On December 31, 2024, NEUBERGER BERMAN GROUP LLC (Trades, Portfolio) executed a strategic transaction involving OraSure Technologies Inc (OSUR, Financial). The firm reduced its holdings in OraSure Technologies by 299,642 shares, marking a 7.63% change in its position. This adjustment reflects a significant move in the firm's investment strategy, potentially indicating a reassessment of the stock's valuation or a broader portfolio realignment. The transaction was executed at a trade price of $3.61 per share, leaving the firm with a total of 3,628,050 shares in OraSure Technologies, which now constitutes 0.01% of its portfolio.

NEUBERGER BERMAN GROUP LLC: A Profile

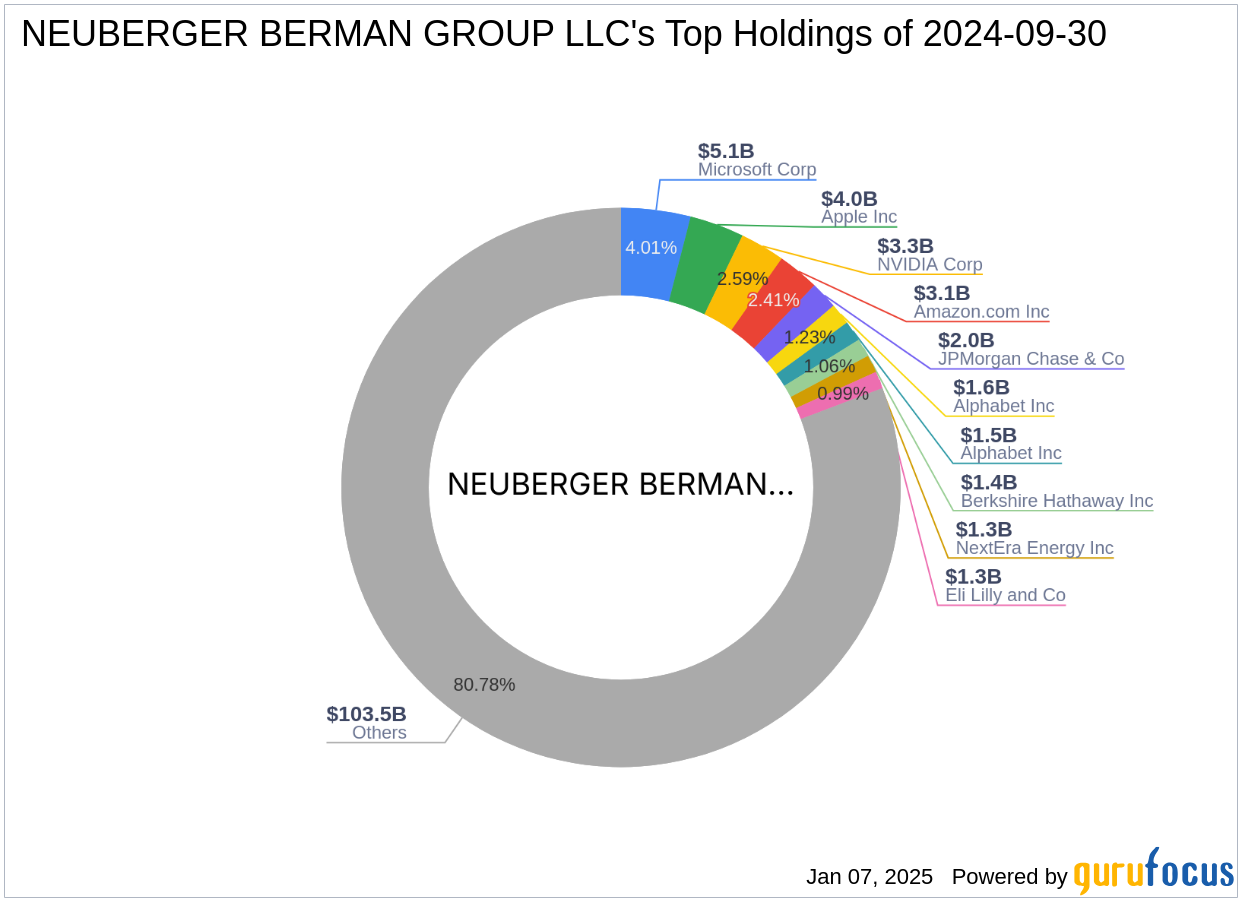

NEUBERGER BERMAN GROUP LLC is a renowned investment firm headquartered in New York, managing a substantial portfolio equity of $128.11 billion. The firm is recognized for its significant investments in the technology and financial services sectors, with top holdings in industry giants such as Apple Inc (AAPL, Financial), Amazon.com Inc (AMZN, Financial), Microsoft Corp (MSFT, Financial), NVIDIA Corp (NVDA, Financial), and JPMorgan Chase & Co (JPM, Financial). This strategic focus underscores the firm's commitment to sectors with robust growth potential and technological innovation.

Understanding OraSure Technologies Inc

OraSure Technologies Inc, based in the USA, is a prominent player in the medical devices industry, specializing in diagnostics and molecular solutions. The company is well-known for its rapid oral diagnostic tests and molecular testing kits, which are crucial in detecting infectious diseases such as HIV and HCV. With a market capitalization of $281.964 million, OraSure Technologies derives the majority of its sales from its molecular solutions segment, primarily serving customers in the United States.

