On January 13, 2025, BARK Inc (BARK, Financial) released its 8-K filing announcing preliminary financial results for the fiscal third quarter ended December 31, 2024. BARK Inc, a vertically integrated, omnichannel brand, serves dogs nationwide through various platforms, including subscription services like BarkBox and Super Chewer, e-commerce, and retail partnerships with Target and Amazon.

Performance Overview

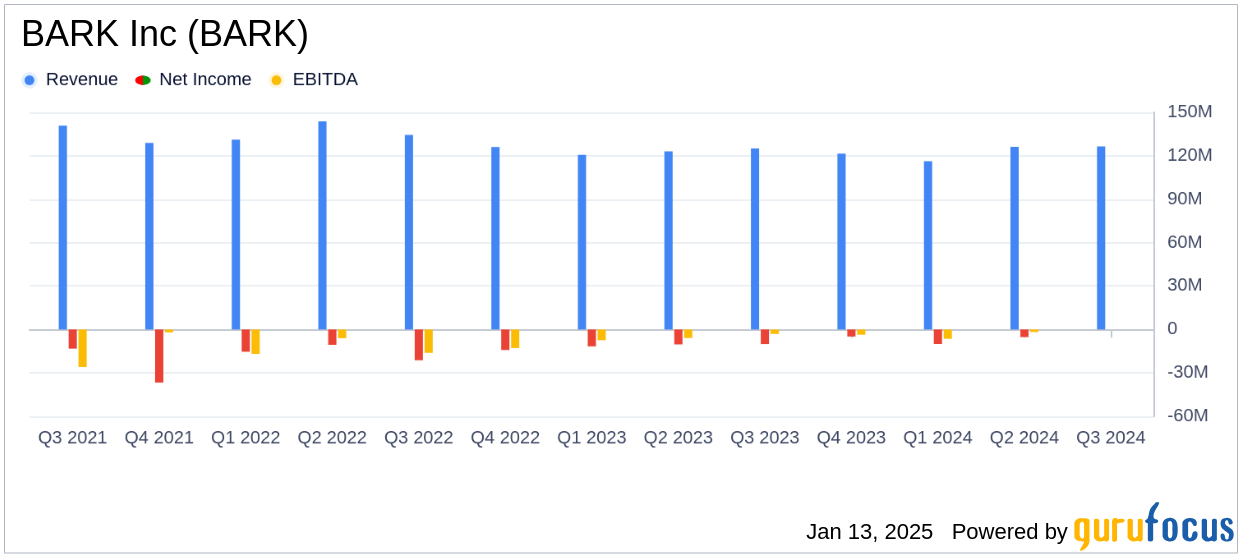

BARK Inc reported total revenue of approximately $126.4 million for the quarter, surpassing the analyst estimate of $125.60 million and marking a 1.1% increase year-over-year. This achievement highlights the company's ability to exceed its revenue guidance and maintain growth momentum. However, the company recorded a net loss of approximately $11.5 million, which was $1.4 million greater than the same period last year, primarily due to a $1.8 million gain from debt extinguishment in the previous year.

Financial Achievements and Challenges

The company's Adjusted EBITDA improved by $4.9 million year-over-year, reaching approximately $(1.6) million, aligning with the company's guidance range. This marks the tenth consecutive quarter of year-over-year growth in Adjusted EBITDA, showcasing BARK Inc's strategic focus on enhancing operational efficiency and profitability. The company also reported an 8% year-over-year growth in new subscribers, driven by increased marketing investments and successful migration of paid media to the BARK.co platform.

“We closed 2024 on a high note, achieving our tenth consecutive quarter of year-over-year growth in Adjusted EBITDA and surpassing our revenue guidance," said Matt Meeker, Co-Founder and Chief Executive Officer.

Key Financial Metrics

Despite the net loss, BARK Inc's financial performance reflects positive trends in its core business segments. The commerce segment, in particular, demonstrated robust growth, with a year-to-date increase of over 25%. Additionally, BARK Air, a new revenue stream, contributed $2 million during the quarter, indicating successful diversification efforts.

| Metric | Q3 FY2025 | Q3 FY2024 |

|---|---|---|

| Total Revenue | $126.4 million | - |

| Net Loss | $(11.5) million | - |

| Adjusted EBITDA | $(1.6) million | - |

Analysis and Outlook

BARK Inc's ability to exceed revenue expectations and improve Adjusted EBITDA underscores its resilience in the competitive retail-cyclical industry. The company's strategic initiatives, including increased marketing investments and platform migration, have yielded positive results, contributing to subscriber growth and revenue diversification. However, the net loss remains a challenge, necessitating continued focus on cost management and operational efficiency.

Looking ahead, BARK Inc reaffirms its full-year fiscal 2025 guidance, projecting total revenue between $490 million and $500 million, with Adjusted EBITDA ranging from $1.0 million to $5.0 million. These projections reflect the company's confidence in sustaining growth and improving profitability in the coming quarters.

Explore the complete 8-K earnings release (here) from BARK Inc for further details.