On December 31, 2024, Dimensional Fund Advisors LP executed a notable transaction involving Cushman & Wakefield PLC. The firm added 736,955 shares to its holdings, marking a 6.79% increase in its position in the stock. This acquisition brings the total number of shares held by Dimensional Fund Advisors to 11,586,407, reflecting the firm's strategic interest in the commercial real estate services sector. The transaction was executed at a price of $13.08 per share, indicating a calculated move by the firm to strengthen its portfolio with Cushman & Wakefield's offerings.

Dimensional Fund Advisors LP: A Profile

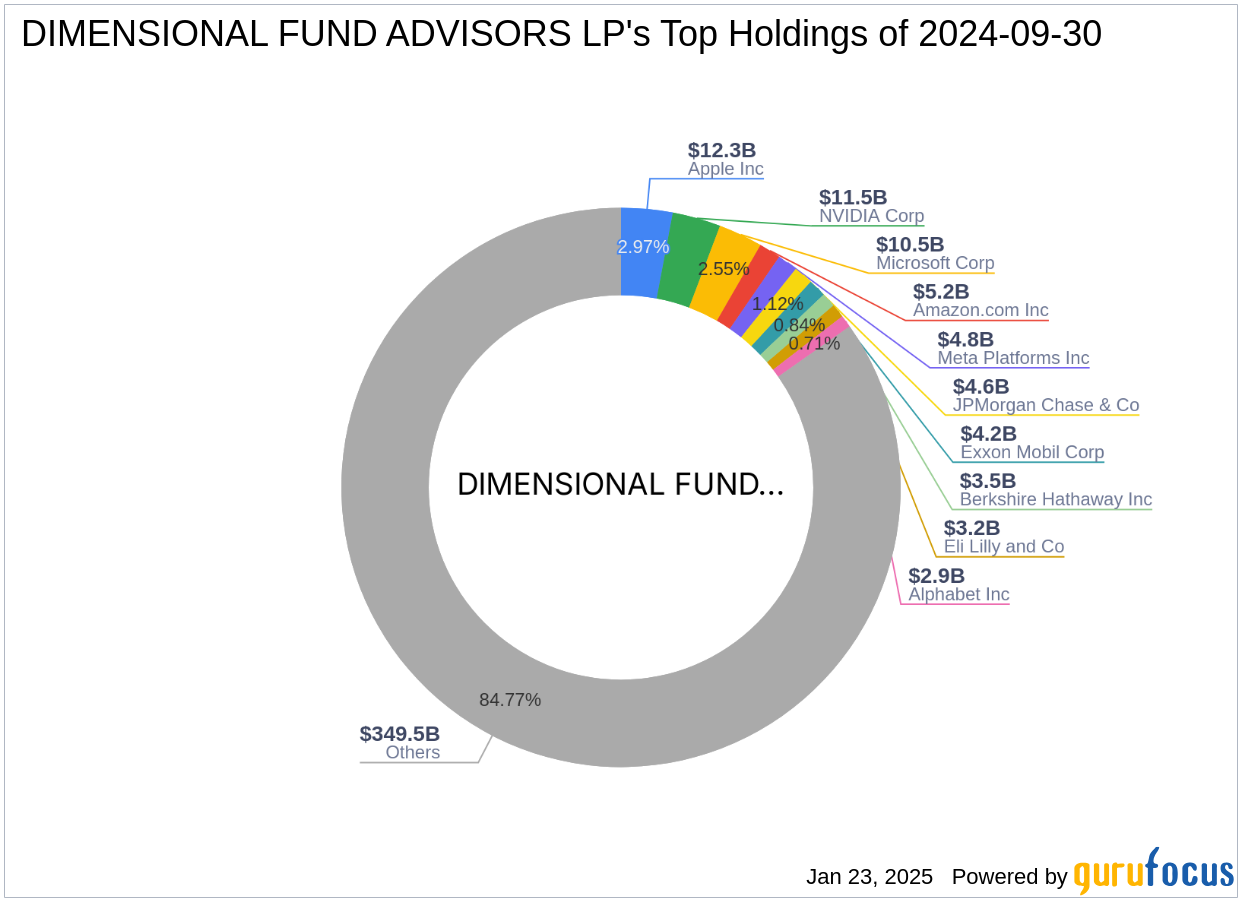

Founded in 1981 by David G. Booth and Rex Sinquefield, Dimensional Fund Advisors is renowned for its academic research-driven approach to capital markets. The firm manages approximately $400 billion in assets, employing a dynamic, market-driven process and flexible trading strategies. Dimensional Fund Advisors has established itself as a leader in the investment community by leveraging rigorous academic research to enhance its business operations. The firm has forged deep relationships with leading financial economists, including Eugene Fama and Kenneth French, to bring financial science to its clients. With a global presence, the firm serves clients in over 25 countries, focusing on US, European, and Asia Pacific markets.

About Cushman & Wakefield PLC

Cushman & Wakefield is a leading global commercial real estate services firm headquartered in Chicago. The company provides a wide range of services, including brokerage, valuation, project management, and facilities management. With a market capitalization of $3.09 billion, Cushman & Wakefield is one of the largest firms in its industry. The company operates across various segments, such as capital markets, leasing, and valuation services, catering to the needs of owners, occupiers, and investors worldwide. Despite its strong market presence, the stock is currently considered modestly overvalued, with a GF Value of $10.85 and a Price to GF Value ratio of 1.24.

