On December 31, 2024, Franklin Resources Inc., a prominent investment management firm, expanded its stake in Context Therapeutics Inc. by acquiring an additional 2,149,392 shares. This transaction increased the firm's total holdings in the biopharmaceutical company to 4,003,380 shares. The shares were acquired at a price of $1.05 each, reflecting Franklin Resources Inc.'s strategic interest in the biotechnology sector. This move underscores the firm's commitment to diversifying its portfolio and exploring growth opportunities within the healthcare industry.

Franklin Resources Inc.: A Legacy of Prudent Investment

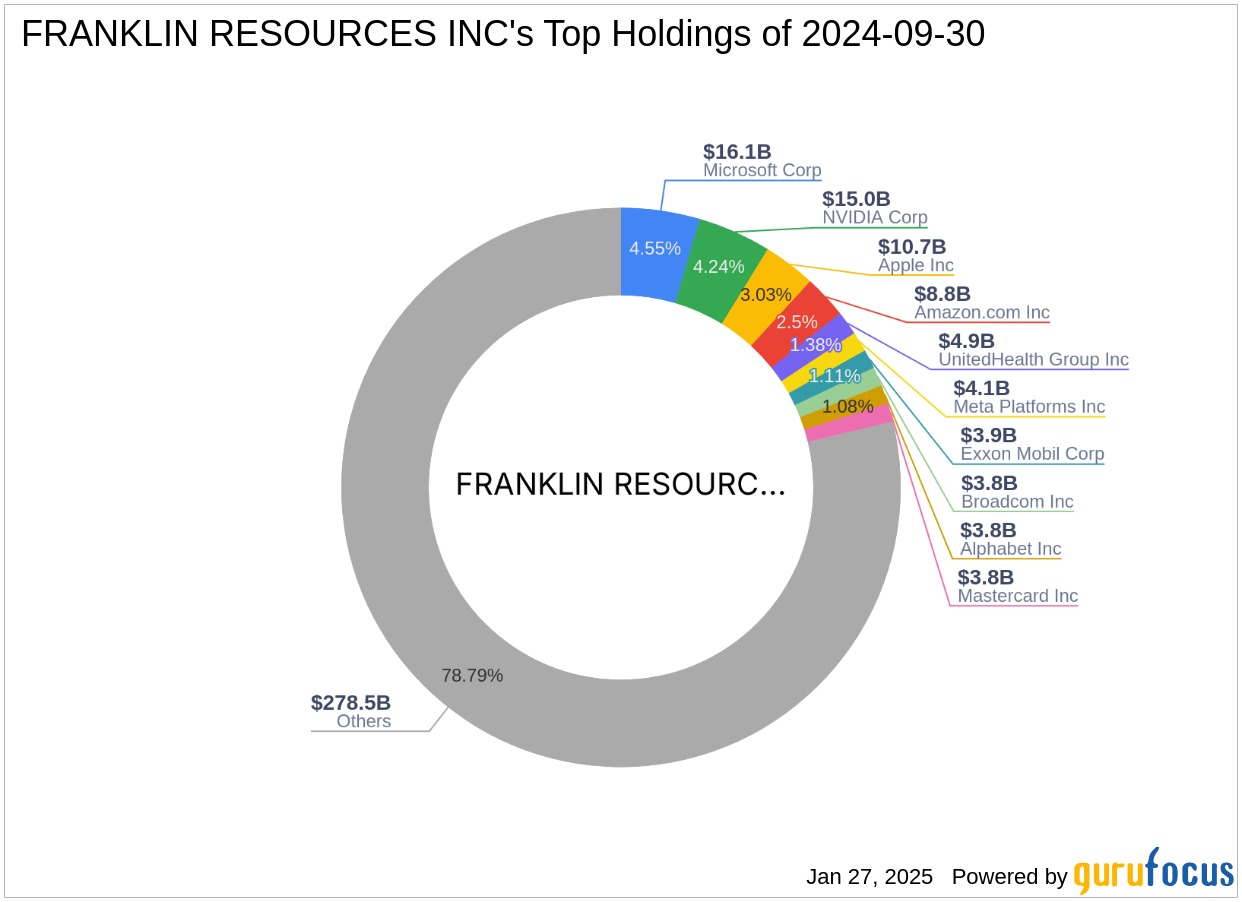

Franklin Resources Inc., also known as Franklin Templeton Investments, is a globally recognized investment management company. Founded in 1847 by Rupert Johnson, Sr., the firm has grown significantly over the years, emphasizing conservatively managed mutual funds. With a history of strategic acquisitions and global expansion, Franklin Resources Inc. has established itself as a leader in the financial sector. The firm manages over 200 mutual funds and has a strong presence in the technology and healthcare sectors, with top holdings in companies like Apple Inc. (AAPL, Financial), Amazon.com Inc. (AMZN, Financial), and Microsoft Corp. (MSFT, Financial).

Context Therapeutics Inc.: Innovating in Cancer Treatment

Context Therapeutics Inc. is a clinical-stage biopharmaceutical company focused on developing therapies for female, hormone-dependent cancers, including breast, ovarian, and endometrial cancer. The company's innovative pipeline includes CTIM-76, an anti-Claudin 6 x anti-CD3 bispecific antibody designed to target malignant cells. With a market capitalization of $68.999 million and a current stock price of $0.92, Context Therapeutics Inc. is positioned as a promising player in the biotechnology industry, despite facing challenges in profitability and growth.

