Recent Acquisition by Dimensional Fund Advisors LP

Dimensional Fund Advisors LP, a prominent investment firm, recently increased its stake in Proto Labs Inc by acquiring an additional 68,006 shares on December 31, 2024. The transaction was executed at a price of $39.09 per share, bringing the firm's total holdings in Proto Labs to 1,300,864 shares. This strategic move reflects Dimensional Fund Advisors' continued interest in the on-demand manufacturing sector, as Proto Labs specializes in providing custom parts for prototyping and short-run production. The acquisition represents 5.30% of the firm's holdings in the stock, while Proto Labs constitutes a modest 0.01% of the firm's overall portfolio.

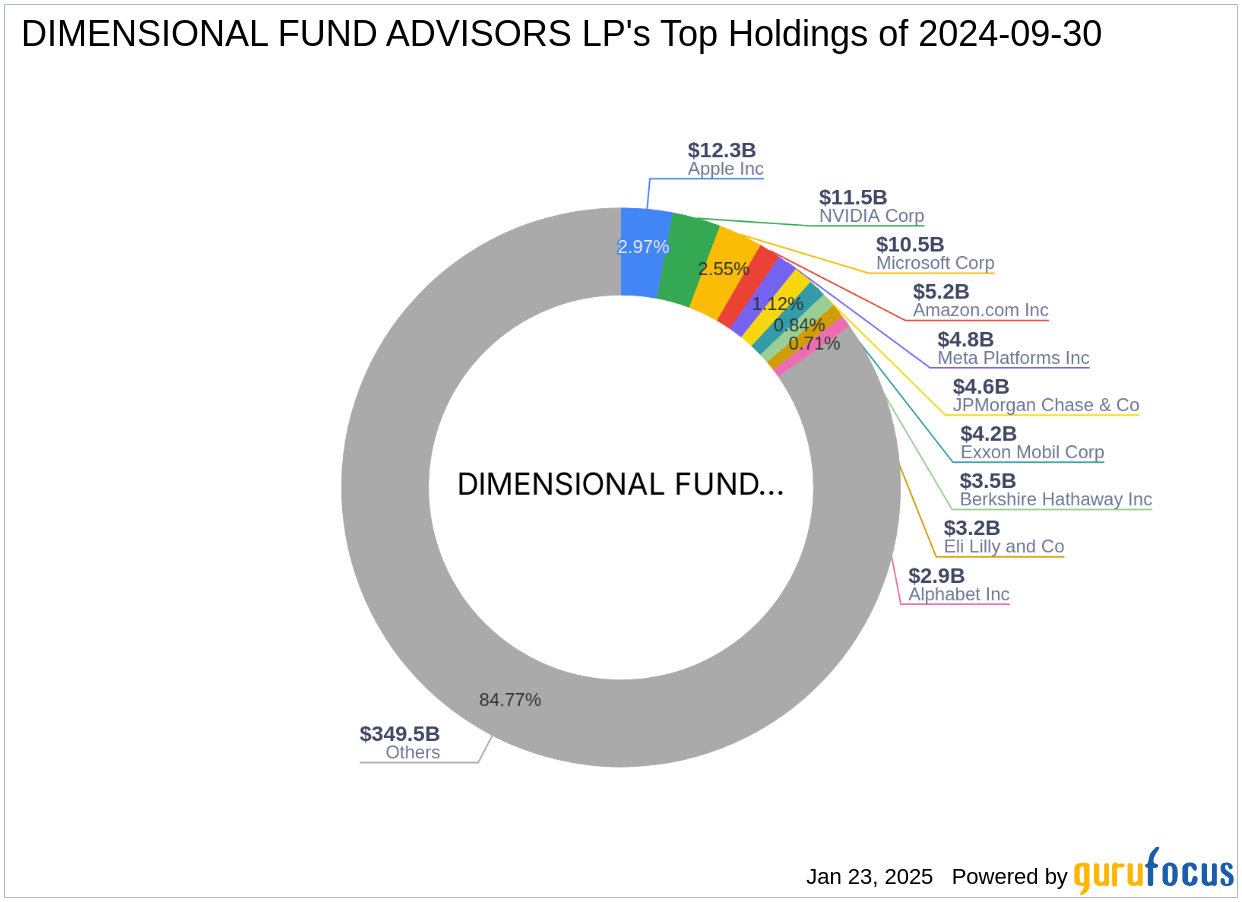

Dimensional Fund Advisors LP: A Brief Profile

Founded in 1981 by David G. Booth and Rex Sinquefield, Dimensional Fund Advisors LP has established itself as a leader in the investment industry. The firm is renowned for its investment philosophy, which is deeply rooted in rigorous academic research and a dynamic, market-driven process. Over the years, Dimensional Fund Advisors has expanded its offerings to include diversified, cost-efficient access to small companies, international small caps, and emerging markets. The firm collaborates with leading financial economists, such as Eugene Fama and Kenneth French, to enhance its portfolio designs and identify new dimensions of higher expected returns. With approximately $400 billion in assets under management, Dimensional Fund Advisors serves clients in over 25 countries, focusing on a flexible trading strategy that balances premiums, diversification, and costs.

Proto Labs Inc: An Overview

Proto Labs Inc is a leading on-demand manufacturer of custom parts, catering to developers and engineers with quick-turn production services. The company utilizes advanced technologies such as injection molding, computer numerical control (CNC) machining, and 3D printing to meet the diverse needs of its clients. Proto Labs' services are crucial for prototype solutions, testing procedures, bridge production, and end-of-life production support. The majority of its revenue is derived from the United States, highlighting its strong presence in the domestic market. As of January 23, 2025, Proto Labs has a market capitalization of $981.386 million and a price-to-earnings (PE) ratio of 42.60, indicating its valuation in the market.