Transaction Analysis and Portfolio Impact

The recent transaction by Dimensional Fund Advisors has increased its stake in Cushman & Wakefield to 11,586,407 shares, representing 0.04% of the firm's portfolio. The stock accounts for 5.00% of Dimensional Fund Advisors' total holdings, indicating a significant commitment to the real estate sector. The current stock price of $13.45, coupled with a PE ratio of 36.35, suggests a modest overvaluation. However, the firm's strategic acquisition reflects confidence in Cushman & Wakefield's potential for growth and value creation.

Financial Metrics and Valuation

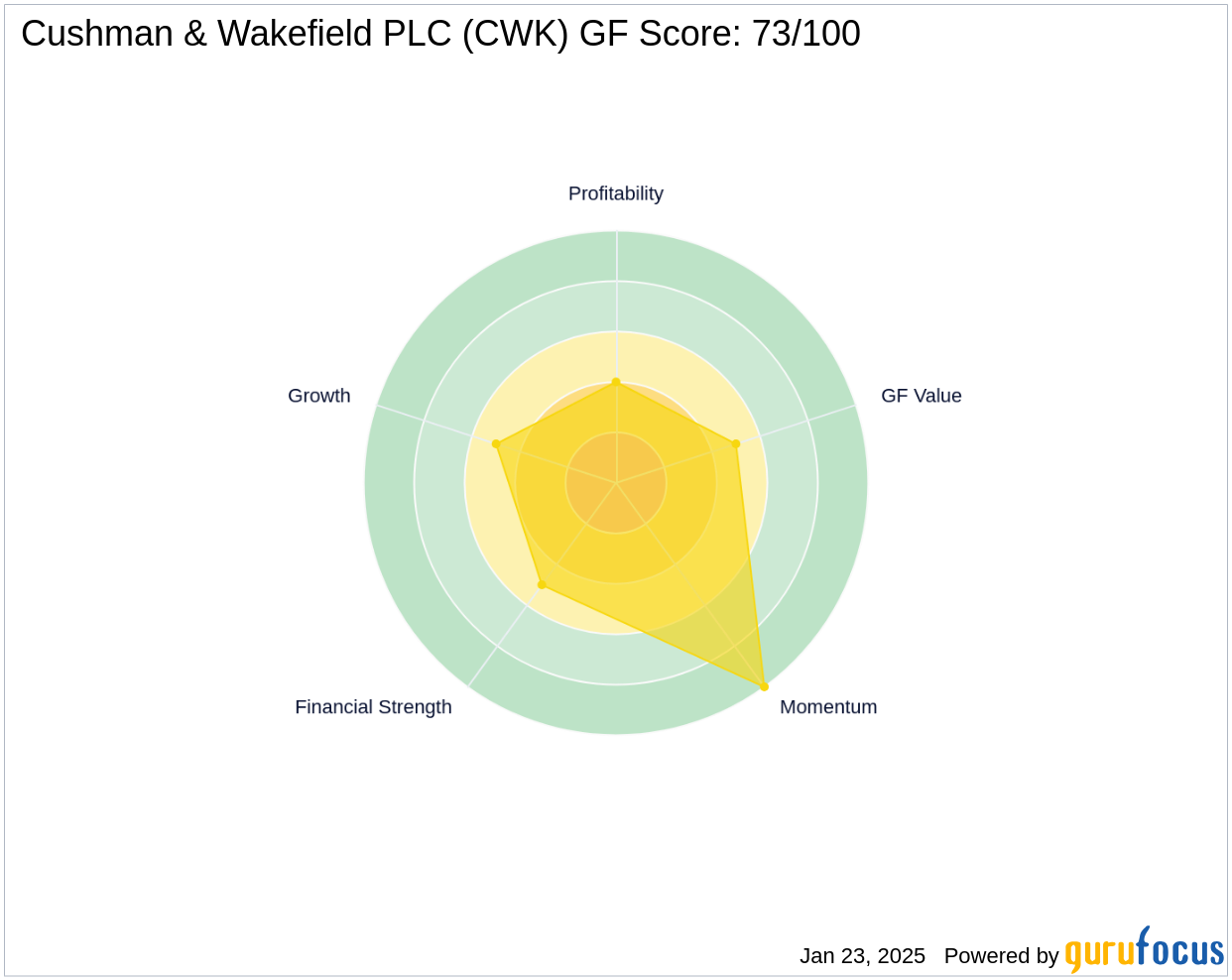

Cushman & Wakefield's current stock price is $13.45, with a PE ratio of 36.35, indicating a modest overvaluation according to GuruFocus. The GF Value of the stock is $10.85, with a Price to GF Value ratio of 1.24, suggesting a potential overvaluation. The stock has shown a year-to-date price change of 6.83% and a 3-year revenue growth rate of 5.60%. Cushman & Wakefield's GF Score is 73/100, indicating likely average performance, with a strong momentum rank of 10/10.

Performance and Growth Indicators

Cushman & Wakefield has demonstrated a 3-year revenue growth rate of 5.60% and an EBITDA growth rate of 7.60%. The company's Profitability Rank is 4/10, while its Growth Rank is 5/10. The firm's Piotroski F-Score is 7, indicating a relatively strong financial position. However, the Altman Z score of 1.58 suggests some financial risk, and the interest coverage ratio of 1.41 highlights potential challenges in meeting interest obligations.

Other Notable Gurus Holding the Stock

In addition to Dimensional Fund Advisors, other prominent investors in Cushman & Wakefield include Robert Olstein (Trades, Portfolio), Joel Greenblatt (Trades, Portfolio), and Barrow, Hanley, Mewhinney & Strauss. Hotchkis & Wiley Capital Management LLC holds the largest share percentage of the stock among gurus, indicating a broad interest in the company's potential within the investment community.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

Also check out: