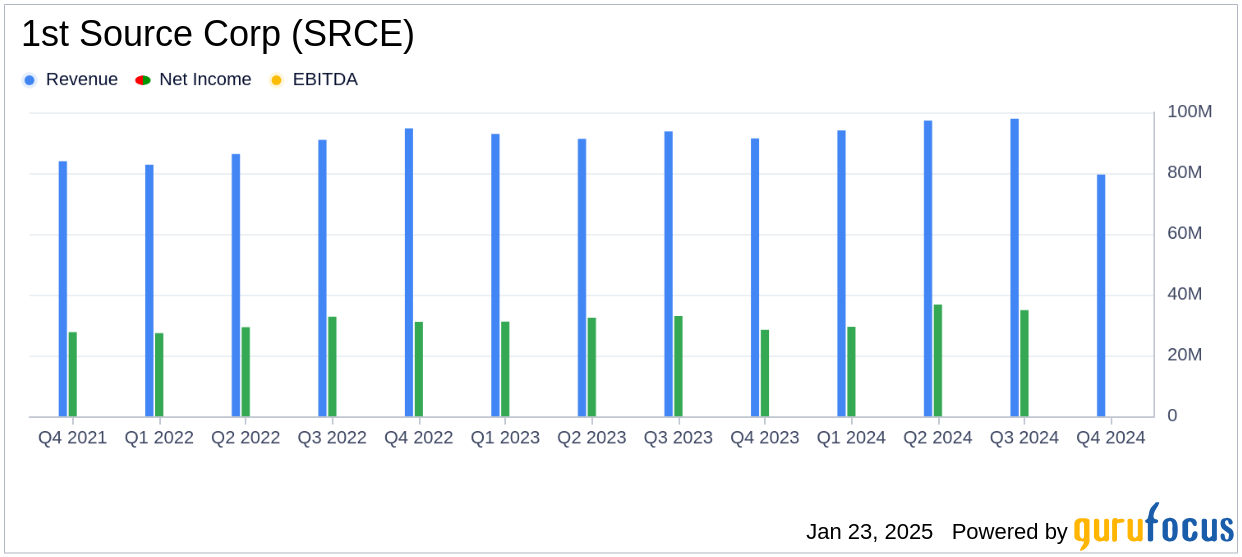

On January 23, 2025, 1st Source Corp (SRCE, Financial) released its 8-K filing, reporting record annual earnings for 2024. The company, which offers a range of banking services including commercial, agricultural, and real estate loans, as well as specialty finance services, achieved a net income of $132.62 million for the year, marking a 6.16% increase from 2023. However, the fourth quarter presented some challenges, with net income at $31.44 million, a 10.02% decrease from the previous quarter but a 10.58% increase from the same quarter last year.

Performance Overview and Challenges

1st Source Corp's performance in 2024 was marked by a record diluted net income per common share of $5.36, up 6.56% from the previous year. However, the fourth quarter's diluted net income per share was $1.27, falling short of the analyst estimate of $1.33. This shortfall was partly due to $3.9 million in pre-tax losses from the sale of available-for-sale securities. Despite these challenges, the company maintained a strong return on average assets of 1.52% for the year, although the return on average common shareholders’ equity decreased to 12.54% from 13.48% in 2023.

Financial Achievements and Industry Significance

The company's financial achievements include a 5.16% increase in end-of-period loans and leases, reaching $6.85 billion, and a 5.06% increase in deposits, totaling $6.73 billion. These metrics are crucial for banks as they reflect the institution's ability to grow its lending and deposit base, which are key drivers of profitability. The tax-equivalent net interest margin also improved to 3.64% for the year, highlighting effective interest rate management amidst a competitive deposit pricing environment.

Key Financial Metrics

1st Source Corp's income statement revealed a net interest income of $300.82 million for 2024, up 7.88% from the previous year. Noninterest income, however, declined by 4.76% to $86.31 million, primarily due to lower equipment rental income and realized losses from securities sales. Noninterest expenses increased by 2.23% to $203.60 million, driven by higher salaries and data processing costs.

| Metric | Q4 2024 | Q3 2024 | Q4 2023 |

|---|---|---|---|

| Net Income | $31.44 million | $34.91 million | $28.43 million |

| Diluted EPS | $1.27 | $1.41 | $1.15 |

| Net Interest Margin | 3.78% | 3.64% | 3.51% |

Analysis and Commentary

Despite the quarterly challenges, 1st Source Corp's annual performance underscores its resilience and strategic growth in loans and deposits. The company's ability to expand its net interest margin amidst competitive pressures is noteworthy. However, the decline in noninterest income and increased expenses highlight areas for potential improvement. The company's commitment to dividend growth, with a 5.88% increase in cash dividends, reflects confidence in its long-term financial health.

Christopher J. Murphy III, Chairman and CEO, stated, "We are pleased to announce record net income for the fourth year in a row and we reached our 37th consecutive year of dividend growth. We were able to grow average loans and leases by $394.47 million or 6.36% from 2023 while maintaining disciplined loan and lease pricing."

Overall, 1st Source Corp's 2024 performance demonstrates its ability to navigate a challenging economic environment while achieving record earnings, positioning it well for future growth. For more detailed insights, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from 1st Source Corp for further details.