On December 18, 2024, Enerpac Tool Group Corp (EPAC, Financial) released its 8-K filing detailing the financial results for the first quarter of fiscal 2025. The company, known for its high-precision tools and solutions for heavy lifting, reported net sales of $145 million, surpassing the analyst estimate of $144.40 million. The earnings per share (EPS) of $0.40 exceeded the estimated EPS of $0.38, showcasing a robust financial performance amidst a challenging industrial environment.

Company Overview

Enerpac Tool Group Corp specializes in the design, manufacture, and distribution of hydraulic and mechanical tools, primarily through its Industrial Tools & Services (IT&S) Segment. The company serves various markets, including refinery, petrochemical, industrial maintenance, and power generation, with operations spanning across multiple countries such as Germany, Japan, and Saudi Arabia.

Performance and Challenges

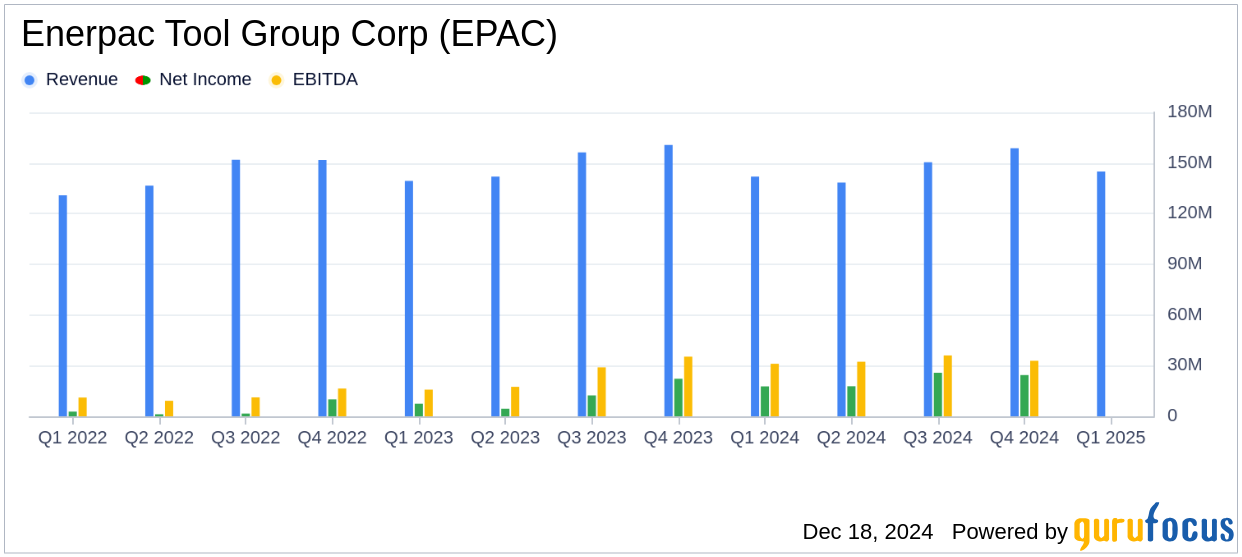

Enerpac Tool Group Corp reported a 2.3% increase in net sales compared to the previous year, despite a 0.8% decline in organic sales. The company's operating margin stood at 21.4%, with an adjusted operating margin of 21.5%. The net income for the quarter was $21.7 million, translating to an EPS of $0.40, marking a 21% year-over-year increase. These results highlight Enerpac's ability to navigate a sluggish industrial macro environment effectively.

Financial Achievements

The company's adjusted EBITDA was $34.3 million, with an adjusted EBITDA margin of 23.6%. The acquisition of DTA, a producer of automated on-site horizontal movement products, contributed positively to the company's portfolio, enhancing its Heavy Lifting Technology offerings. This strategic acquisition is expected to leverage Enerpac's global sales network, expanding DTA's reach beyond Europe.

Income Statement and Key Metrics

Enerpac's gross profit margin declined by 90 basis points to 51.4%, influenced by lower sales in the Americas and a higher percentage of service revenue. Selling, general, and administrative expenses were reduced by $2.3 million year-over-year, reflecting improved operational efficiency. The company's net cash provided by operating activities was $8.6 million, a significant improvement from a cash use of $6.7 million in the prior-year period.

Balance Sheet and Cash Flow

The balance sheet revealed a cash balance of $130.7 million and a debt balance of $193.3 million as of November 30, 2024. The net debt to adjusted EBITDA ratio was 0.5x, indicating a strong financial position. The company repurchased approximately 110,000 shares of its common stock for $4.4 million, demonstrating a commitment to returning value to shareholders.

Analysis and Outlook

Enerpac Tool Group Corp's performance in the first quarter of fiscal 2025 reflects its resilience in a challenging market. The company's strategic initiatives, including the DTA acquisition and focus on operational efficiency, position it well for future growth. The management remains optimistic, maintaining its full-year fiscal 2025 guidance with projected net sales between $610 million and $625 million and adjusted EBITDA growth of 5% at the midpoint of the guidance.

“We entered fiscal 2025 mindful of a sluggish industrial macro environment,” said Paul Sternlieb, Enerpac Tool Group’s President & CEO. “Nonetheless, we believe Enerpac can continue to outperform the market given our global brand leadership, targeted growth strategy, customer-driven innovation, and continuous improvement process to enhance operational efficiency and productivity.”

“First quarter fiscal 2025 was essentially in line with our expectations, reflecting our ability to operate in a soft market, while lapping strong growth in the first quarter of fiscal 2024,” said Darren Kozik, Executive Vice President and Chief Financial Officer.

Enerpac Tool Group Corp's strategic focus and financial discipline are expected to drive continued success, making it an attractive consideration for value investors seeking opportunities in the industrial products sector.

Explore the complete 8-K earnings release (here) from Enerpac Tool Group Corp for further details.