Ames National Corp (ATLO, Financial) released its 8-K filing on January 24, 2025, announcing its financial results for the fourth quarter of 2024. Ames National Corporation, a bank holding company based in the United States, offers a range of financial services through its subsidiaries, including checking, savings, and time deposits, as well as various loan products. The company's operations are primarily conducted in central, north central, and south-central Iowa.

Fourth Quarter 2024 Financial Performance

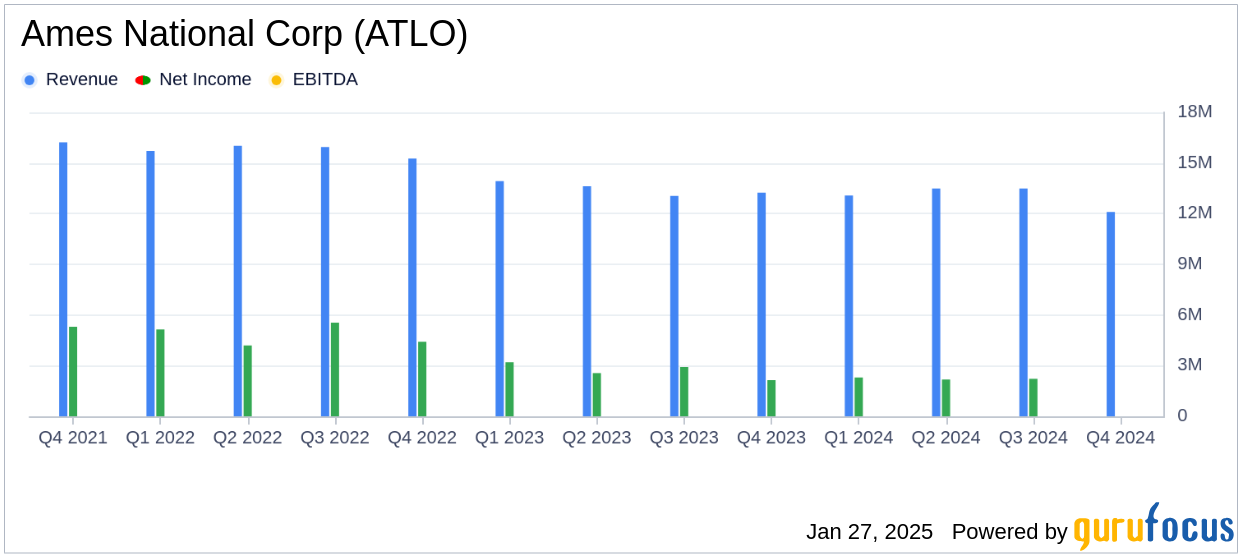

For the fourth quarter of 2024, Ames National Corp reported a net income of $3.5 million, or $0.39 per share, a significant increase from $2.1 million, or $0.24 per share, in the same period of 2023. This improvement was driven by higher loan interest income and a reduction in credit loss expenses. The increase in loan interest income was attributed to higher average interest rates and growth in the loan portfolio.

Annual Financial Overview

For the year ended December 31, 2024, the company reported a net income of $10.2 million, or $1.14 per share, compared to $10.8 million, or $1.20 per share, in 2023. The slight decline in annual earnings was due to increased deposit interest expenses as customers shifted to higher rate deposit products.

Key Financial Metrics and Achievements

The company's net interest margin for the fourth quarter of 2024 was 2.38%, up from 2.15% in the fourth quarter of 2023. This increase was primarily due to a higher volume and yield of loans, partially offset by increased deposit interest expenses. The efficiency ratio improved to 71.47% in the fourth quarter of 2024 from 75.59% in the same period of 2023, indicating better cost management.

| Metric | Q4 2024 | Q4 2023 | 2024 | 2023 |

|---|---|---|---|---|

| Net Income (in thousands) | $3,513 | $2,139 | $10,218 | $10,817 |

| Earnings Per Share | $0.39 | $0.24 | $1.14 | $1.20 |

| Return on Average Assets | 0.66% | 0.40% | 0.48% | 0.51% |

| Return on Average Equity | 7.84% | 5.74% | 6.02% | 7.05% |

| Net Interest Margin | 2.38% | 2.15% | 2.22% | 2.20% |

Balance Sheet Highlights

As of December 31, 2024, Ames National Corp's total assets stood at $2.13 billion, a decrease from $2.16 billion at the end of 2023. This decline was primarily due to a reduction in securities available-for-sale. However, net loans increased to $1.30 billion from $1.28 billion, reflecting growth in residential real estate and agricultural operating loans.

Challenges and Strategic Moves

The company faced challenges with an increase in substandard loans, which rose to $35.5 million from $18.4 million in 2023, primarily due to weakening in the commercial real estate loan portfolio. Despite these challenges, Ames National Corp managed to reduce its borrowings significantly, from $110.6 million in 2023 to $47.0 million in 2024, by utilizing proceeds from maturing investments.

Shareholder Returns and Future Outlook

Ames National Corp declared a quarterly cash dividend of $0.20 per share, maintaining a dividend yield of 4.87%. The company also repurchased 43,057 shares of its common stock in the fourth quarter of 2024, reflecting its commitment to returning value to shareholders.

The company forecasts earnings for 2025 to be in the range of $1.72 to $1.82 per share, driven by an expected improvement in net interest margin as lower yielding investments and loans are anticipated to reprice at higher market rates.

Explore the complete 8-K earnings release (here) from Ames National Corp for further details.