year. Non-GAAP results showed a net loss of $0.0 million, with an EPS of $0.00, compared to a net income of $0.5 million and an EPS of $0.04 in the prior year.

Strategic Achievements and Challenges

The Zedge Marketplace saw a 21% increase in subscription revenue, with a notable 8% rise in overall subscribers. The Average Revenue per Monthly Active User (ARPMAU) increased by 22%, driven by innovative features such as parallax wallpapers and the AI image generator, pAInt. However, the company faced advertising challenges, including a coding error and delays in ad partner testing, which impacted revenue growth.

“We are encouraged by the underlying trends in our business, which provide a strong foundation for future growth despite a mixed bag of results at the start of the fiscal year,” commented Jonathan Reich, CEO of Zedge Inc.

Financial Highlights

| Metric | Q1 Fiscal 2025 | Q1 Fiscal 2024 |

|---|---|---|

| Revenue | $7.2 million | $7.1 million |

| GAAP Operating Income | ($0.5) million | $0.3 million |

| GAAP Net Loss | ($0.3) million | ($0.0) million |

| Non-GAAP Net Income | ($0.0) million | $0.5 million |

| Adjusted EBITDA | $0.3 million | Not provided |

Analysis and Outlook

Zedge Inc's performance in the first quarter reflects both the potential and challenges within the interactive media industry. The growth in subscription revenue and ARPMAU highlights the company's ability to innovate and attract users. However, the advertising challenges and resulting financial losses underscore the volatility and competitive nature of the market.

Looking ahead, Zedge Inc anticipates improvements in the second quarter, driven by seasonal strength and the resolution of first-quarter challenges. The company is focusing on integrating generative AI into its product offerings and enhancing user engagement through new features and strategic marketing efforts.

Overall, while Zedge Inc faces near-term challenges, its strategic initiatives and focus on innovation position it for potential growth in the interactive media space. Investors and stakeholders will be keen to see how these efforts translate into financial performance in the coming quarters.

Explore the complete 8-K earnings release (here) from Zedge Inc for further details.