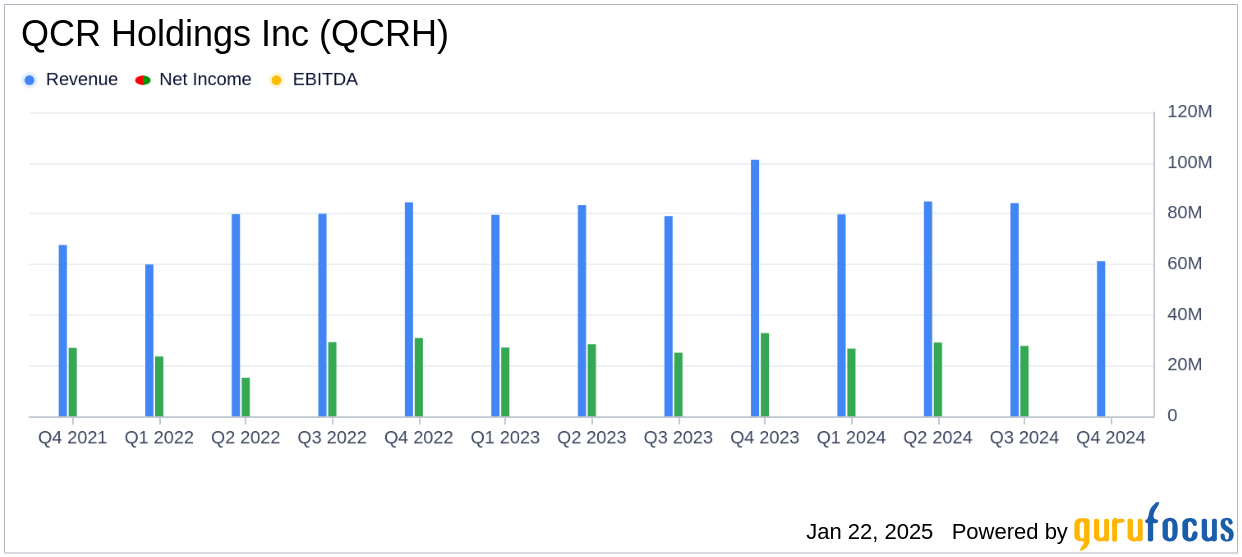

On January 22, 2025, QCR Holdings Inc (QCRH, Financial) released its 8-K filing announcing its fourth-quarter results, showcasing a robust financial performance. The company reported a net income of $30.2 million, or $1.77 per diluted share, for the fourth quarter of 2024, surpassing the analyst estimate of $1.74 per share. QCR Holdings Inc is a multi-bank holding company operating through segments such as Commercial Banking and Wealth Management, generating revenue primarily through interest.

Performance and Challenges

QCR Holdings Inc's performance in the fourth quarter was marked by a record net interest income of $61.2 million, reflecting a significant increase from the previous quarter. The company's net interest margin (NIM) expanded by 5 basis points to 2.95%, with an adjusted NIM (TEY) of 3.40%. This performance is crucial as it highlights the company's ability to manage interest rate changes effectively, a key factor for banks in maintaining profitability. However, the increase in nonperforming assets (NPAs) to $45.6 million poses a challenge, indicating potential credit risks that need to be managed carefully.

Financial Achievements

QCR Holdings Inc achieved a record annual net income of $113.9 million, or $6.71 per diluted share, exceeding the annual estimate of $6.67 per share. The company's capital markets revenue was significant, contributing $71.1 million for the year, driven by strong demand for its low-income housing tax credit (LIHTC) securitizations. These achievements underscore the company's strategic focus on capital markets and wealth management, which are vital for diversifying income streams in the banking industry.

Key Financial Metrics

The company's balance sheet showed total assets of $9.0 billion as of December 31, 2024, with total deposits reaching $7.1 billion. The tangible book value per share increased by $1.21, or 10% annualized, during the fourth quarter, reflecting strong earnings and a modest dividend. The total risk-based capital ratio improved to 14.10%, indicating a solid capital position.

| Metric | Q4 2024 | Q3 2024 | Q4 2023 |

|---|---|---|---|

| Net Income ($ millions) | 30.2 | 27.8 | 32.9 |

| Diluted EPS ($) | 1.77 | 1.64 | 1.95 |

| Adjusted Net Income (non-GAAP) ($ millions) | 32.8 | 30.3 | 33.3 |

| Adjusted Diluted EPS (non-GAAP) ($) | 1.93 | 1.78 | 1.97 |

Analysis and Outlook

QCR Holdings Inc's strong financial performance in the fourth quarter and throughout 2024 highlights its effective management and strategic focus on growth areas such as capital markets and wealth management. The company's ability to expand its net interest margin and manage expenses efficiently positions it well for future growth. However, the increase in nonperforming assets requires careful monitoring to mitigate potential risks. Overall, QCR Holdings Inc's results demonstrate its resilience and adaptability in a challenging economic environment.

Explore the complete 8-K earnings release (here) from QCR Holdings Inc for further details.