Progress Software Corp (PRGS, Financial) released its 8-K filing on January 21, 2025, detailing its financial results for the fourth quarter and full fiscal year ending November 30, 2024. The company, known for providing AI-powered digital experiences and infrastructure software, reported a notable increase in revenue but faced challenges with its earnings per share (EPS).

Company Overview

Progress Software Corporation is a provider of cloud-based security solutions to large and mid-sized organizations across various industries. Its product portfolio includes OpenEdge, Chef, Developer Tools, Kemp LoadMaster, MOVEit, DataDirect, WhatsUp Gold, Sitefinity, Flowmon, and Corticon. The company generates revenue from perpetual licenses and term licensing models, with a significant portion of its revenue coming from the United States, alongside a presence in Canada, EMEA, Latin America, and Asia Pacific.

Fourth Quarter 2024 Financial Highlights

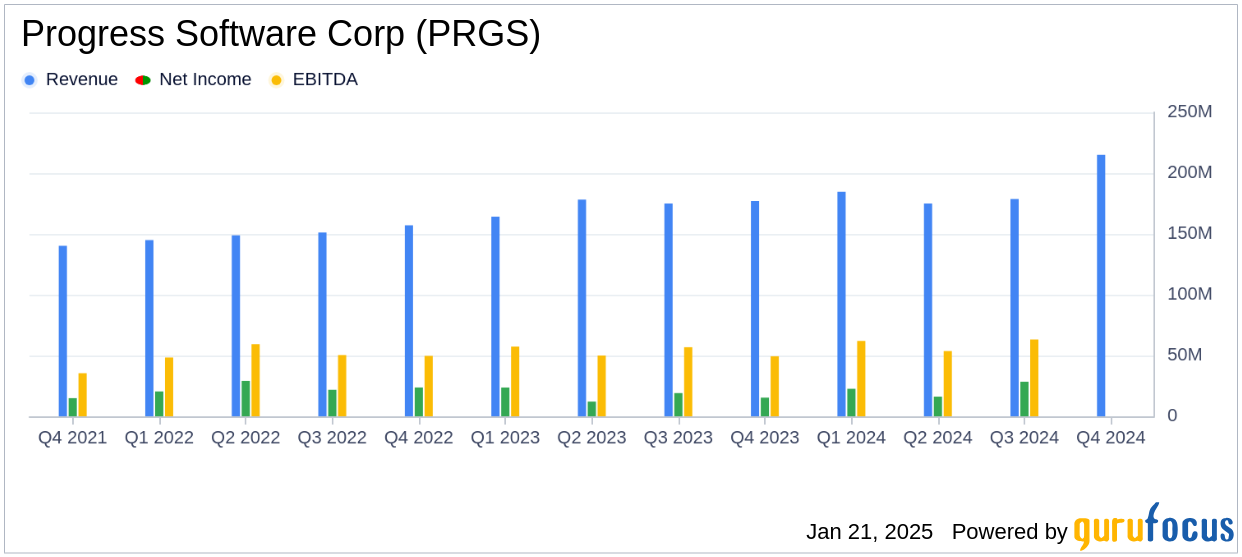

Progress Software reported a revenue of $215 million for the fourth quarter of 2024, marking a 21% increase year-over-year, surpassing the analyst estimate of $211.25 million. However, the company's GAAP diluted earnings per share (EPS) was $0.03, significantly below the estimated EPS of $0.31. The non-GAAP diluted EPS was $1.33, which exceeded the previous year's $1.02 by 30%.

Annual Performance and Strategic Developments

For the full fiscal year 2024, Progress Software achieved a revenue of $753.4 million, an 8% increase from the previous year. The company's annualized recurring revenue (ARR) grew by 46% year-over-year, reaching $842 million. Cash flow from operations also saw a significant rise, amounting to $212 million, a 22% increase from the prior year.

The company completed the acquisition of ShareFile, a SaaS-native, AI-powered, document-centric collaboration platform, which is expected to contribute positively to its financial performance. The integration of ShareFile is underway, with a focus on enhancing top- and bottom-line growth.

Key Financial Metrics and Analysis

Progress Software's operating margin for the fourth quarter was 10%, with a non-GAAP operating margin of 37%. The company's net income for the quarter was $1.15 million, a sharp decline from $15.34 million in the same period last year. Despite this, the non-GAAP net income increased by 31% to $59.98 million.

| Metric | Q4 2024 | Q4 2023 | % Change |

|---|---|---|---|

| Revenue | $214.96 million | $176.97 million | 21% |

| Net Income | $1.15 million | $15.34 million | -93% |

| GAAP EPS | $0.03 | $0.34 | -91% |

| Non-GAAP EPS | $1.33 | $1.02 | 30% |

Strategic Insights and Future Outlook

Progress Software's strategic acquisition of ShareFile is a significant move aimed at bolstering its product offerings and enhancing its market position. The company's focus on integrating ShareFile and leveraging its AI-powered capabilities is expected to drive future growth.

2024 was a strong year for Progress as we continue to execute on our long-term strategy to invest and innovate, acquire and integrate, and drive customer success to deliver Total Growth," said Yogesh Gupta, CEO at Progress.

Despite the challenges in EPS, the company's robust revenue growth and strategic acquisitions position it well for future success. The focus on recurring revenue and cash flow generation remains a key strength for Progress Software in navigating the competitive software industry landscape.

Explore the complete 8-K earnings release (here) from Progress Software Corp for further details.