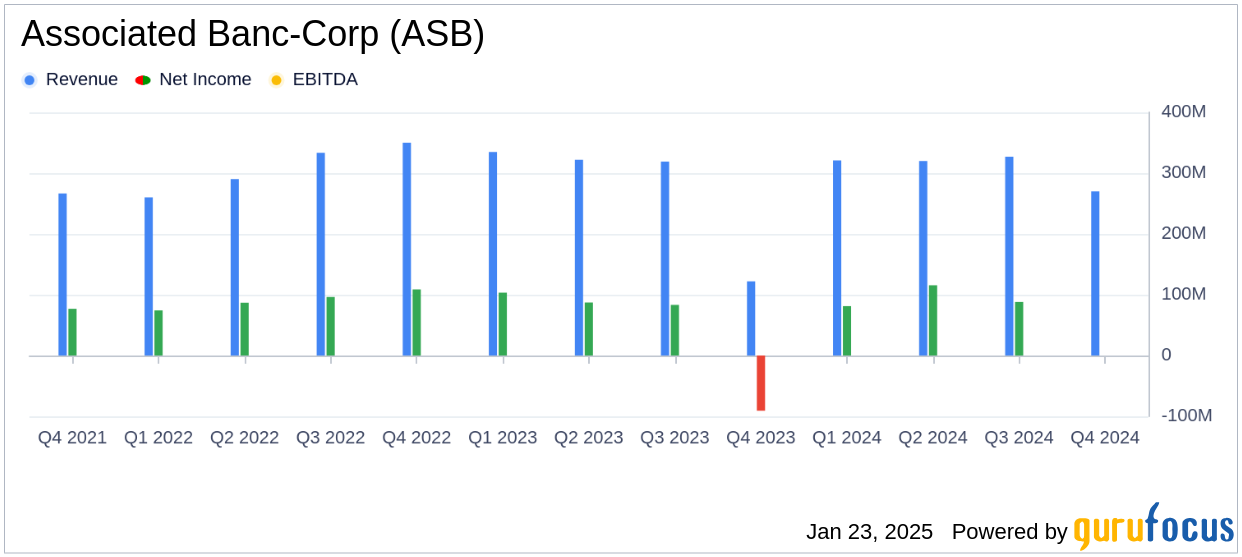

On January 23, 2025, Associated Banc-Corp (ASB, Financial) released its 8-K filing detailing the financial results for the fourth quarter and full year of 2024. The bank holding company, which provides a wide range of banking and nonbanking services through its subsidiaries, reported a challenging quarter with a net loss of $164 million, or $1.03 per common share, missing the analyst estimate of -$0.86 per share. The company's revenue for the quarter was not explicitly stated, but the annual revenue was reported at $1.0 billion, falling short of the estimated $1,227.55 million.

Company Overview and Segment Performance

Associated Banc-Corp operates through three main segments: Corporate and Commercial Specialty; Community, Consumer, and Business; and Risk Management and Shared Services. The majority of its revenue is derived from the first two segments. The company's strategic repositioning in the fourth quarter, which included the sale of a mortgage portfolio and investments, significantly impacted its financial performance.

Financial Performance and Challenges

The fourth quarter results were heavily influenced by nonrecurring items related to balance sheet repositioning, including a $130 million loss on a mortgage portfolio sale and a $148 million net loss on investment sales. These strategic moves were aimed at strengthening the company's financial position but resulted in a substantial quarterly loss. The adjusted earnings for the quarter, excluding these nonrecurring items, were $91 million, or $0.57 per share, which still fell short of expectations.

Key Financial Achievements and Metrics

Despite the quarterly challenges, Associated Banc-Corp reported several financial achievements for the full year 2024. The company achieved a total deposit growth of $1.2 billion and a total loan growth of $552 million. Net interest income for the year was $1.0 billion, reflecting a 1% increase from the previous year. These achievements are crucial for banks as they indicate growth in core banking activities and customer base expansion.

Income Statement and Balance Sheet Highlights

The income statement revealed a total noninterest loss income of $9 million for the year, primarily due to the aforementioned nonrecurring losses. The balance sheet showed total assets of $43 billion, with a notable increase in investment securities available for sale, which rose by $428 million from the previous quarter. The company's capital position remained strong, with a Common Equity Tier 1 (CET1) capital ratio of 10.00%.

Analysis and Future Outlook

Associated Banc-Corp's strategic repositioning efforts, while resulting in short-term financial setbacks, are aimed at enhancing long-term profitability and stability. The company enters 2025 with positive momentum, including record-high customer satisfaction scores and a strengthened profitability profile. The management anticipates continued growth in loans and deposits, projecting a 5% to 6% increase in loan growth and a 1% to 2% increase in deposit growth for the upcoming year.

“2024 was a year of significant progress for Associated," said President and CEO Andy Harmening. "We bolstered our executive team with several high-quality leaders, enhanced our consumer value proposition, expanded our commercial team, and complemented these actions with an equity raise and balance sheet repositioning.”

For more detailed insights and financial data, visit the full 8-K filing.

Explore the complete 8-K earnings release (here) from Associated Banc-Corp for further details.