On December 31, 2024, Chuck Royce (Trades, Portfolio), a renowned figure in small-cap investing, executed a significant transaction involving BayCom Corp (BCML, Financial). The firm added 60,075 shares to its portfolio at a price of $26.84 per share. This acquisition reflects a strategic move by Royce, known for identifying undervalued small-cap stocks with strong potential for future profitability. The transaction increased the firm's total holdings in BayCom Corp to 603,286 shares, representing 0.15% of the overall portfolio and 5.42% of the total shares of BayCom Corp.

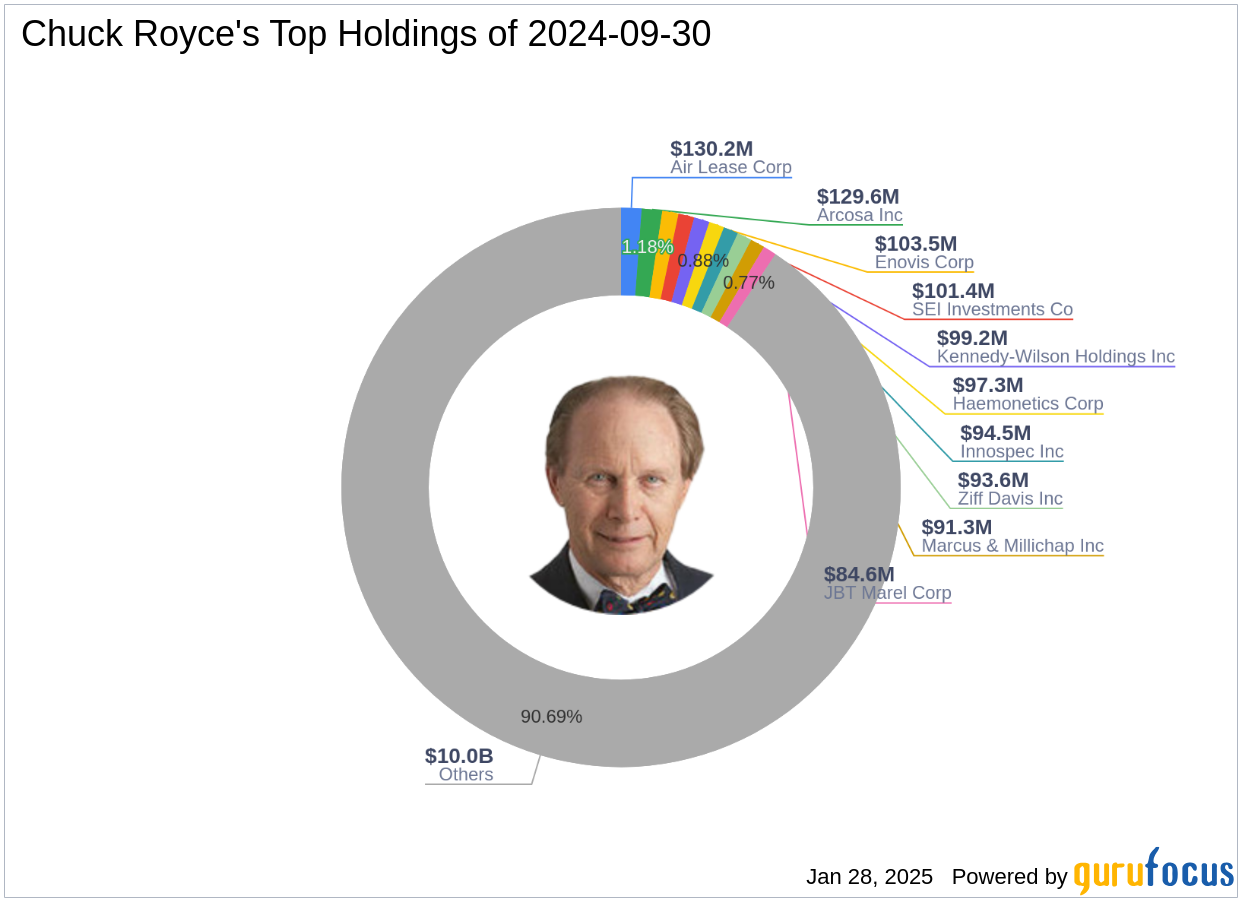

Profile of Chuck Royce (Trades, Portfolio)

Charles M. Royce is a pioneer in the realm of small-cap investing, having managed the Royce Pennsylvania Mutual Fund since 1972. With a bachelor's degree from Brown University and an MBA from Columbia University, Royce has built a reputation for investing in smaller companies with market capitalizations up to $5 billion. The firm's investment philosophy centers on identifying companies with strong balance sheets, a history of business success, and the potential for a profitable future. This approach has guided Royce's investment decisions, including the recent acquisition of BayCom Corp shares.

Overview of BayCom Corp

BayCom Corp serves as the bank holding company for United Business Bank, offering a wide range of financial services to businesses and individuals. The company targets small and medium-sized businesses, professional firms, real estate professionals, and nonprofit entities. With a market capitalization of $311.624 million, BayCom Corp is currently trading at $28.02 per share, with a price-to-earnings (PE) ratio of 13.34. Despite being modestly overvalued with a GF Value of $21.94 and a price-to-GF value ratio of 1.28, the company continues to attract interest from investors like Chuck Royce (Trades, Portfolio).

