On January 17, 2025, GENERAL ATLANTIC, L.P. (Trades, Portfolio) made a strategic move by acquiring an additional 665,148 shares of Third Harmonic Bio Inc (THRD, Financial). This transaction increased the firm's total holdings in the biopharmaceutical company to 3,623,910 shares. The acquisition was executed at a price of $5.79 per share, reflecting a calculated decision to bolster its position in the healthcare sector. This addition represents a 0.11% increase in the firm's portfolio, with Third Harmonic Bio now constituting 8.00% of GENERAL ATLANTIC, L.P. (Trades, Portfolio)'s total holdings.

GENERAL ATLANTIC, L.P. (Trades, Portfolio): A Profile of the Investment Firm

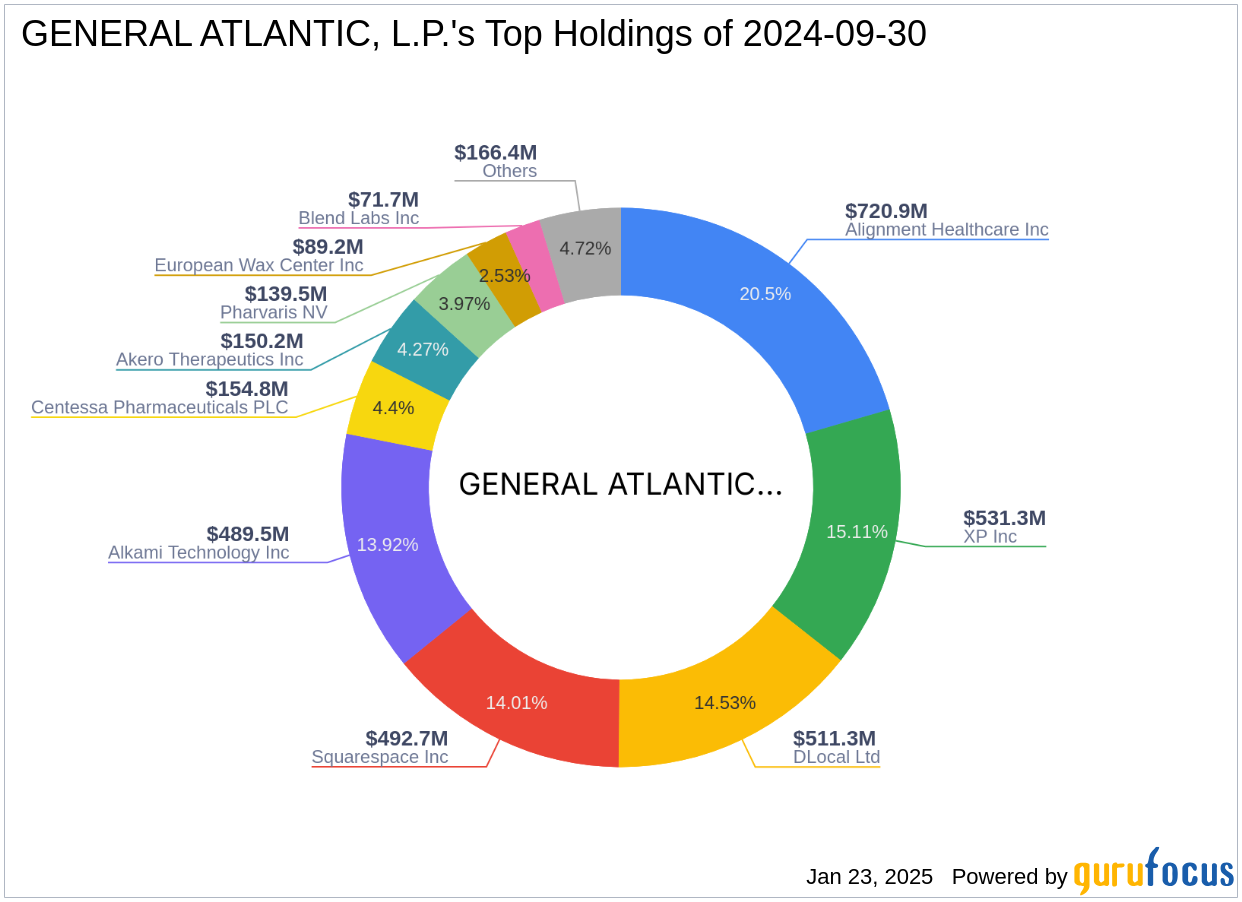

GENERAL ATLANTIC, L.P. (Trades, Portfolio), headquartered at 55 East 52nd Street, New York, is a prominent investment firm known for its focus on technology and healthcare sectors. The firm manages a substantial equity portfolio valued at $3.52 billion, with top holdings in companies such as XP Inc (XP, Financial), Alignment Healthcare Inc (ALHC, Financial), Alkami Technology Inc (ALKT, Financial), Squarespace Inc (SQSP, Financial), and DLocal Ltd (DLO, Financial). GENERAL ATLANTIC, L.P. (Trades, Portfolio) is recognized for its strategic investments aimed at fostering growth and innovation within its chosen sectors.

Third Harmonic Bio Inc: A Biopharmaceutical Innovator

Third Harmonic Bio Inc, based in the USA, is a biopharmaceutical company dedicated to developing advanced treatments for inflammatory diseases. The company's product pipeline includes THB001, a selective, oral small-molecule inhibitor of KIT, and THB335, another potent KIT inhibitor targeting multiple mast cell-driven inflammatory conditions. With a market capitalization of $263.144 million and a current stock price of $5.84, Third Harmonic Bio is positioned as a key player in the biotechnology industry.

