On January 21, 2025, Trustco Bank Corp N Y (TRST, Financial) released its 8-K filing detailing its financial results for the fourth quarter of 2024. The company, a savings and loan holding entity, focuses on community banking through its subsidiary, Trustco Bank, offering a variety of personal and business banking services across New York, Florida, Massachusetts, New Jersey, and Vermont.

Performance Overview

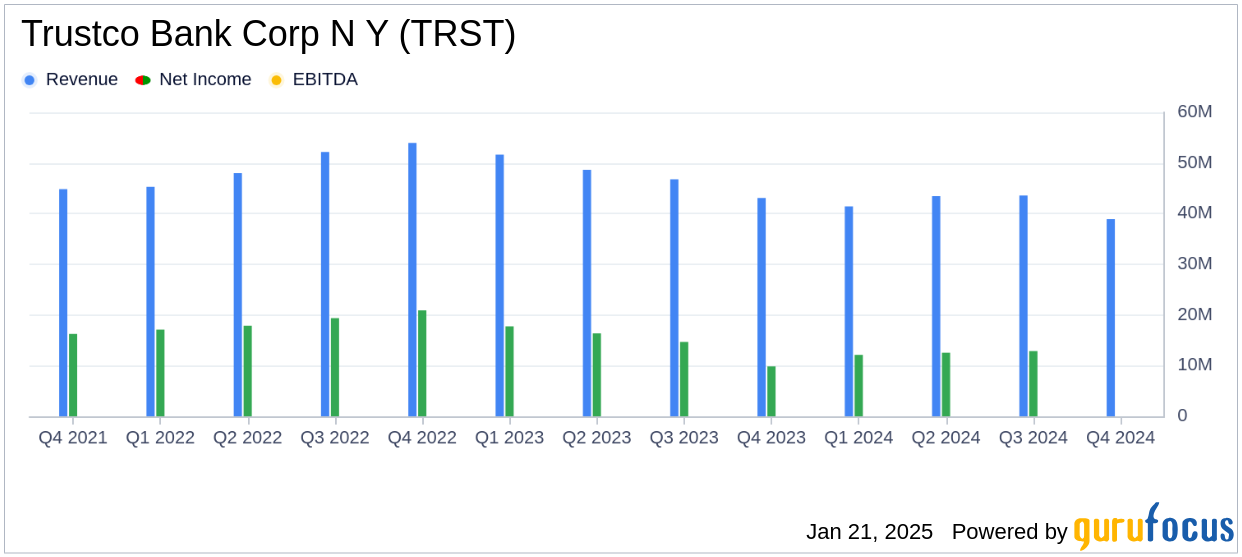

Trustco Bank Corp N Y reported a net income of $11.3 million for the fourth quarter of 2024, translating to $0.59 diluted earnings per share (EPS). This result fell short of the analyst estimate of $0.64 EPS. However, the company met revenue expectations, reporting $43.88 million in revenue against the estimated $43.88 million. For the full year 2024, the company achieved a net income of $48.8 million, or $2.57 diluted EPS, compared to $58.6 million, or $3.08 diluted EPS, in 2023.

Key Financial Achievements

Trustco Bank Corp N Y's net interest income for the fourth quarter was $38.9 million, a slight increase from $38.6 million in the same period of 2023. The return on average assets (ROAA) improved to 0.73% from 0.64% in the previous year, indicating enhanced asset utilization efficiency. The company's strategic focus on home equity lines of credit (HECLs) resulted in a significant increase in average loans by $104.9 million, or 2.1%, compared to the fourth quarter of 2023.

Financial Statements and Metrics

The company's balance sheet reflected a robust equity to asset ratio of 10.84% as of December 31, 2024, up from 10.46% a year earlier. The book value per share increased by 4.8% to $35.56. Trustco Bank Corp N Y maintained strong asset quality, with nonperforming loans (NPLs) at $18.8 million, representing 0.37% of total loans, slightly up from 0.35% in 2023.

| Metric | Q4 2024 | Q4 2023 |

|---|---|---|

| Net Income | $11.3 million | $9.8 million |

| Net Interest Income | $38.9 million | $38.6 million |

| ROAA | 0.73% | 0.64% |

Analysis and Strategic Insights

Trustco Bank Corp N Y's performance highlights its strategic focus on efficiency and shareholder value. The company's ability to grow its loan portfolio, particularly in HECLs, demonstrates its commitment to leveraging customer relationships and meeting market demands. The slight decline in net income for the full year compared to 2023 underscores the challenges faced in a competitive banking environment, particularly in managing interest margins and deposit costs.

Chairman, President, and CEO, Robert J. McCormick stated, "The story of Trustco Bank for 2024 is one of efficiency, strength, and shareholder value. We controlled costs, resisted the temptation to chase deposits with rate, improved our already strong capital position, and delivered a meaningful return to our owners in the form of dividends and price appreciation."

Trustco Bank Corp N Y's strategic initiatives, including aggressive marketing and product differentiation, aim to retain and grow its customer base while maintaining a conservative banking approach. The company's focus on maintaining strong asset quality and capital position positions it well for future growth and stability in the banking sector.

Explore the complete 8-K earnings release (here) from Trustco Bank Corp N Y for further details.