On January 22, 2025, First Bancorp Inc (FNLC, Financial) released its 8-K filing detailing the financial results for the fourth quarter and full year ending December 31, 2024. The Damariscotta-based bank holding company, which offers a range of retail and commercial banking services, reported a notable increase in net interest margin and core deposit growth, despite a decline in annual net income.

Company Overview

First Bancorp Inc is a bank holding company headquartered in Damariscotta, Maine. It provides a comprehensive suite of retail and commercial banking services, including deposit accounts and various loan products. The company also offers investment management and private banking services through its bank division, with revenues primarily derived from dividends paid by the bank.

Performance Highlights and Challenges

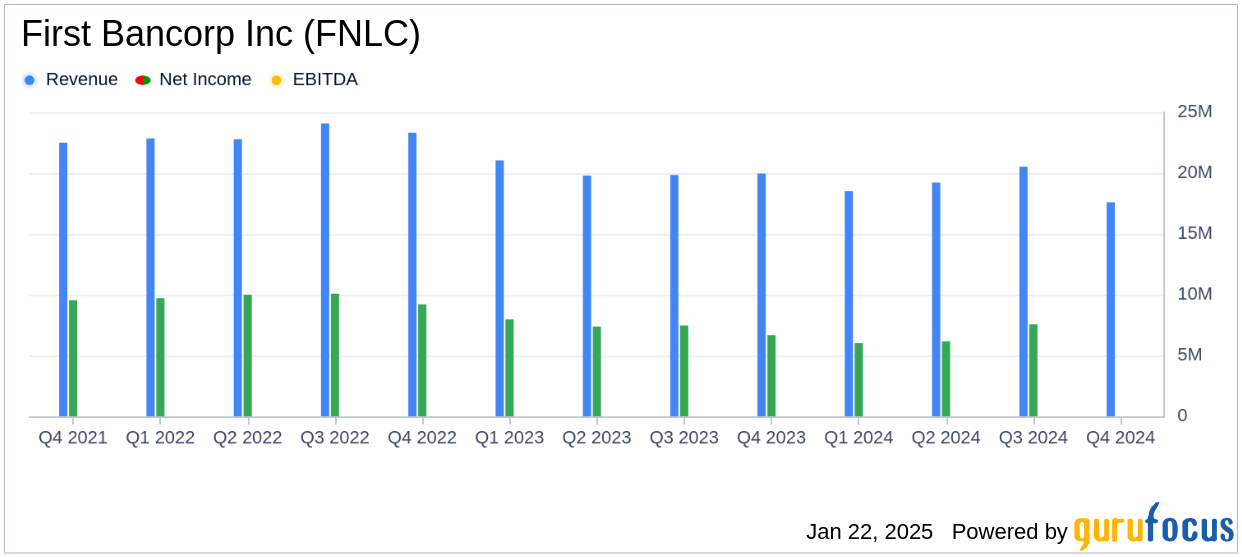

For the fourth quarter of 2024, First Bancorp Inc reported an unaudited net income of $7.3 million, marking a 9.0% increase from the same period in 2023. Earnings per share (EPS) on a fully diluted basis rose to $0.65, up 8.5% from the previous year. However, the annual net income for 2024 was $27.0 million, reflecting an 8.4% decrease from 2023, with diluted EPS down by 8.9% to $2.43.

The company's performance was bolstered by a 10.7% increase in net interest income from the fourth quarter of 2023, driven by a 10 basis point improvement in net interest margin from the third quarter of 2024. Despite these gains, the annual decline in net income highlights ongoing challenges, including margin contraction earlier in the year.

Financial Achievements

First Bancorp Inc's financial achievements in the fourth quarter included a $33.7 million increase in total loans, representing an annualized growth rate of 5.9%, and a $33.0 million rise in core deposits. The efficiency ratio improved to 53.39%, indicating enhanced operational efficiency. These achievements are crucial for banks as they reflect the company's ability to grow its loan portfolio and deposit base while maintaining cost control.

Key Financial Metrics

Net interest income for the fourth quarter was $17.6 million, a 7.0% increase from the third quarter of 2024. The net interest margin improved to 2.42%, up from 2.32% in the previous quarter. The provision for credit losses was $1.16 million, reflecting loan growth and specific reserve requirements.

Non-interest income rose to $4.4 million, driven by increases in debit card and mortgage banking revenues. Non-interest expenses totaled $12.1 million, with a modest increase from the third quarter, primarily due to higher employee salaries and benefits.

Balance Sheet and Asset Quality

As of December 31, 2024, total assets were $3.15 billion, up from $2.95 billion at the end of 2023. Loan balances grew by $211.5 million year-over-year, with significant contributions from commercial and residential mortgage loans. Total deposits increased to $2.73 billion, with core deposits rising by $81.0 million for the year.

Asset quality remained stable, with non-performing assets at 0.14% of total assets. The allowance for loan losses was 1.06% of total loans, reflecting strong asset quality metrics.

Capital and Dividend

First Bancorp Inc maintained a strong capital position with a total risk-based capital ratio of 13.21% and a leverage capital ratio of 8.47%. The tangible book value per share increased to $19.87. The company declared a fourth-quarter dividend of $0.36 per share, representing a payout ratio of 54.71% of earnings per share.

Analysis and Outlook

First Bancorp Inc's fourth-quarter results demonstrate resilience in improving net interest margins and deposit growth, despite challenges earlier in the year. The company's focus on asset quality and operational efficiency positions it well for future growth. However, the decline in annual net income underscores the need for continued strategic initiatives to enhance profitability.

Explore the complete 8-K earnings release (here) from First Bancorp Inc for further details.