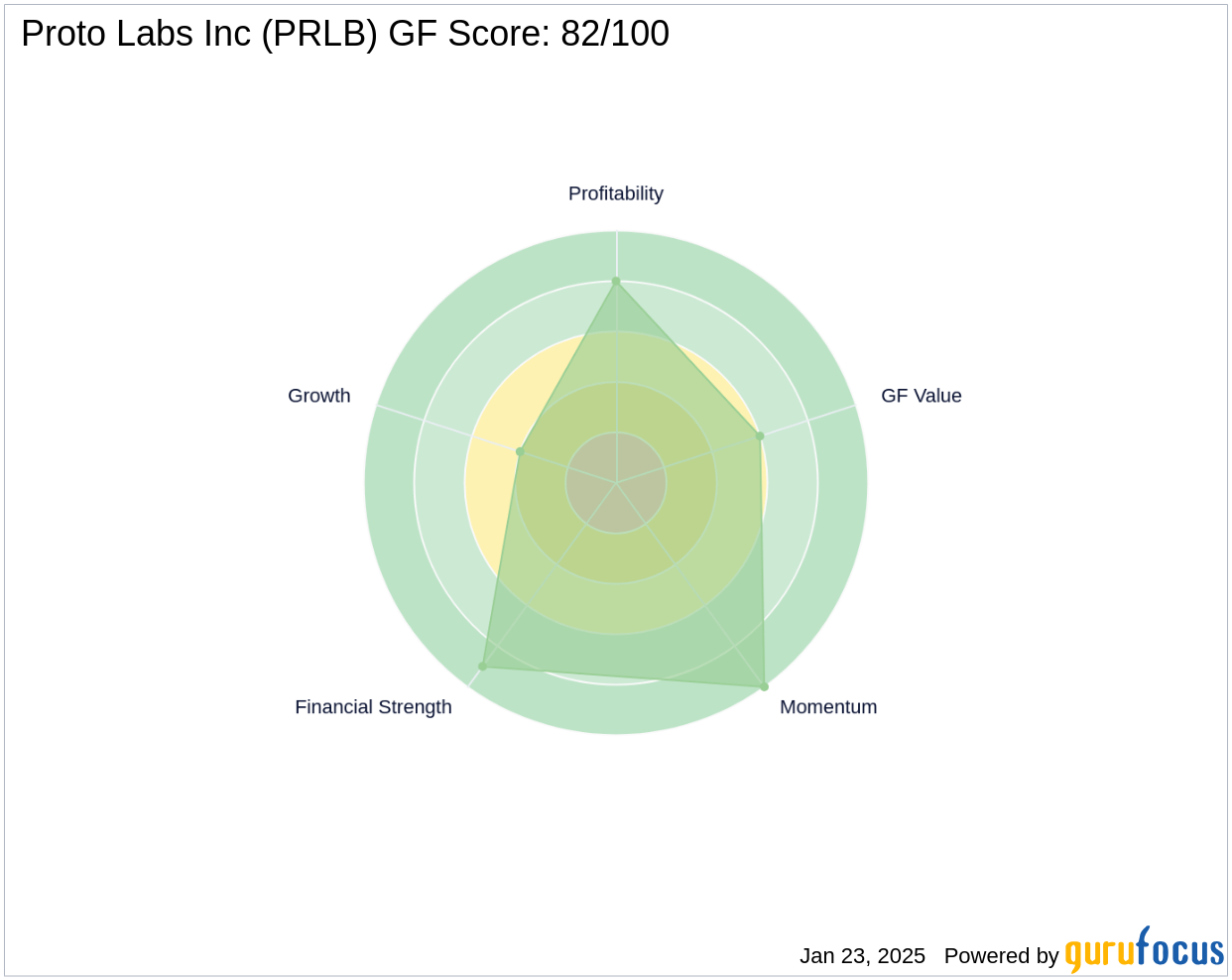

Financial Metrics and Valuation of Proto Labs Inc

Proto Labs Inc is currently considered fairly valued, with a GF Value of $37.33 and a Price to GF Value ratio of 1.07. The company's [GF Score](https://www.gurufocus.com/term/gf-score/PRLB) of 82/100 suggests good outperformance potential. Notable financial ranks include a [Balance Sheet Rank](https://www.gurufocus.com/term/rank-balancesheet/PRLB) of 9/10 and a [Profitability Rank](https://www.gurufocus.com/term/rank-profitability/PRLB) of 8/10, reflecting its strong financial health and profitability. Despite challenges in [operating margin](https://www.gurufocus.com/term/operating-margin/PRLB) growth, Proto Labs maintains a robust [Altman Z score](https://www.gurufocus.com/term/zscore/PRLB) of 9.50, indicating financial stability.

Impact on Dimensional Fund Advisors' Portfolio

The recent acquisition of Proto Labs shares by Dimensional Fund Advisors LP has increased the firm's holding in the company to 1,300,864 shares. This represents 5.30% of the firm's holdings in Proto Labs, while the stock's position in the overall portfolio remains at 0.01%. The transaction underscores Dimensional Fund Advisors' strategic interest in the industrial products sector, particularly in companies with strong growth potential and innovative manufacturing solutions.

