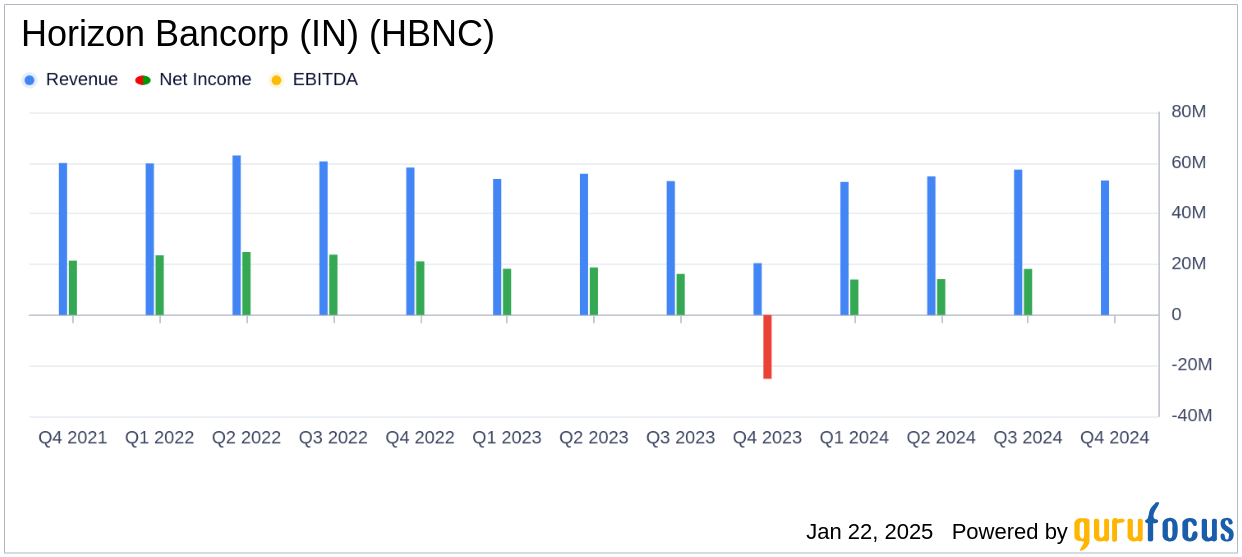

Horizon Bancorp (IN) (HBNC, Financial) released its 8-K filing on January 22, 2025, detailing its financial results for the fourth quarter of 2024. The company, a United States-based holding company providing a range of banking services, reported a net loss for the quarter, reflecting strategic repositioning efforts and market challenges.

Performance and Challenges

Horizon Bancorp (IN) (HBNC, Financial) reported a net loss of $10.9 million, or $0.25 per diluted share, for the fourth quarter of 2024. This result fell short of the analyst estimate of a $0.13 loss per share. The loss was primarily driven by a $39.1 million pre-tax loss on the sale of investment securities, as the company repositioned its portfolio to focus on higher-yielding loans. Despite these challenges, the company achieved a 22.4% annualized growth rate in commercial loans, which contributed to a 31 basis point increase in the net interest margin from the previous quarter.

Financial Achievements

Horizon Bancorp (IN) (HBNC, Financial) successfully executed several strategic initiatives aimed at improving efficiency and profitability. The company increased its net interest income to $53.1 million, marking the fifth consecutive quarter of growth. This increase was supported by a favorable shift in asset and funding mix, as well as disciplined pricing strategies. The net interest margin expanded to 2.97% from 2.66% in the third quarter of 2024.

Income Statement and Key Metrics

For the fourth quarter of 2024, Horizon Bancorp (IN) (HBNC, Financial) reported total interest income of $93.4 million, with net interest income reaching $53.1 million. The provision for loan losses was $1.2 million, reflecting increased provisions for unfunded commitments and commercial loan growth. Non-interest income was negatively impacted by the securities sale, resulting in a loss of $29.0 million for the quarter.

| Metric | Q4 2024 | Q3 2024 | Q4 2023 |

|---|---|---|---|

| Net Interest Income | $53.1 million | $46.9 million | $42.3 million |

| Net Loss | $(10.9) million | $18.2 million | $(25.2) million |

| Net Interest Margin | 2.97% | 2.66% | 2.42% |

Balance Sheet and Capital Position

As of December 31, 2024, Horizon Bancorp (IN) (HBNC, Financial) reported total assets of $7.80 billion, a decrease from $7.93 billion at the end of the third quarter. Total loans increased to $4.91 billion, while total deposits declined to $5.60 billion. The company's capital ratios remained strong, with a total capital ratio of 13.84% and a tangible common equity ratio of 7.83%.

Analysis and Outlook

Horizon Bancorp (IN) (HBNC, Financial)'s strategic initiatives, including the repositioning of its securities portfolio and focus on higher-yielding loans, are expected to enhance profitability in the long term. However, the immediate impact of these actions resulted in a quarterly loss, highlighting the challenges of navigating market conditions and strategic transitions. The company's strong capital position and continued growth in commercial loans provide a solid foundation for future performance.

"We are very pleased with Horizon’s fourth quarter results, which displayed a significantly more profitable core business model and the successful completion of several major initiatives aimed at continuing this positive trajectory throughout 2025," stated President and CEO, Thomas Prame.

For more detailed insights and analysis, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Horizon Bancorp (IN) for further details.