On January 16, 2025, First Horizon Corp (FHN, Financial) released its 8-K filing detailing its financial performance for the fourth quarter and full year of 2024. First Horizon Corp, the parent company of First Tennessee Bank, operates as a prominent regional bank with approximately 200 branches in Tennessee. The bank generates about 65% of its revenue from regional banking, 25% from capital markets, and the remainder from non-strategic and corporate operations.

Performance Overview and Challenges

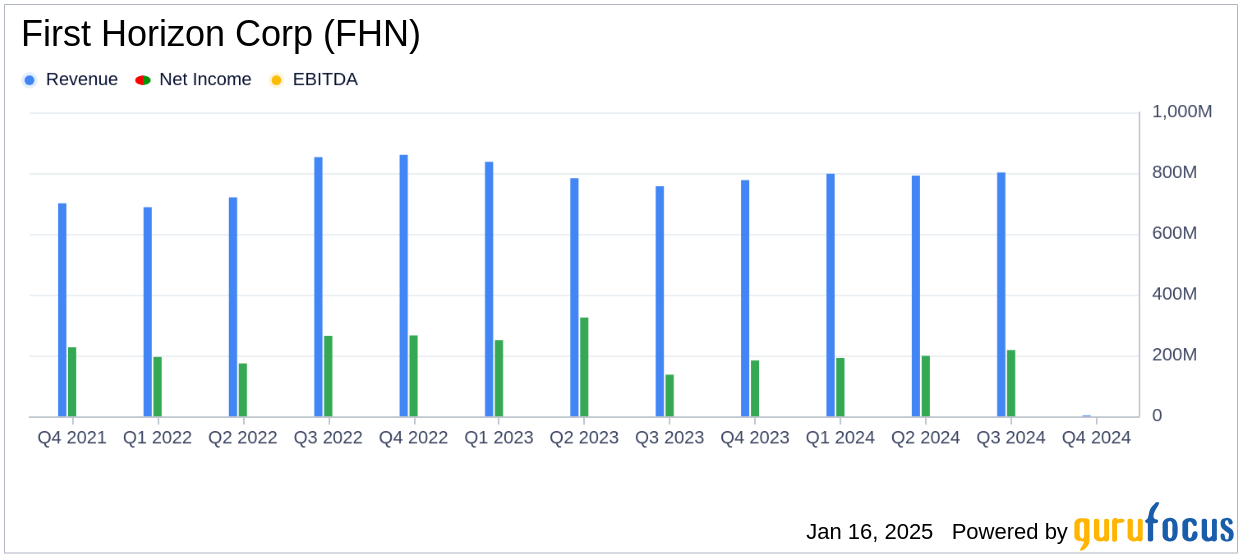

First Horizon Corp reported a fourth-quarter net income available to common shareholders of $158 million, translating to an earnings per share (EPS) of $0.29. This figure fell short of the analyst estimate of $0.39. On an adjusted basis, the EPS was $0.43, slightly above the previous quarter's $0.42. The company's revenue for the quarter was $729 million, which did not meet the estimated $820.70 million.

The full-year 2024 net income available to common shareholders was $738 million, or $1.36 per share, compared to $865 million, or $1.54 per share, in 2023. Adjusted net income increased by 5% to $843 million, or $1.55 per share, driven by strong credit performance and increased fee income.

Financial Achievements and Industry Context

Despite the challenges, First Horizon Corp achieved a 2% increase in net interest margin during the fourth quarter, reflecting effective management of interest-bearing deposit costs. The bank's fixed income revenue rose by 6%, and net charge-offs decreased to 8 basis points, indicating improved asset quality.

These achievements are significant in the banking industry, where managing interest margins and maintaining asset quality are crucial for profitability, especially in a fluctuating interest rate environment.

Key Financial Metrics and Statements

From the income statement, net interest income on a fully taxable equivalent basis was $2.5 billion for 2024, a slight decrease from the previous year. Noninterest income declined by $248 million, primarily due to a $225 million merger termination fee in 2023. However, adjusted noninterest income increased by $72 million, supported by higher fixed income and mortgage banking revenues.

The balance sheet showed average loan and lease balances of $62.0 billion, up by $1.8 billion, while average deposits increased by 2% to $65.7 billion. The allowance for credit losses to loans ratio slightly increased to 1.43%, reflecting prudent risk management.

Commentary and Strategic Insights

Our fourth quarter and full-year 2024 results reflect focused execution of our strategic priorities," said Chairman, President and Chief Executive Officer Bryan Jordan. "Strong client relationships and our attractive business mix positioned us to deliver earnings through a complex interest rate cycle."

First Horizon Corp's strategic focus on client relationships and business mix has been pivotal in navigating the challenging interest rate environment. The company's ability to grow its business through a strong net interest margin and improved counter-cyclical revenues positions it well for future growth.

Analysis and Conclusion

First Horizon Corp's performance in 2024 highlights both achievements and challenges. While the company missed analyst estimates for EPS and revenue, its strategic initiatives and focus on asset quality and interest margin management have laid a foundation for potential growth. The bank's ability to adapt to changing market conditions and maintain strong client relationships will be crucial as it moves forward into 2025.

Explore the complete 8-K earnings release (here) from First Horizon Corp for further details.