Performance and Growth Indicators of Proto Labs Inc

Proto Labs Inc exhibits promising growth indicators, with a [GF Score](https://www.gurufocus.com/term/gf-score/PRLB) of 82/100, suggesting good outperformance potential. The company's [Balance Sheet Rank](https://www.gurufocus.com/term/rank-balancesheet/PRLB) of 9/10 and [Profitability Rank](https://www.gurufocus.com/term/rank-profitability/PRLB) of 8/10 highlight its strong financial foundation. However, challenges in [growth rank](https://www.gurufocus.com/term/rank-growth/PRLB) and [operating margin](https://www.gurufocus.com/term/operating-margin/PRLB) growth persist, with a [Growth Rank](https://www.gurufocus.com/term/rank-growth/PRLB) of 4/10. Despite these challenges, Proto Labs' [Momentum Rank](https://www.gurufocus.com/term/rank-momentum/PRLB) of 10/10 indicates strong market momentum, positioning the company for potential future success.

Other Notable Gurus Holding Proto Labs Inc

In addition to Dimensional Fund Advisors LP, other notable investment firms have also shown interest in Proto Labs Inc. Joel Greenblatt (Trades, Portfolio) is among the gurus holding shares in the company. The largest guru holding Proto Labs is Hotchkis & Wiley Capital Management LLC, reflecting a broader interest in the company's innovative manufacturing capabilities and growth potential.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.