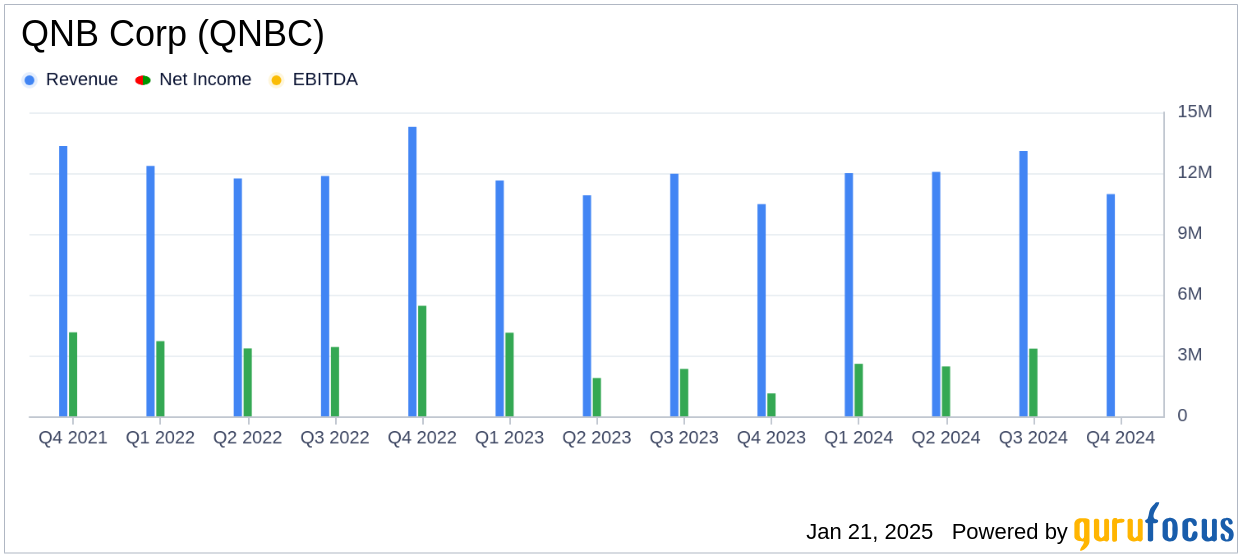

On January 21, 2025, QNB Corp (QNBC, Financial) released its 8-K filing detailing the financial results for the fourth quarter of 2024. QNB Corp, a bank holding company based in the United States, operates through its wholly-owned subsidiary, QNB Bank, offering a full range of banking services. The company reported a notable increase in net income for the fourth quarter of 2024, reaching $3,051,000, or $0.83 per diluted share, compared to $1,134,000, or $0.31 per diluted share, in the same period of 2023. For the full year, net income was $11,488,000, or $3.12 per diluted share, up from $9,483,000, or $2.63 per diluted share, in 2023.

Performance and Challenges

The company's performance was bolstered by an improved interest margin, which led to a $1,621,000 increase in net interest income. Additionally, there was a $548,000 decrease in the provision for credit losses and a $1,814,000 increase in non-interest income. However, these gains were partially offset by a $303,000 increase in non-interest expenses. The issuance of subordinated debt in 2024 resulted in a decrease in net interest income by $838,000, highlighting a challenge in managing debt-related costs.

Financial Achievements

QNB Corp's financial achievements are significant for the banking industry, as they reflect the company's ability to grow its asset base and improve profitability. Total assets increased to $1,870,894,000 as of December 31, 2024, from $1,706,318,000 at the end of 2023. The loan portfolio grew by $122,515,000, or 11.2%, to $1,216,048,000, and total deposits rose by $139,828,000, or 9.4%, to $1,628,541,000. These metrics are crucial as they indicate the bank's capacity to attract deposits and extend loans, which are core functions of its business model.

Income Statement and Key Metrics

Net interest income for the fourth quarter of 2024 was $10,975,000, an increase of $783,000 from the same period in 2023. The net interest margin slightly improved to 2.38% from 2.36% in the previous year. The yield on earning assets increased by 34 basis points to 4.78%, while the cost of interest-bearing liabilities rose by 36 basis points to 2.91%. These metrics are vital as they reflect the bank's efficiency in managing its interest income and expenses.

“We are pleased with the strong growth and quality of our business throughout 2024, resulting in a $1.9 million increase in earnings vs. the prior year,” said David W. Freeman, President and Chief Executive Officer.

Asset Quality and Non-Interest Income

QNB Corp recorded a $242,000 reversal in the provision for credit losses in the fourth quarter of 2024, compared to a $291,000 provision in the same period of 2023. The allowance for credit losses on loans decreased to 0.72% of loans receivable, down from 0.81% in 2023, indicating improved asset quality. Non-interest income surged to $1,645,000 from $283,000 in the fourth quarter of 2023, driven by gains on securities and increased fees for services.

Non-Interest Expense and Income Taxes

Total non-interest expense rose to $9,081,000 in the fourth quarter of 2024, up from $8,746,000 in the same period of 2023, primarily due to increased salaries and benefits. The provision for income taxes increased by $441,000 to $743,000, reflecting higher pre-tax income. The effective tax rate for the quarter was 19.6%, slightly lower than the 21.0% in the previous year.

Conclusion

QNB Corp's fourth-quarter results demonstrate robust growth in net income and asset expansion, driven by improved interest margins and asset quality. The company's strategic focus on top-line growth and prudent capital management positions it well for future opportunities. However, managing the costs associated with debt issuance remains a challenge that the company must address to sustain its financial performance.

Explore the complete 8-K earnings release (here) from QNB Corp for further details.