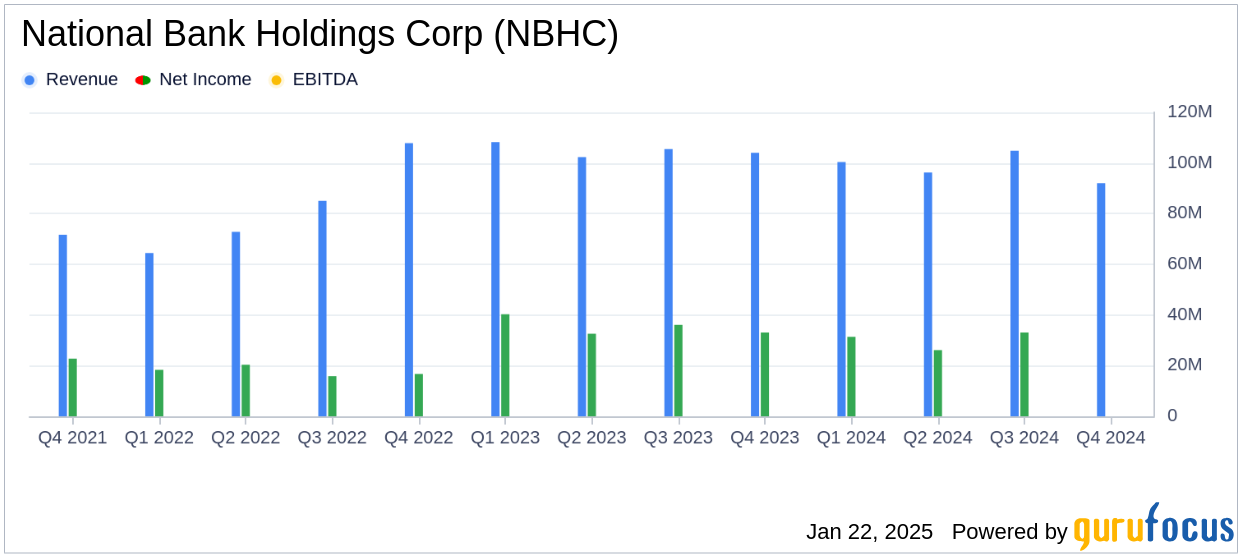

On January 22, 2025, National Bank Holdings Corp (NBHC, Financial) released its 8-K filing detailing the financial results for the fourth quarter and full year of 2024. National Bank Holdings Corp is a bank holding company that provides a range of banking products and financial services to commercial, business, and consumer clients in the United States.

Performance Overview

For the fourth quarter of 2024, National Bank Holdings Corp reported a net income of $28.2 million, or $0.73 per diluted share, falling short of the analyst estimate of $0.76 per share. This represents a decline from the previous quarter's earnings of $33.1 million, or $0.86 per diluted share. The company's revenue for the quarter was not explicitly stated, but the net interest income on a fully taxable equivalent basis increased to $92.0 million, driven by loan growth and disciplined deposit pricing.

Strategic Adjustments and Challenges

During the quarter, NBHC strategically sold approximately $130 million of available-for-sale investment securities, resulting in a pre-tax loss of $6.6 million. This move was part of the company's balance sheet management strategy to redeploy proceeds into higher-yielding securities. The sale impacted the non-interest income, which totaled $11.1 million, down from $18.4 million in the previous quarter.

Financial Achievements and Metrics

Despite the challenges, NBHC achieved a return on average tangible common equity of 12.31% and a net interest margin of 3.99%, reflecting a 12 basis point expansion. The company also reported loan originations of $1.5 billion and a 4.7% growth in total average deposits during 2024. These achievements are crucial for maintaining competitive positioning in the banking industry.

Income Statement and Balance Sheet Highlights

| Metric | Q4 2024 | Q3 2024 | Q4 2023 |

|---|---|---|---|

| Net Income ($000's) | 28,184 | 33,105 | 33,121 |

| Earnings per Share - Diluted | 0.73 | 0.86 | 0.87 |

| Return on Average Tangible Assets | 1.23% | 1.43% | 1.44% |

Analysis and Commentary

Chief Executive Officer Tim Laney commented on the results, stating,

We delivered quarterly earnings of $0.73 per diluted share and a return on average tangible common equity of 12.31%, adjusted for the impact of security sales during the quarter. We remain focused on disciplined loan and deposit pricing, delivering net interest income growth of 11.3% annualized during the quarter, and 12 basis points of margin expansion with a strong net interest margin of 3.99%."

Overall, while National Bank Holdings Corp faced challenges in meeting earnings expectations, the strategic adjustments and focus on core banking operations position the company for potential growth in 2025. The company's strong capital ratios and commitment to disciplined banking practices are expected to support its future endeavors.

Explore the complete 8-K earnings release (here) from National Bank Holdings Corp for further details.