On December 16, 2024, PURE Bioscience Inc (PURE, Financial) released its 8-K filing detailing the financial results for the fiscal first quarter ended October 31, 2024. PURE Bioscience Inc is a company focused on developing and commercializing proprietary antimicrobial products, primarily in the food and beverage industry. The company's technology platform is based on patented stabilized ionic silver, with initial products containing silver dihydrogen citrate (SDC).

Performance Overview and Challenges

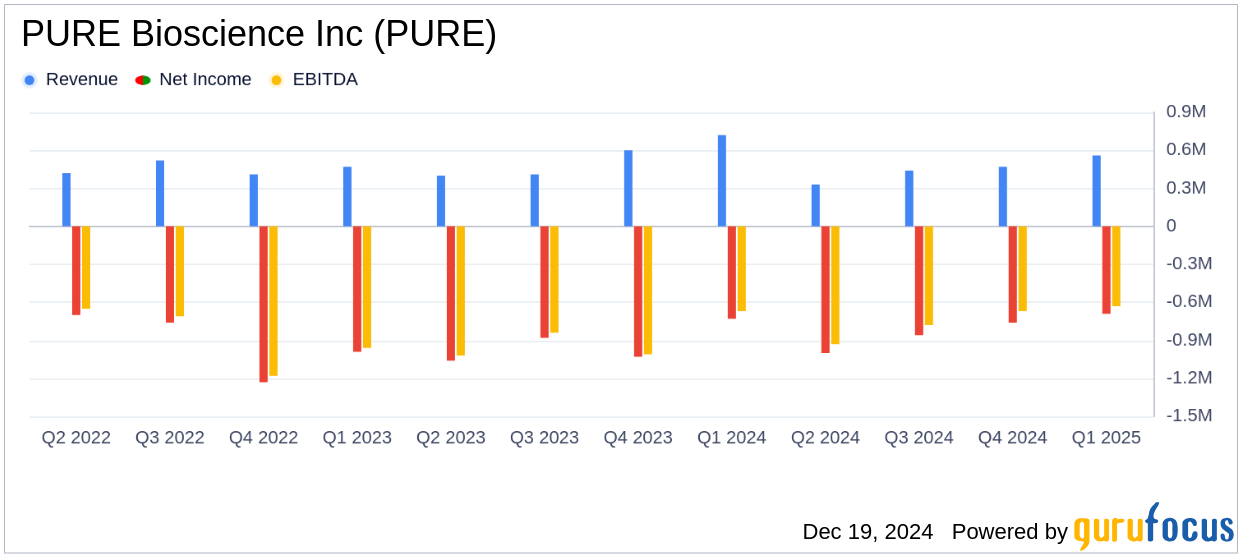

During the fiscal first quarter of 2025, PURE Bioscience Inc reported net product sales of $555,000, a decrease from $718,000 in the same quarter of the previous year. This decline of $163,000 was primarily due to budgetary constraints faced by a significant end-use customer. Despite the drop in sales, the company managed to reduce its net loss to $689,000 from $735,000 in the prior year. Excluding share-based compensation, the net loss was $632,000 compared to $655,000 in the previous year.

The company's Chief Executive Officer, Robert Bartlett, commented on the situation, stating,

To expand on my recent comment from October 29th, we are continuing to diligently grow our business strategy with key distributors. Although this process is taking longer than expected, it allows us to broaden our product offerings across a larger customer base in the food and beverage industry."Bartlett also noted that the first-quarter revenue was anticipated to be lower due to an unexpected interruption in product flow to a major customer and the absence of replacement revenue.

Financial Achievements and Industry Context

Despite the challenges, PURE Bioscience Inc's efforts to manage its financials are noteworthy. The company's focus on expanding its distributor network and enhancing product offerings is crucial in the Consumer Packaged Goods industry, where innovation and market reach are key drivers of success. The reduction in net loss, even amidst declining sales, highlights the company's commitment to financial discipline.

Key Financial Metrics

From the income statement, PURE Bioscience Inc reported total revenue of $556,000, down from $722,000 in the previous year. The cost of goods sold decreased to $231,000 from $280,000, resulting in a gross profit of $325,000 compared to $442,000 last year. Operating costs and expenses were reduced to $952,000 from $1,153,000, reflecting the company's efforts to streamline operations.

On the balance sheet, total assets increased to $924,000 from $818,000, while total liabilities rose to $4,420,000 from $3,682,000. The company's stockholders' deficiency widened to $3,496,000 from $2,864,000, primarily due to the accumulated deficit.

| Metric | October 31, 2024 | October 31, 2023 |

|---|---|---|

| Net Product Sales | $555,000 | $718,000 |

| Net Loss | ($689,000) | ($735,000) |

| Net Loss Per Share | ($0.01) | ($0.01) |

Analysis and Outlook

The financial results for PURE Bioscience Inc reflect a challenging quarter, marked by a significant decline in sales due to external factors. However, the company's strategic focus on expanding its distributor network and product offerings could position it for future growth. The reduction in operating expenses and net loss indicates a disciplined approach to managing financial resources, which is vital for sustaining operations and achieving long-term profitability.

As PURE Bioscience Inc continues to navigate the complexities of the market, its commitment to innovation and strategic partnerships will be crucial in overcoming current challenges and capitalizing on future opportunities in the antimicrobial products sector.

Explore the complete 8-K earnings release (here) from PURE Bioscience Inc for further details.