Financial Metrics and Valuation

OraSure Technologies is currently trading at $3.78 per share, with a price-to-earnings (PE) ratio of 25.20, indicating profitability. However, the stock is considered significantly overvalued, with a GF Value of $2.82 and a Price to GF Value ratio of 1.34. This valuation suggests that the stock's market price exceeds its intrinsic value, potentially prompting the firm's decision to reduce its holdings. The company's financial strength is further highlighted by its strong balance sheet rank of 9/10.

Performance and Growth Indicators

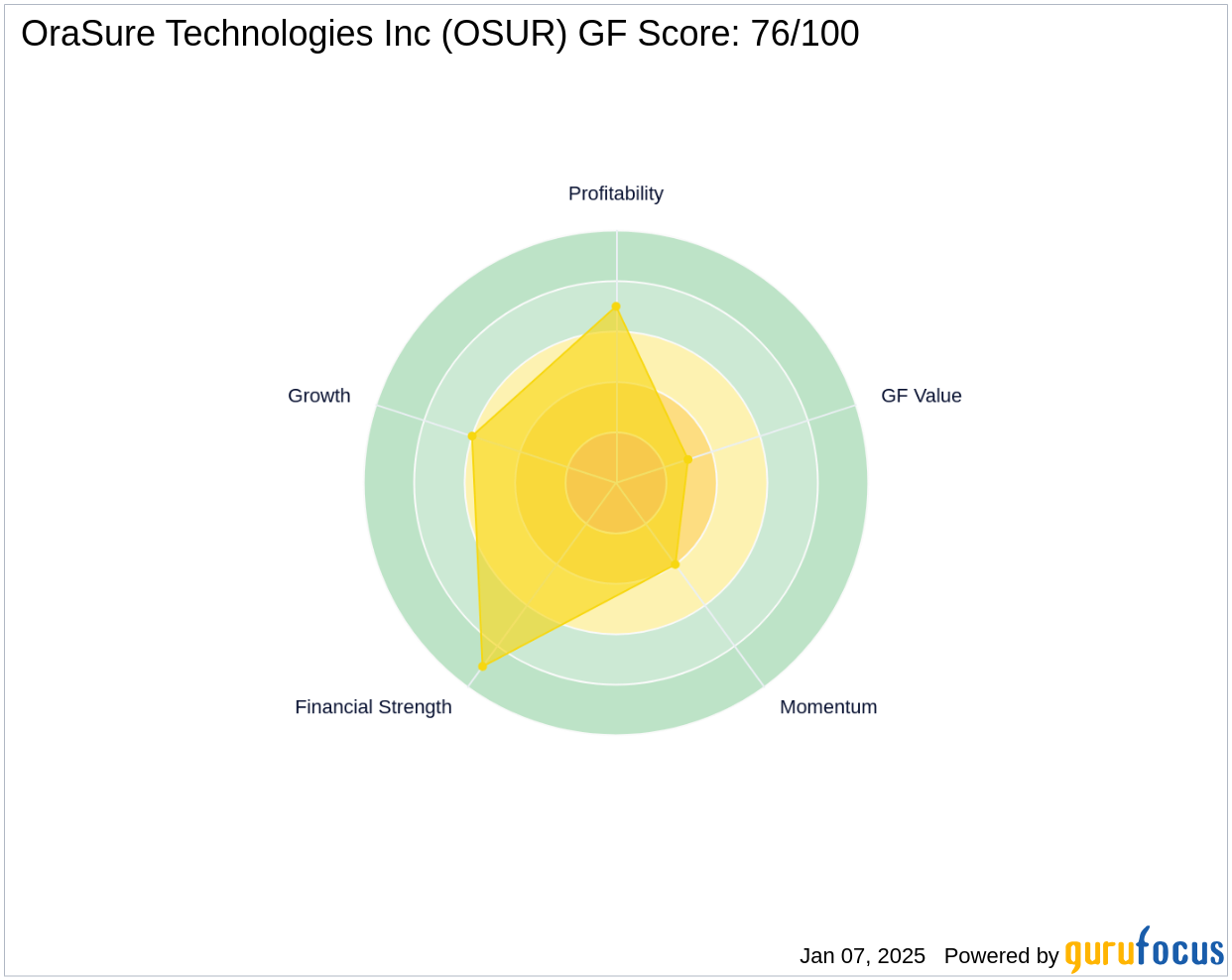

Since the transaction, OraSure Technologies has experienced a 4.71% gain, with a year-to-date price change of 6.78%. The company holds a GF Score of 76/100, indicating likely average performance. Its financial strength is underscored by a strong balance sheet and a Profitability Rank of 7/10. Despite these strengths, the stock's GF Value Rank is relatively low at 3/10, reflecting its overvaluation in the market.

Implications of the Transaction

The reduction in holdings by NEUBERGER BERMAN GROUP LLC (Trades, Portfolio) may reflect a strategic portfolio adjustment or a reassessment of OraSure Technologies' valuation. With a current portfolio position of 0.01% in the company, this decision could influence other investors' perceptions of the stock. The firm's move might be seen as a signal to reevaluate the stock's potential, given its current market valuation and performance metrics.

Conclusion

The transaction by NEUBERGER BERMAN GROUP LLC (Trades, Portfolio) underscores the dynamic nature of investment strategies and the critical role of valuation in portfolio management. Despite the reduction in holdings, OraSure Technologies remains a key player in the medical devices industry, with potential growth opportunities in its molecular solutions segment. Investors should consider the firm's strategic adjustments and the stock's valuation metrics when evaluating their investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.