On January 23, 2025, BayCom Corp (BCML, Financial) released its 8-K filing detailing its financial performance for the fourth quarter of 2024. The company, a bank holding entity for United Business Bank, provides a comprehensive range of financial services to various clients, including small and medium-sized businesses, professional firms, and individual consumers.

Performance Overview

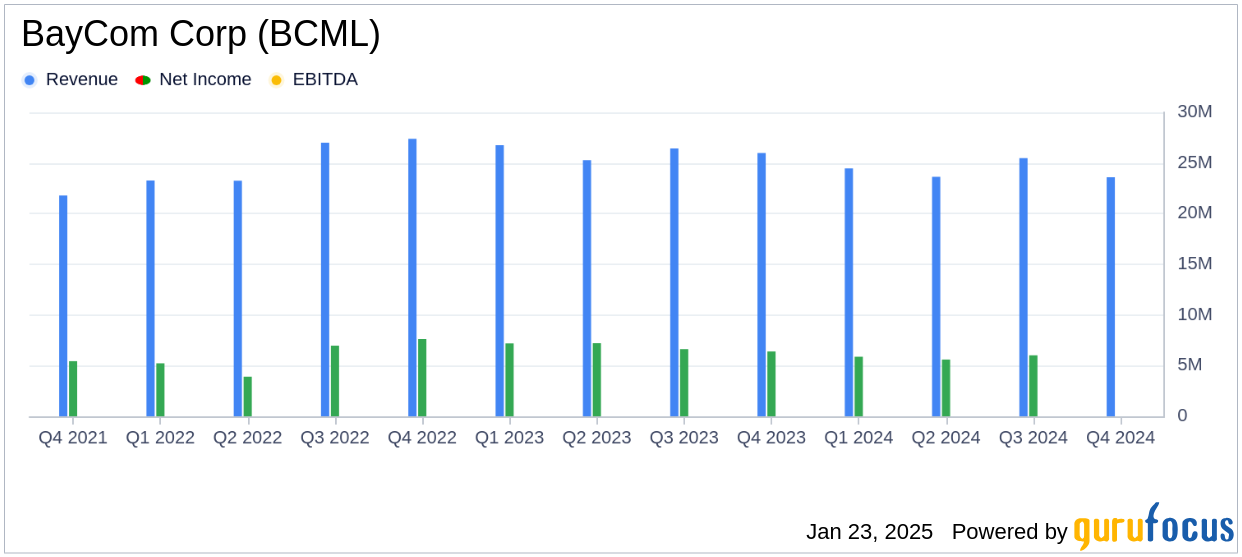

BayCom Corp reported earnings of $6.1 million, or $0.55 per diluted common share, for the fourth quarter of 2024. This result exceeded the analyst estimate of $0.51 per share. The company's net income showed a slight increase from the previous quarter's $6.0 million, or $0.54 per share, but a decrease from $6.4 million, or $0.55 per share, in the same quarter of the previous year.

Financial Achievements and Challenges

BayCom Corp's net interest income rose by $709,000, reaching $23.6 million for the quarter, driven by increased interest income on loans and investment securities. However, the company faced a $2.7 million decrease in noninterest income, primarily due to negative fair value adjustments on equity securities.

George Guarini, President and CEO, stated, “Our financial results for the fourth quarter and full year 2024 reflect a continuing trend of new lending activities and improvement in our net interest margin. Improving credit quality and economic factors are evident in the reversal of our provision for credit losses.”

Key Financial Metrics

BayCom Corp's annualized net interest margin was 3.80% for the fourth quarter, slightly up from 3.73% in the previous quarter. The company's assets totaled $2.7 billion, with loans net of deferred fees amounting to $2.0 billion. Nonperforming loans decreased to $9.5 million, representing 0.48% of total loans, indicating improved credit quality.

| Metric | Q4 2024 | Q3 2024 | Q4 2023 |

|---|---|---|---|

| Net Income | $6.1 million | $6.0 million | $6.4 million |

| Earnings Per Share | $0.55 | $0.54 | $0.55 |

| Net Interest Income | $23.6 million | $22.9 million | $23.5 million |

| Noninterest Income | $87,000 | $2.7 million | $2.7 million |

Analysis and Outlook

BayCom Corp's performance in the fourth quarter highlights its ability to navigate a challenging economic environment, with a focus on improving net interest margins and maintaining strong asset quality. The decrease in noninterest income poses a challenge, but the company's strategic focus on lending activities and credit quality improvements provides a positive outlook for future growth.

Overall, BayCom Corp's financial results demonstrate resilience and adaptability, positioning the company well for continued success in the banking industry. For more detailed insights and analysis, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from BayCom Corp for further details.