On January 15, 2025, Loop Industries Inc (LOOP, Financial) released its 8-K filing detailing the financial results for the third quarter of fiscal year 2025. The company, known for its innovative recycling technology, aims to transform waste PET plastic and polyester fiber into high-quality materials, contributing to a sustainable future.

Financial Performance and Challenges

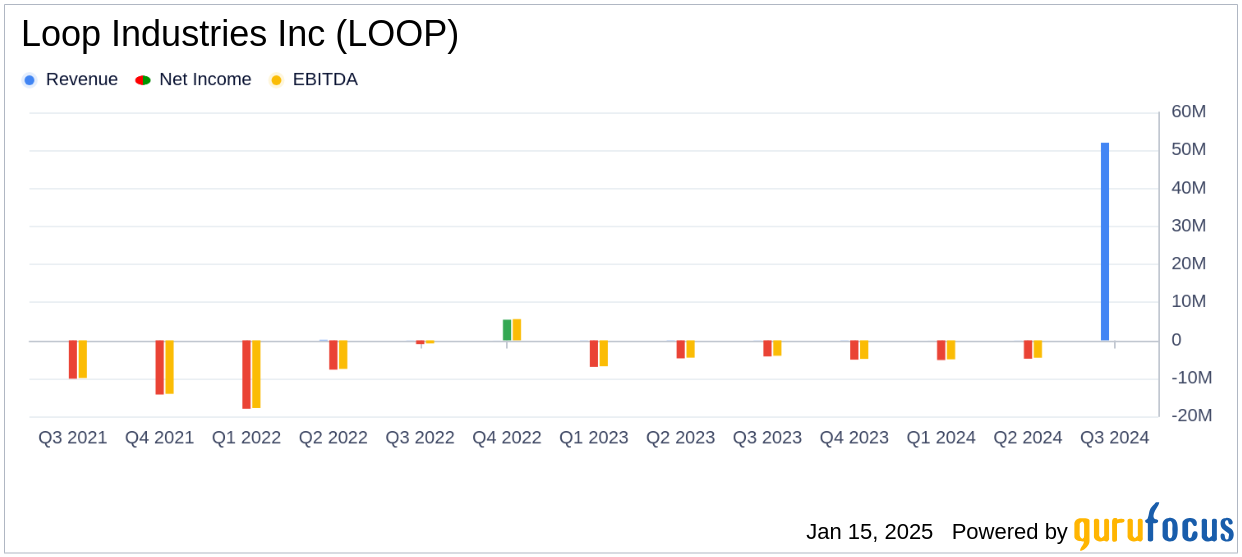

Loop Industries Inc (LOOP, Financial) reported a net loss of $11.912 million for the quarter ended November 30, 2024, a significant increase from the $4.244 million loss in the same period of 2023. This increase was primarily driven by an $8.460 million impairment charge related to machinery and equipment following the termination of a joint venture with SK Geo Centric in South Korea. Despite this setback, the company managed to reduce research and development expenses by $456,000 and general and administrative expenses by $310,000 compared to the previous year.

Revenue and Strategic Transactions

Revenues for the quarter increased to $52,000, up from $26,000 in the same period last year, attributed to initial deliveries of Loop™ PET resin. However, this figure fell short of the analyst estimate of $20,000. In a strategic move, Loop closed a financing and technology licensing transaction with Reed Societe Generale Group, securing $20.8 million in cash proceeds. This transaction is pivotal for Loop's commercialization strategy, particularly in Europe and India.

Key Financial Metrics

| Metric | Q3 2025 | Q3 2024 | Change |

|---|---|---|---|

| Revenue | $52,000 | $26,000 | +100% |

| Net Loss | $(11.912) million | $(4.244) million | -180.7% |

| Impairment of Assets | $8.460 million | $0 | N/A |

Strategic Developments and Future Outlook

Loop Industries Inc (LOOP, Financial) is making significant progress on its Infinite Loop™ India manufacturing facility, in partnership with Ester Industries Ltd. The project is strategically located in Gujarat, India, and aims to meet the demand for recycled polyester fiber in the circular fashion industry. The company has also terminated its joint venture with SK Geo Centric in South Korea, aligning its focus on low-cost manufacturing regions and licensing its technology in higher-cost areas.

Daniel Solomita, Founder and CEO of Loop, commented: “The successful completion of our transaction with Reed Societe Generale Group marks a significant step towards our strategic goals. This includes investing in low-cost manufacturing locations like India and licensing our technology to companies seeking solutions to the plastic waste crisis in higher-cost regions such as Europe.”

Conclusion

Loop Industries Inc (LOOP, Financial) faces challenges with increased net losses and asset impairments, yet it continues to pursue strategic partnerships and technology licensing to expand its global footprint. The company's focus on sustainable solutions and strategic investments in key regions like India and Europe positions it to potentially capitalize on the growing demand for recycled materials in the future. Investors and stakeholders will be keenly watching Loop's progress in executing its strategic initiatives and improving its financial performance.

Explore the complete 8-K earnings release (here) from Loop Industries Inc for further details.