On December 16, 2024, Baker Bros. Advisors LP, a prominent hedge fund, executed a strategic acquisition by adding 24,000 shares of Bicycle Therapeutics PLC to its portfolio. The transaction was completed at a price of $14.29 per share, reflecting the firm's continued confidence in the potential of this clinical-stage biopharmaceutical company. This acquisition brings Baker Bros. Advisors' total holdings in Bicycle Therapeutics to 10,909,357 shares, which now constitutes 1.63% of the firm's portfolio and 15.80% of Bicycle Therapeutics' total shares.

About Baker Bros. Advisors LP

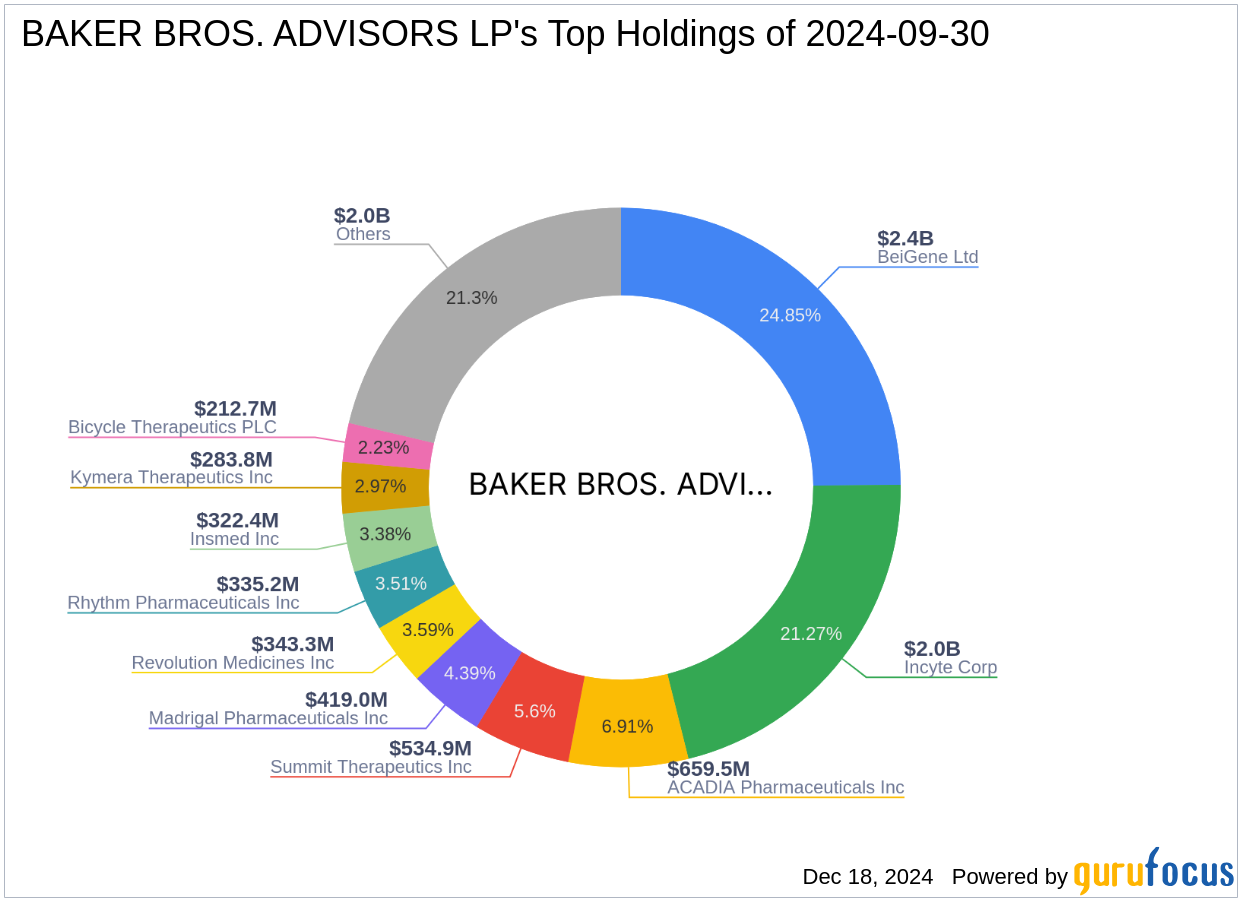

Founded in 2000 by Julian and Felix Baker, Baker Bros. Advisors LP is a New York City-based hedge fund with a focus on life sciences companies. The firm employs a fundamental-driven investment approach, emphasizing long-term holdings in the healthcare sector. With a current market value exceeding $12 billion, Baker Bros. Advisors maintains a concentrated portfolio strategy, investing heavily in select companies. The firm's top holdings include ACADIA Pharmaceuticals Inc, BeiGene Ltd, and Incyte Corp, among others. This focused investment strategy has allowed the firm to generate significant returns over time.

Overview of Bicycle Therapeutics PLC

Bicycle Therapeutics PLC is a clinical-stage biopharmaceutical company based in the UK, specializing in the development of a novel class of medicines known as Bicycles. These synthetic short peptides are designed to stabilize structural geometry, with a primary focus on oncology indications. The company's flagship product candidate, BT1718, is a Bicycle Toxin Conjugate aimed at addressing high unmet medical needs in cancer treatment. Bicycle Therapeutics currently holds a market capitalization of $1.05 billion, with its stock trading at $15.14. Despite a challenging year-to-date performance, the company's innovative approach positions it for potential future growth.

