On January 13, 2025, Comtech Telecommunications Corp (CMTL, Financial) released its 8-K filing for the first fiscal quarter ended October 31, 2024. The company, a provider of modern communications solutions, reported a net sales figure of $115.8 million, falling short of the estimated revenue of $125.53 million. The reported earnings per share (EPS) was a loss of $5.29, significantly below the estimated EPS of -0.69. This indicates a challenging quarter for the company.

Company Overview

Comtech Telecommunications Corp is a U.S.-based company engaged in designing, developing, producing, and marketing products, systems, and services for communications solutions. It operates in two main segments: Satellite and Space Communications and Terrestrial and Wireless Networks. The majority of its sales are generated from the Satellite and Space Communications segment, which provides modems, high-power amplifiers, and troposcatter technologies, serving defense contractors and allied foreign governments. The Terrestrial and Wireless Networks segment offers next-generation 911 infrastructure and solutions for state and local governments and carriers.

Performance and Challenges

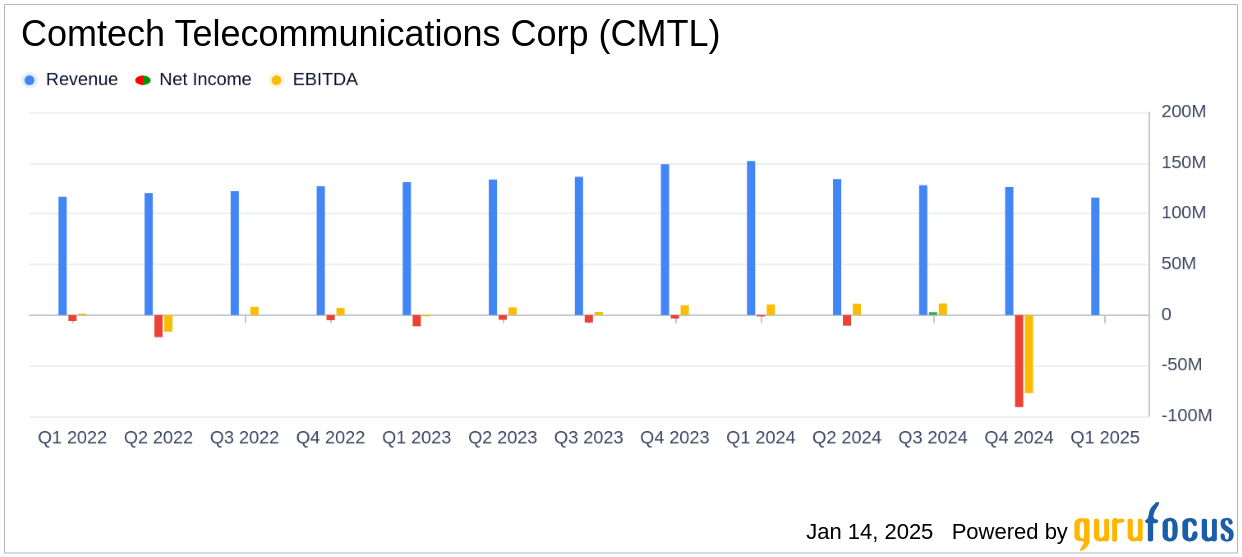

Comtech's performance in the first fiscal quarter of 2025 was marked by a 23.8% decline in net sales compared to the prior year period, primarily due to decreased performance in the Satellite and Space Communications segment. The company also faced a significant operating loss of $129.2 million and a net loss of $148.4 million, compared to a net loss of $1.4 million in the prior year period. These results highlight the company's ongoing challenges, including a non-cash goodwill impairment charge of $79.6 million and restructuring costs.

Financial Achievements and Industry Importance

Despite the challenges, Comtech achieved a book-to-bill ratio of 1.10x, with net bookings of $127.9 million. The company secured several significant contracts, including a sole source contract valued at over $50 million with the U.S. Navy Information Warfare Systems Command. These achievements are crucial for maintaining a competitive edge in the hardware industry, particularly in the communications sector.

Financial Statements and Key Metrics

The company's gross margin decreased to 12.5% from 31.5% in the prior year period, impacted by higher-than-expected costs and inventory write-downs. The funded backlog stood at $811.0 million, with revenue visibility of approximately $1.6 billion. These metrics are vital for assessing the company's future revenue potential and operational efficiency.

Mr. Traub commented, "While Comtech's recent historical performance has been unsatisfactory, the Company has great assets, including its people, technologies, reputation, customers and relationships. We are implementing a comprehensive set of initiatives to better position Comtech for the future."

Segment Performance

The Satellite and Space Communications segment reported a 42.5% decline in net sales, driven by reduced sales of troposcatter and SATCOM solutions and the impact of divestitures. In contrast, the Terrestrial and Wireless Networks segment saw a 14.9% increase in net sales, supported by higher sales of call handling and Next Generation 911 services.

Analysis and Outlook

Comtech's financial results indicate significant challenges, particularly in the Satellite and Space Communications segment. The company's strategic initiatives, including cost-saving measures and leadership changes, aim to address these challenges and improve profitability. However, the company's ability to comply with financial covenants and reduce debt levels remains a critical concern. The ongoing review of strategic alternatives may provide opportunities for capital-raising and de-levering, essential for strengthening the balance sheet and ensuring long-term sustainability.

Explore the complete 8-K earnings release (here) from Comtech Telecommunications Corp for further details.