Financial Metrics and Market Performance

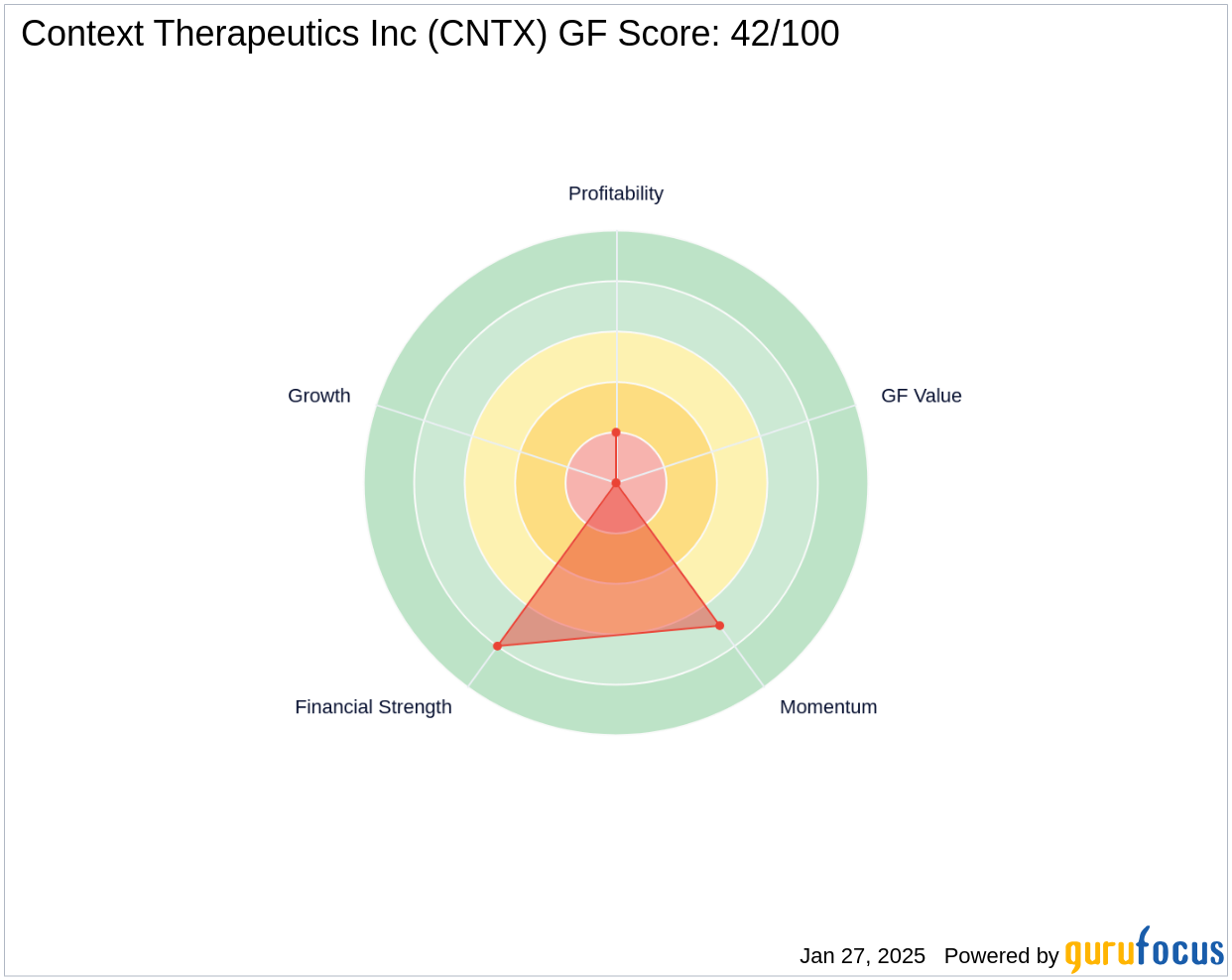

Context Therapeutics Inc. has a market capitalization of $68.999 million, with a stock price of $0.92. The company's financial metrics reveal a challenging landscape, with a return on equity (ROE) of -67.41% and a return on assets (ROA) of -63.04%. The Profitability Rank is 2/10, indicating significant room for improvement. Despite these challenges, the company's Financial Strength is relatively strong, with a balance sheet rank of 8/10 and a cash-to-debt ratio of 347.55, suggesting a solid foundation for future growth.

Strategic Implications of the Transaction

The acquisition of additional shares in Context Therapeutics Inc. by Franklin Resources Inc. highlights the firm's strategic interest in the biotechnology sector. This transaction positions Context Therapeutics Inc. as a significant component of Franklin Resources Inc.'s portfolio, with a 5.30% holding ratio. The investment reflects the firm's confidence in the potential of Context Therapeutics Inc. to deliver innovative cancer therapies and contribute to the firm's long-term growth objectives.

Stock Performance and Valuation Analysis

Context Therapeutics Inc. has faced challenges in stock performance, with a year-to-date price change of -22.69% and a decline of 79.28% since its IPO. The stock's GF Score is 42/100, indicating poor future performance potential. Despite these challenges, the company's Momentum Rank is 7/10, suggesting potential for recovery. The GF Value Rank and Growth Rank are both 0/10, reflecting the need for strategic initiatives to enhance value and growth prospects.

Conclusion: Strategic Outlook for Franklin Resources Inc. and Context Therapeutics Inc.

The acquisition of additional shares in Context Therapeutics Inc. by Franklin Resources Inc. represents a strategic move to enhance its portfolio's exposure to the biotechnology sector. While Context Therapeutics Inc. faces challenges in profitability and growth, its innovative pipeline and strong financial foundation offer potential for future success. As Franklin Resources Inc. continues to diversify its investments, the firm is well-positioned to capitalize on emerging opportunities within the biotechnology industry, potentially driving long-term growth and value creation.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.