On January 27, 2025, WSFS Financial Corp (WSFS, Financial) released its 8-K filing detailing the financial results for the fourth quarter and full year of 2024. WSFS Financial Corp, a savings and loan holding company, operates through three segments: WSFS Bank, Cash Connect, and Wealth Management. The majority of its revenue is generated from the WSFS Bank segment, which provides loans, leases, and other financial products to commercial and consumer customers.

Performance Overview and Challenges

WSFS Financial Corp reported a diluted earnings per share (EPS) of $1.09 for Q4 2024, exceeding the analyst estimate of $0.97. The company's net interest margin (NIM) stood at 3.80%, and return on average assets (ROA) was 1.21%. These results underscore the company's robust financial health, driven by strong deposit growth and record revenue in its Wealth and Trust segment. However, WSFS faced challenges, including a significant adverse event related to a Cash Connect client, which led to the termination of the relationship and impacted pre-tax income by $4.7 million.

Financial Achievements and Industry Significance

WSFS's financial achievements are noteworthy, particularly in the banking industry, where deposit growth and fee revenue diversification are critical. The company reported a 4% increase in customer deposits compared to both the previous quarter and the same quarter last year. Additionally, the Wealth and Trust segment achieved a record quarter with a 12% year-over-year growth in fee revenue, highlighting the company's successful expansion in wealth management services.

Key Financial Metrics

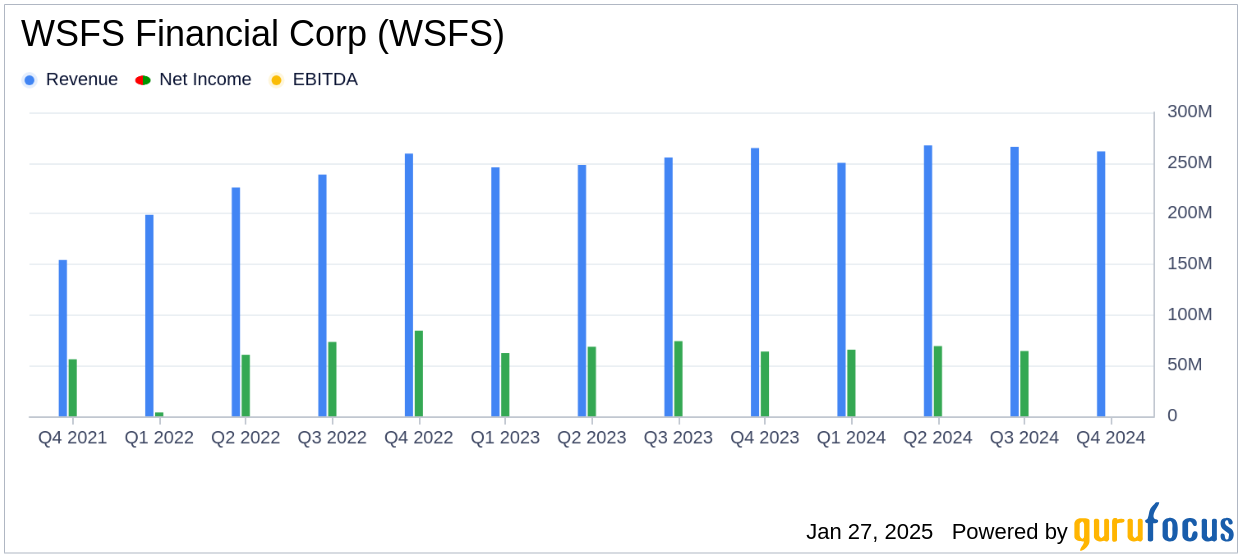

WSFS's total net revenue for Q4 2024 was $261.5 million, slightly down from $267.7 million in Q3 2024. The provision for credit losses decreased significantly to $8.0 million from $18.4 million in the previous quarter, reflecting improved credit conditions. Noninterest expense increased to $169.1 million, up from $163.7 million in Q3 2024, driven by higher compliance and risk-related costs.

| Metric | Q4 2024 | Q3 2024 | Q4 2023 |

|---|---|---|---|

| Net Interest Income | $178.2 million | $177.5 million | $178.1 million |

| Fee Revenue | $83.3 million | $90.2 million | $87.2 million |

| Net Income | $64.2 million | $64.4 million | $63.9 million |

| EPS (Diluted) | $1.09 | $1.08 | $1.05 |

Analysis and Commentary

WSFS Financial Corp's performance in Q4 2024 reflects its strategic focus on deposit growth and wealth management expansion. The company's ability to exceed EPS estimates demonstrates its resilience in navigating challenges, such as the Cash Connect client termination. The decrease in credit costs and strong deposit growth are positive indicators of the company's financial stability and potential for future growth.

Rodger Levenson, Chairman, CEO, and President, commented, "WSFS delivered another strong quarter, with core EPS of $1.11 and a core ROA of 1.24%. Our performance was highlighted by robust deposit growth, a strong NIM, lower credit costs, and record performance in our Wealth and Trust franchise."

Overall, WSFS Financial Corp's Q4 2024 results position the company well for continued success in the banking sector, with a strong foundation in deposit growth and wealth management services. The company's strategic initiatives and financial discipline are likely to support its growth trajectory in the coming years.

Explore the complete 8-K earnings release (here) from WSFS Financial Corp for further details.