Impact of the Transaction on GENERAL ATLANTIC, L.P. (Trades, Portfolio)'s Portfolio

The recent acquisition of Third Harmonic Bio shares by GENERAL ATLANTIC, L.P. (Trades, Portfolio) signifies a strategic enhancement of its portfolio. The firm's increased stake in the company reflects confidence in Third Harmonic Bio's potential to deliver innovative solutions in the healthcare sector. This transaction has resulted in Third Harmonic Bio representing 8.00% of the firm's portfolio, indicating a significant commitment to the biopharmaceutical company's future prospects.

Financial Metrics and Valuation of Third Harmonic Bio Inc

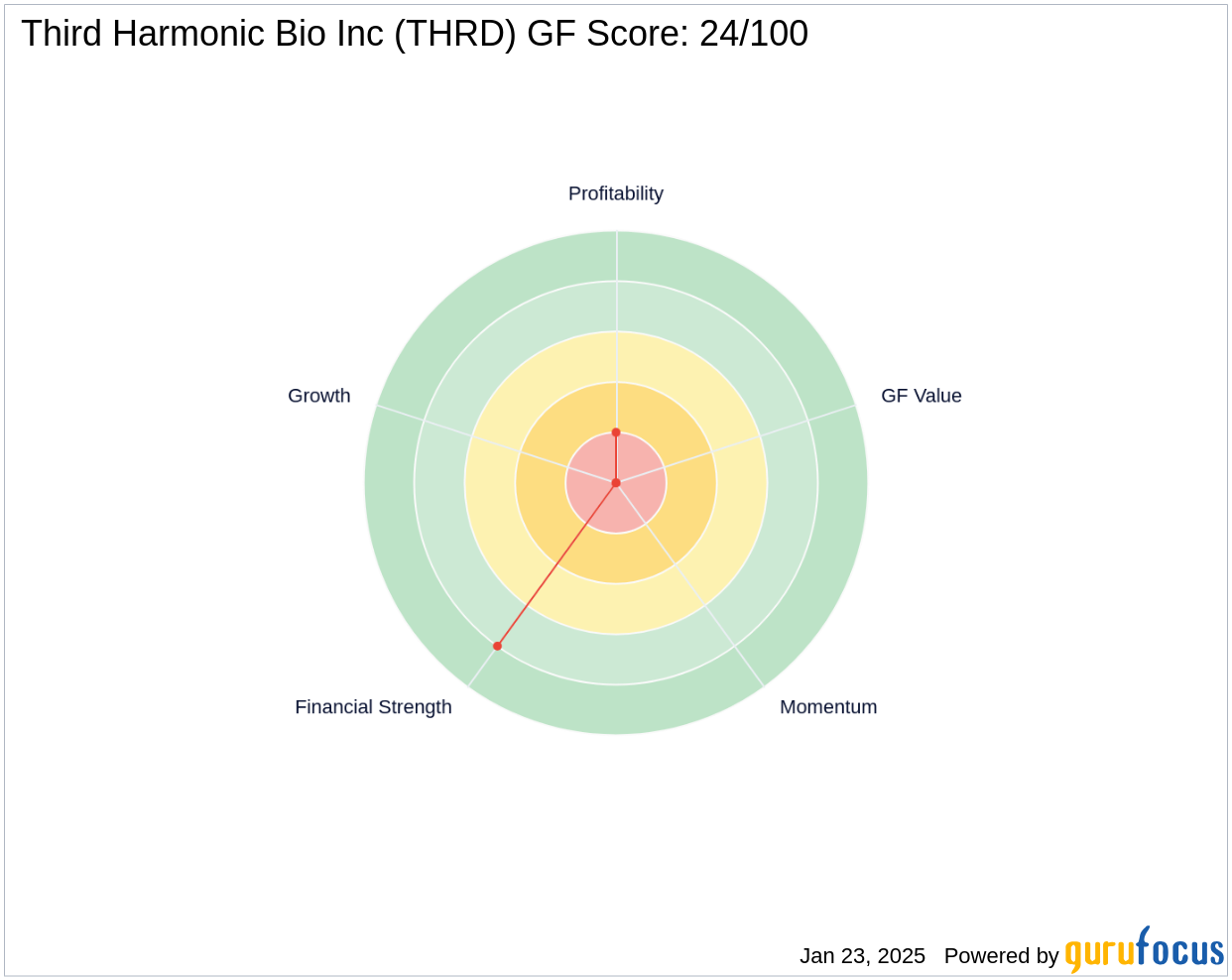

Third Harmonic Bio Inc's financial metrics reveal a challenging landscape, with a PE percentage of 0.00, indicating the company is currently operating at a loss. The absence of GF Valuation data further complicates the assessment of the stock's intrinsic value. The company's GF Score stands at 24/100, suggesting a poor potential for future performance. These metrics highlight the risks associated with investing in Third Harmonic Bio, despite its innovative product pipeline.

Stock Performance and Market Sentiment

Third Harmonic Bio's stock performance has been underwhelming, with a year-to-date price change of -47.1% and a significant decline of -71.51% since its IPO. The stock's momentum indicators, including the RSI, reflect a bearish market sentiment, with the 14-day RSI at 23.75. These figures suggest that the stock is currently experiencing downward pressure, which may present both challenges and opportunities for investors.

Conclusion: Strategic Portfolio Addition by GENERAL ATLANTIC, L.P. (Trades, Portfolio)

GENERAL ATLANTIC, L.P. (Trades, Portfolio)'s decision to increase its holdings in Third Harmonic Bio Inc underscores a strategic commitment to the healthcare sector. While the financial metrics and market sentiment present potential risks, the firm's investment reflects confidence in the company's innovative approach to treating inflammatory diseases. As with any investment, there are inherent risks, but the potential for groundbreaking advancements in biopharmaceuticals offers intriguing opportunities for growth and value creation.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.