Impact of the Transaction

The addition of BayCom Corp shares has a notable impact on Chuck Royce (Trades, Portfolio)'s portfolio. The stock now constitutes 0.15% of the portfolio, highlighting its strategic importance. BayCom Corp's position in Royce's holdings accounts for 5.42% of the total shares, indicating a significant level of confidence in the company's potential. This transaction aligns with Royce's investment philosophy of seeking out small-cap companies with promising futures.

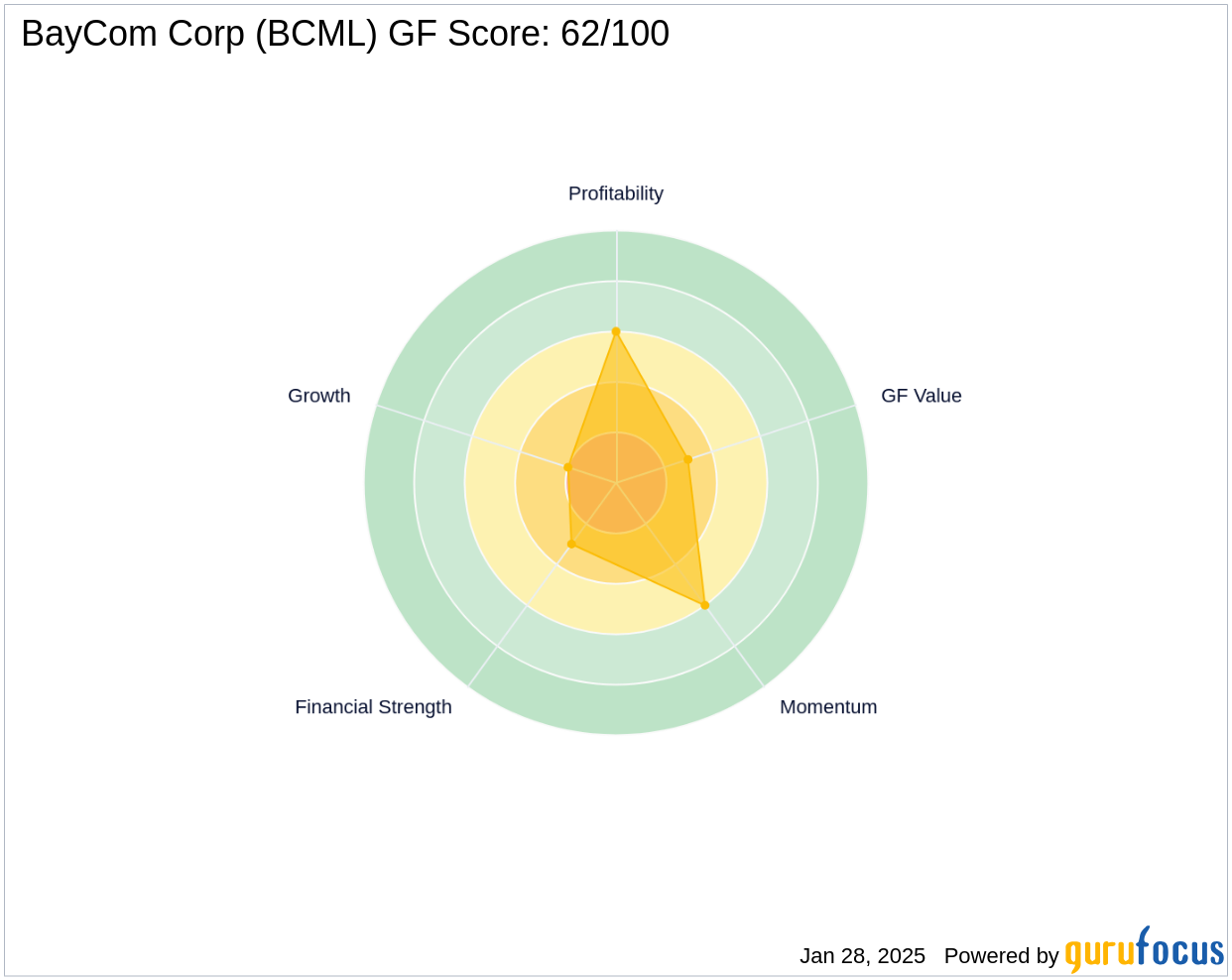

Valuation and Performance Metrics

BayCom Corp's valuation is considered modestly overvalued, with a GF Value of $21.94 and a price-to-GF value ratio of 1.28. The company's [GF Score](https://www.gurufocus.com/term/gf-score/BCML) stands at 62/100, suggesting a poor future performance potential. The [Financial Strength](https://www.gurufocus.com/term/rank-balancesheet/BCML) is ranked at 3/10, while the [Profitability Rank](https://www.gurufocus.com/term/rank-profitability/BCML) is 6/10. These metrics provide a comprehensive view of BayCom Corp's current financial standing and future prospects.

Market and Growth Analysis

Since the transaction, BayCom Corp has experienced a 4.4% gain, with a year-to-date price change of 6.95%. Over the past three years, the company has achieved a revenue growth of 6.10% and an impressive earnings growth of 25.40%. These growth metrics underscore the company's potential for continued success in the financial services sector.

Conclusion

Chuck Royce (Trades, Portfolio)'s strategic acquisition of BayCom Corp shares is a testament to the firm's commitment to identifying undervalued small-cap stocks with strong growth potential. This transaction aligns with Royce's investment philosophy and highlights the potential opportunities for value investors in the banking sector. As BayCom Corp continues to grow and evolve, it presents a compelling case for investors seeking to capitalize on its promising future.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

Also check out: