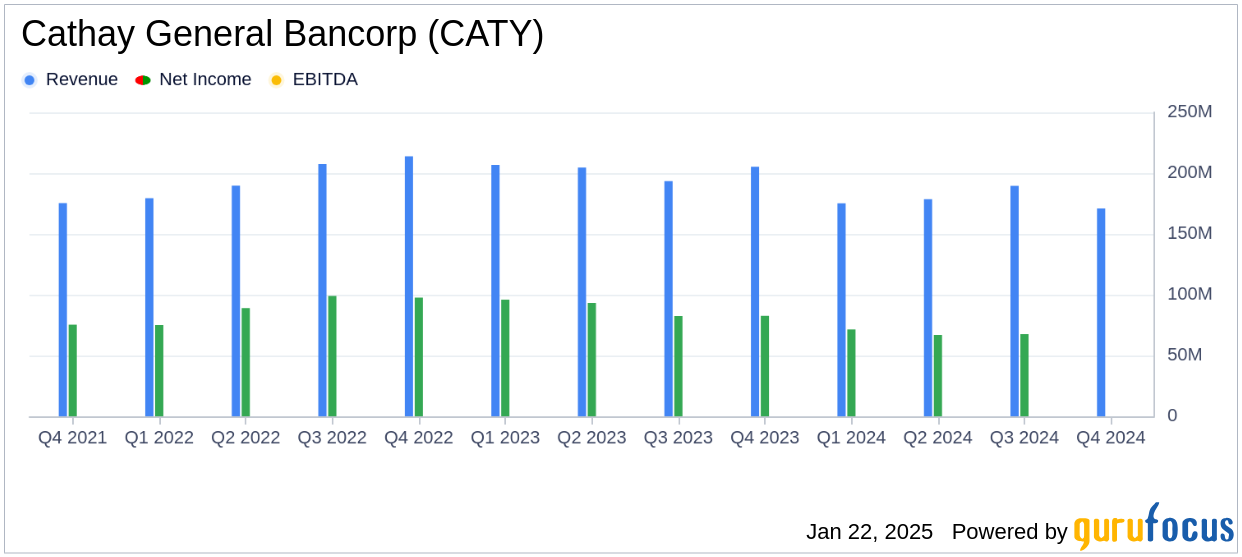

Cathay General Bancorp (CATY, Financial) released its 8-K filing on January 22, 2025, announcing its financial results for the fourth quarter and full year of 2024. The company reported a net income of $80.2 million, or $1.12 per diluted share, for the fourth quarter, surpassing the analyst estimate of $1.10 per share. The annual net income was $286.0 million, or $3.95 per diluted share, slightly above the annual estimate of $3.93 per share.

Company Overview

Cathay General Bancorp is a regional bank primarily serving the Chinese-American community. It offers a range of financial services, including checking and deposit accounts, commercial and real estate loans, and wealth management services. The bank is committed to serving low-to-moderate income groups within its branch service areas.

Financial Performance and Challenges

The fourth quarter of 2024 saw Cathay General Bancorp's net income increase by 18.8% from the previous quarter, reaching $80.2 million. This growth was driven by an improved net interest margin, which rose to 3.07% from 3.04% in the third quarter. However, the company faced challenges with a decrease in total loans to $19.38 billion, down 0.9% from the previous year. This decline in loans could pose challenges in maintaining revenue growth.

Key Financial Achievements

The bank's financial achievements include a significant increase in total deposits, which rose by $360.8 million, or 1.9%, to $19.69 billion in 2024. This growth in deposits is crucial for the bank's liquidity and ability to fund new loans. Additionally, the efficiency ratio improved to 45.70% in the fourth quarter, indicating better cost management compared to the previous quarter's 51.11%.

Income Statement and Balance Sheet Highlights

Net interest income before provision for credit losses increased by $1.8 million to $171.0 million in the fourth quarter. The provision for credit losses remained stable at $14.5 million. Non-interest income decreased by 23.9% to $15.5 million, primarily due to lower gains on equity securities. On the balance sheet, total non-accrual loans increased significantly by 153.7% to $169.2 million, highlighting potential asset quality concerns.

Capital Adequacy and Asset Quality

Cathay General Bancorp maintained strong capital ratios, with a Tier 1 risk-based capital ratio of 13.55% and a total risk-based capital ratio of 15.09%, categorizing it as "well capitalized" under regulatory standards. However, the increase in non-performing assets to $196.3 million, up 110.4% from the previous year, indicates rising credit risk.

Analysis and Commentary

The company's performance in the fourth quarter demonstrates resilience in a challenging economic environment. The increase in net interest margin and deposits are positive indicators for future growth. However, the rise in non-performing assets and the decline in loan balances warrant careful monitoring. As President and CEO Chang M. Liu stated,

“We are pleased by the increase in the net interest margin compared to the third quarter of 2024. During the quarter, we repurchased 506,651 shares at an average cost of $47.10 per share for a total of $23.9 million.”

Overall, Cathay General Bancorp's ability to exceed earnings expectations and manage costs effectively positions it well for continued success, though challenges in loan growth and asset quality remain areas of concern for investors.

Explore the complete 8-K earnings release (here) from Cathay General Bancorp for further details.