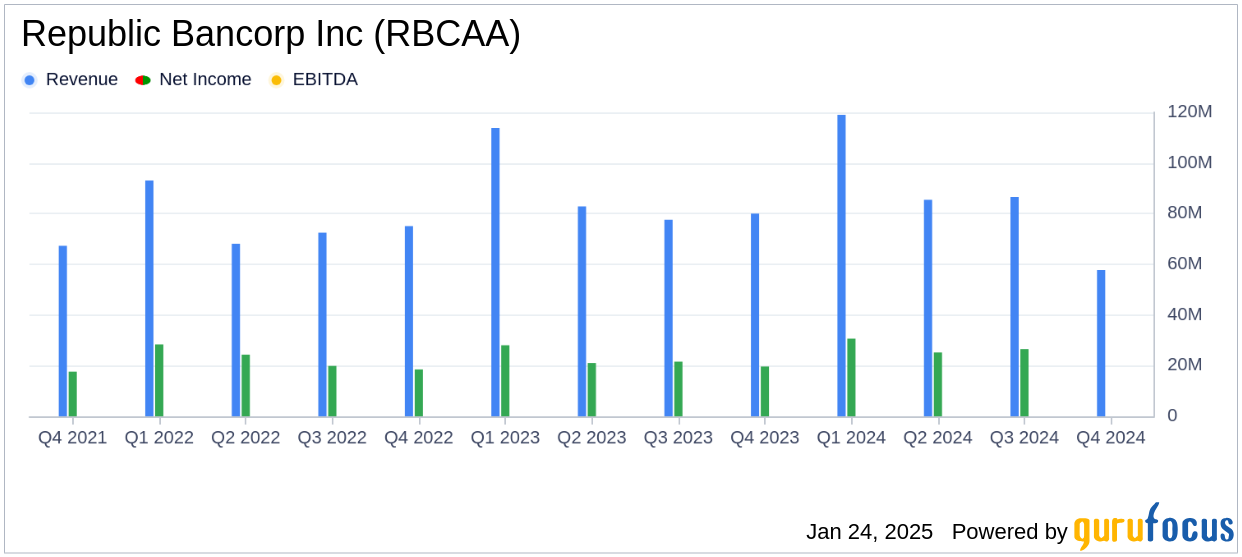

Republic Bancorp Inc (RBCAA, Financial) released its 8-K filing on January 24, 2025, reporting a fourth quarter 2024 net income of $19.0 million and diluted earnings per share (EPS) of $0.98. This performance fell short of the analyst estimates, which projected an EPS of $1.20 and revenue of $71.70 million. The company's full-year net income reached $101.4 million, marking a 12% increase over 2023.

Company Overview

Republic Bancorp Inc operates as a financial institution offering a range of traditional and non-traditional banking products through six reportable segments. These include traditional banking, warehouse, mortgage banking, Tax Refund Solutions (TRS), Republic Payment Solutions, and Republic Credit Solutions (RCS). The company engages in various activities such as retail mortgage and commercial lending, internet lending, and treasury management services.

Performance and Challenges

The company's Core Bank segment, which includes traditional banking and warehouse lending, showed strong performance with a net income increase of 11% over the fourth quarter of 2023. This was driven by a $7.0 million increase in net interest income, attributed to a rise in net interest margin (NIM) from 3.40% to 3.64%. However, the Republic Processing Group (RPG) faced challenges, with a $2.4 million decline in net income due to increased losses in the Tax Refund Solutions segment.

Financial Achievements

Republic Bancorp Inc's Core Bank segment achieved a notable increase in net interest income, reflecting effective interest rate risk management and growth in core deposits. The company's return on average assets (ROA) was 1.47%, and return on average equity (ROE) was 10.50% for 2024, highlighting its strong financial position in the banking industry.

Key Financial Metrics

The Core Bank's net interest income rose to $57.7 million, a 14% increase from the previous year. The company's total deposits grew by $157 million, with a significant contribution from the Core Bank. The loan-to-deposit ratio remained stable at 104% as of December 31, 2024.

Logan Pichel, President & CEO of Republic Bank & Trust Company, commented, "We are pleased to report another strong performance for the fourth quarter, particularly within our Core Bank, as its net income increased 11% over the fourth quarter of 2023."

Analysis and Outlook

Republic Bancorp Inc's performance in the fourth quarter reflects a mixed outcome, with strong results in its Core Bank segment offset by challenges in the RPG segment. The company's strategic focus on interest rate management and deposit growth has bolstered its financial stability. However, the increased losses in the TRS segment highlight potential risks that need to be addressed to sustain growth.

Overall, Republic Bancorp Inc's diversified business model and strong Core Bank performance position it well for future growth, though careful management of its processing group segments will be crucial to maintaining profitability.

Explore the complete 8-K earnings release (here) from Republic Bancorp Inc for further details.