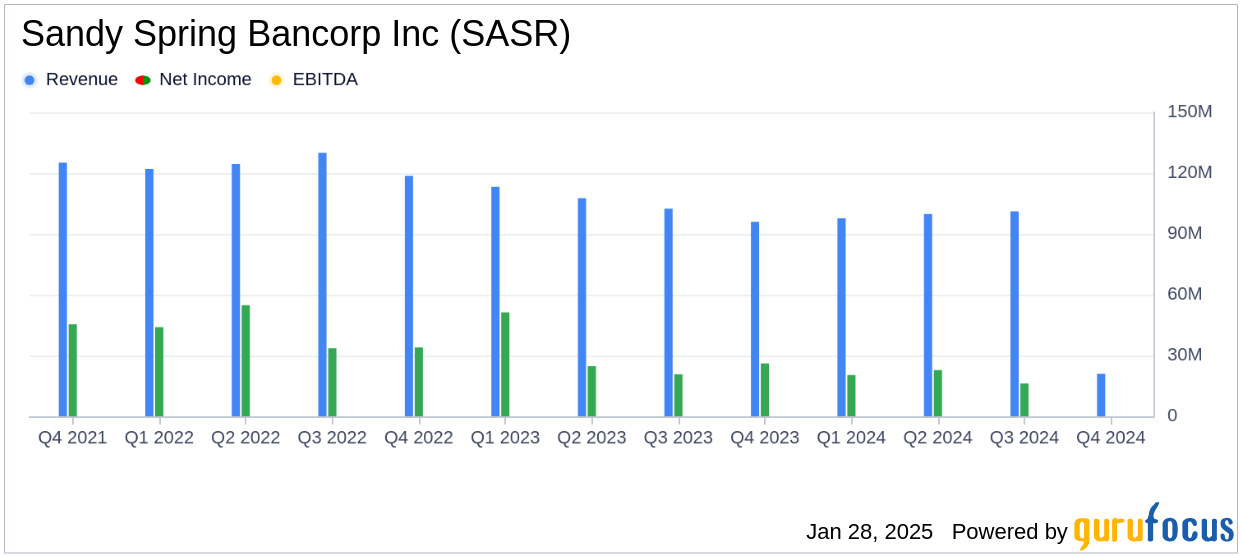

On January 28, 2025, Sandy Spring Bancorp Inc (SASR, Financial) released its 8-K filing for the fourth quarter of 2024, revealing a net loss of $39.5 million, or $0.87 per diluted common share. This contrasts sharply with the net income of $16.2 million, or $0.36 per diluted share, reported in the previous quarter. The loss was primarily due to a $54.4 million goodwill impairment charge related to the merger agreement with Atlantic Union Bankshares Corporation (AUB). Despite this setback, core earnings improved to $21.0 million, or $0.47 per diluted share, up from $17.9 million, or $0.40 per share, in the third quarter.

Company Overview

Sandy Spring Bancorp Inc is a community-oriented banking organization offering a full range of commercial banking services in Central Maryland, Northern Virginia, and Washington D.C. The company operates through two segments: Community Banking, which provides loan and deposit products, and Investment Management, offering financial planning and wealth management services.

Performance and Challenges

The fourth quarter results highlight significant challenges for Sandy Spring Bancorp Inc, primarily due to the goodwill impairment charge. This non-cash charge does not affect the company's regulatory capital ratios or liquidity but significantly impacts reported earnings. The impairment reflects the terms of the merger agreement with AUB, which valued the company below its book value.

Financial Achievements

Despite the net loss, Sandy Spring Bancorp Inc achieved growth in core earnings, driven by higher net interest income and non-interest income, alongside a reduction in the provision for credit losses. The net interest margin improved to 2.53% from 2.44% in the previous quarter, reflecting effective management of interest-bearing liabilities and asset yields.

Key Financial Metrics

Net interest income for the quarter increased by 6% to $86.1 million compared to the previous quarter. Non-interest income rose by 10% to $21.6 million, supported by higher income from bank-owned life insurance and wealth management. However, non-interest expenses surged by 84% due to the goodwill impairment, reaching $134.2 million.

| Metric | Q4 2024 | Q3 2024 | Q4 2023 |

|---|---|---|---|

| Net Interest Income | $86.1 million | $81.7 million | $81.7 million |

| Non-Interest Income | $21.6 million | $19.7 million | $16.6 million |

| Non-Interest Expense | $134.2 million | $72.9 million | $67.1 million |

| Net Loss | $(39.5) million | $16.2 million | $26.1 million |

Analysis and Outlook

The goodwill impairment significantly impacted Sandy Spring Bancorp Inc's financial results, overshadowing improvements in core operations. The company's focus on enhancing net interest margins and reducing brokered deposits is a positive sign for future stability. However, the pending merger with AUB and associated costs remain critical factors influencing the company's financial health.

“We are pleased with our fourth quarter results, most notably our improved net interest margin, growth in core earnings, and reductions in brokered deposits,” said Daniel J. Schrider, Chair, President and CEO of Sandy Spring Bank.

Overall, while the goodwill impairment presents a substantial challenge, Sandy Spring Bancorp Inc's underlying business performance shows resilience, with strategic initiatives aimed at strengthening its financial position in the competitive banking sector.

Explore the complete 8-K earnings release (here) from Sandy Spring Bancorp Inc for further details.