Impact of the Transaction on Baker Bros. Advisors' Portfolio

The recent acquisition of Bicycle Therapeutics shares by Baker Bros. Advisors LP signifies a strategic move to bolster its portfolio with promising biopharmaceutical assets. With Bicycle Therapeutics now accounting for 1.63% of the firm's portfolio, this investment aligns with Baker Bros. Advisors' focus on high-potential life sciences companies. The firm's substantial holding of 10,909,357 shares represents 15.80% of Bicycle Therapeutics' total shares, underscoring its confidence in the company's future prospects.

Financial Metrics and Valuation

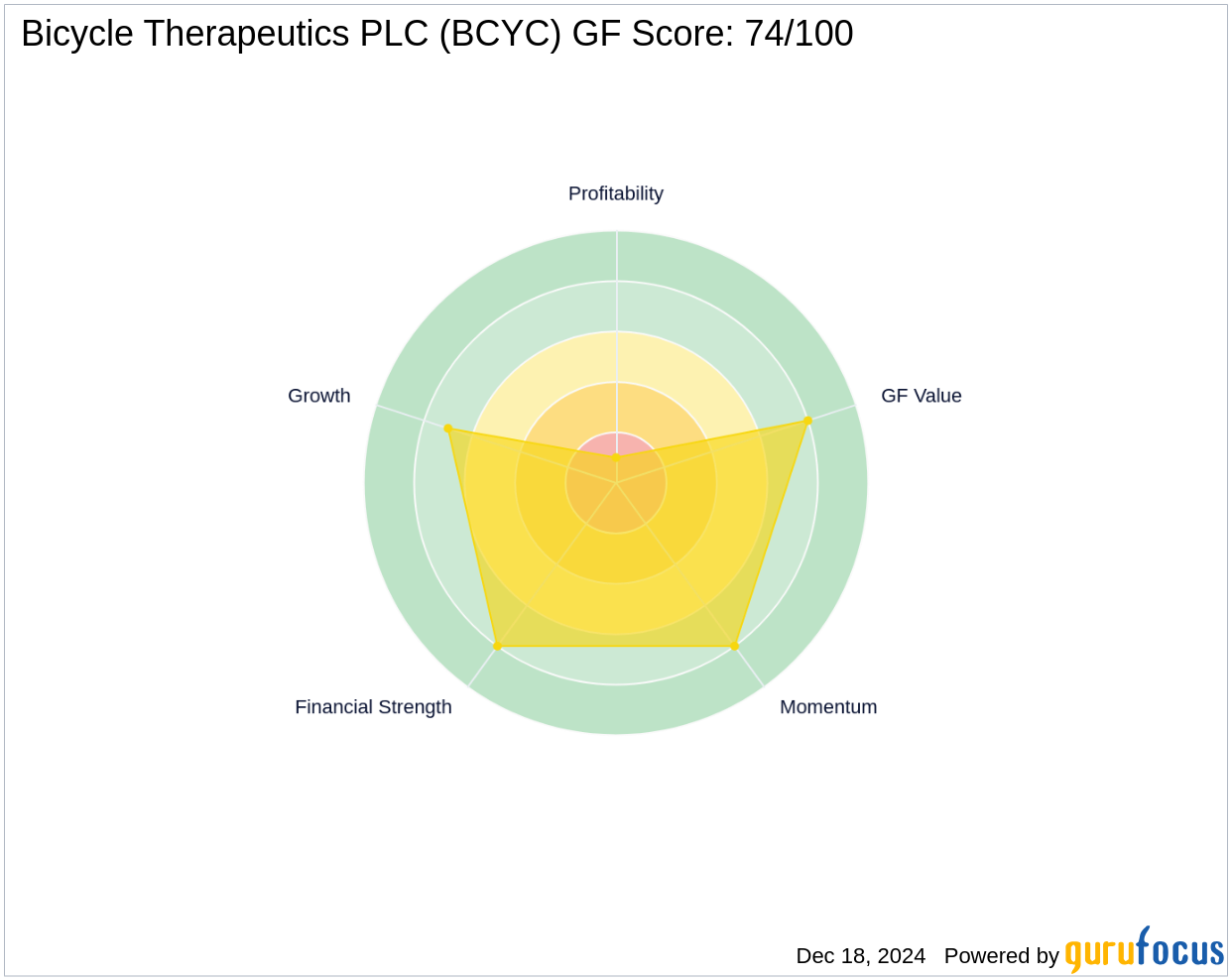

Bicycle Therapeutics' current stock price of $15.14 is below its GF Value of $23.36, suggesting a possible value trap. The company's financial metrics reveal a challenging landscape, with a PE percentage of 0.00, indicating losses. The [GF Score](https://www.gurufocus.com/term/gf-score/BCYC) of 74/100 suggests average performance potential, while the [Financial Strength](https://www.gurufocus.com/term/rank-balancesheet/BCYC) is rated 8/10. Despite these challenges, the company's innovative pipeline and strategic partnerships offer potential for future growth.

Performance and Growth Indicators

Bicycle Therapeutics' [Profitability Rank](https://www.gurufocus.com/term/rank-profitability/BCYC) is low at 1/10, reflecting current operational challenges. However, the [Growth Rank](https://www.gurufocus.com/term/rank-growth/BCYC) of 7/10 indicates a positive outlook for revenue growth, which has increased by 11.80% over the past three years. The company's [Momentum Rank](https://www.gurufocus.com/term/rank-momentum/BCYC) of 8/10 further supports its potential for future performance improvements.

Conclusion

The strategic acquisition of Bicycle Therapeutics shares by Baker Bros. Advisors LP highlights the firm's commitment to investing in innovative biopharmaceutical companies. This transaction not only strengthens the firm's portfolio but also aligns with its concentrated investment approach in the biotechnology sector. For value investors, Baker Bros. Advisors' focus on high-potential life sciences companies offers a compelling opportunity to consider, given the firm's track record of generating significant returns through its focused investment strategy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.